Technical Guide for Creating and Charging Payment Tokens

This technical guide outlines the steps for creating and charging payment tokens using CCBill's Transaction RESTful API service.

It is intended for programmers, technicians, and others with advanced coding skills.

Requirements

- The user has a CCBill Account.

- The user has been given API credentials.

- The user has had their domain whitelisted with the help of CCBill Support.

- The user has experience with RESTful Web Services.

- The user has experience with JSON formats.

- The RESTful Transaction API supports TLS 1.2 only.

Important: To maintain PCI compliance at all times, use CCBill’s Advanced Widget and ensure that payment details are sent directly to CCBill without them being sent through your server. Always load the CCBill’s JavaScript libraries via https://js.ccbill.com to remain compliant. Don’t bundle or host the scripts yourself.

Terminology

- Merchant Account: Each CCBill merchant receives an account number for tracking purposes. The standard format is 9xxxxx-xxxx, where 9xxxxx is the main account. The main account is a six (6) digit number. For example: "999999".

- Merchant Sub-account: CCBill Merchants may open one or more sub-accounts. The sub-account is a four (4) digit number. The standard format is: xxxx. For example: "1234". The sub-account is part of the main account.

- Payment Token: A Payment Token identifies a billable entity within the system.

- Subscription ID: Transaction subscription identification number

- Merchant Application ID: This is the client ID that the merchant has received upon signing up to use the CCBill RESTful API.

- Merchant Secret: This is the password that was setup for the authentication with the CCBill RESTful API.

- Strong Customer Authentication (SCA): European laws (PSD2) require the use of SCA, such as the 3DS protocol, for online payment processing. SCA is initiated when an EU-based cardholder makes a payment online. Merchants can use CCBill's Advanced Widget and its functions to facilitate strong customer authentication.

The Payment Flow

Below are the 3 essential steps for charging the consumer using a payment token:

1. Generate the CCBill OAuth Bearer Token

The request to generate the CCBill OAuth token must be sent from your back-end services directly to the CCBill API, and it can not be requested from within the browser.

2. Create the Payment Token

3. Charge the Payment Token

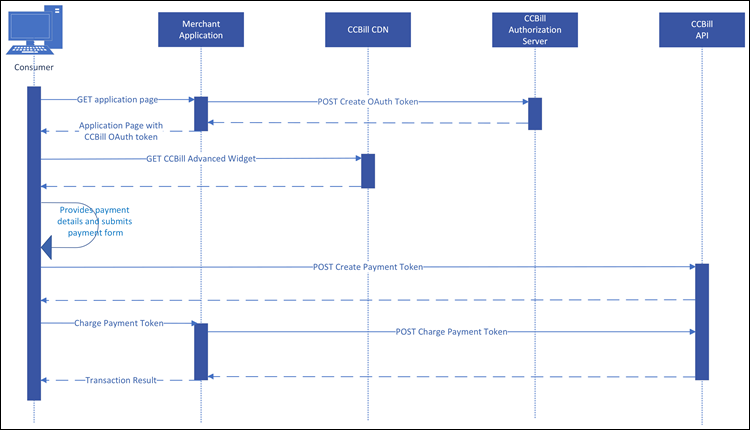

The following sequence diagram describes the flow for creating and charging payment tokens without 3DS verification. Click the image to view it in full size.

While all of the above steps can be completed by making requests from your backend to our API endpoints, you can also use the CCBill Advanced Widget (JS library) to:

- create the payment tokens

- check whether the 3DS verification is required or not, and

- perform strong customer authentication (SCA) from within the browser

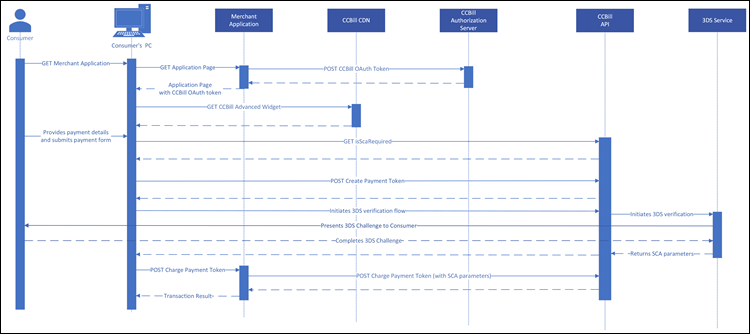

The following sequence diagram describes the flow for creating and charging payment tokens with 3DS verification. Click the image to view it in full size.

Creation of the CCBill OAuth token and charging payment tokens are not supported by the CCBill Advanced Widget and must be performed by making API calls from your back-end services.

1. Generate CCBill OAuth Bearer Token

The CCBill RESTful Transaction API uses OAuth based authentication and authorization. Before accessing the API, you must register your application with CCBill to receive a merchant application ID and secret key.

Use these credentials to generate a token by providing them to the authorization server.

In the first curl example, the -u option automatically encodes the provided credentials into a format compatible with HTTP Basic Authentication.

Alternatively, merchants can manually encode their merchant application ID and secret key using Base64 encoding. The encoded credentials must be included in the request as authorization header parameters, as shown in the second example request.

Please note that this step cannot be done from within the browser, and you must make the call from your backend.

Once you have generated an access token (not to be confused with a payment token), provide it in the Authorization header of each API request. You will have access until the access token expires or is revoked.

EndPoint URL

https://api.ccbill.com/ccbill-auth/oauth/token?grant_type=client_credentialsHeader

Content-Type: application/x-www-form-urlencoded

Authorization: Basic MerchantApplicationID:SecretKey

Example Request

curl -X POST 'https://api.ccbill.com/ccbill-auth/oauth/token' \

-i -u 'Basic Merchant_Application_ID:Secret_Key' \

-H 'Content-Type: application/x-www-form-urlencoded' \

-d 'grant_type=client_credentials'Example Request 2

curl -X POST \

https://api.ccbill.com/ccbill-auth/oauth/token \

--header 'Content-Type: application/x-www-form-urlencoded' \

--header 'Authorization: Basic [base64_encoded_Merchant_ApplicationID:Merchant_Secret]' \

--data-urlencode 'grant_type=client_credentials'The acquired token is a random data string that does not hold sensitive information or value. It is an authentication and authorization tool that grants your applications access to CCBill's RESTful API resources.

Example of Bearer Token in Request Header

-H 'Authorization: Bearer eyJhbGciOiJSUzI1NiIsInR5cCI6IkpXVCJ9.eyJhdWQiOlsibWNuLXRyYW5zYWN0aW9uLXNlcnZpY2UiLCJtY24tYWRtaW4tc2VydmljZSJdLCJzY29wZSI6WyJjcmVhdGVfdG9rZW4iLCJyZWFkX3Rva2VuIiwiY2hhcmdlX3Rva2VuIiwiY3JlYXRlX3Byb2dyYW0iLCJyZWFkX3Byb2dyYW0iLCJjcmVhdGVfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIiwicmVhZF9wcm9ncmFtX3BhcnRpY2lwYXRpb24iLCJtb2RpZnlfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIl0sImV4cCI6MTUzNzM4MDczNiwiYXV0aG9yaXRpZXMiOlsiTUNOX0FQSV9UT0tFTl9DSEFSR0VSIiwiTUNOX0FQSV9UT0tFTl9DUkVBVE9SIiwiTUNOX0FQSV9BRE1JTiJdLCJqdGkiOiI4YzI2Njg1MC00NjMzLTQzZDMtYjZjOC1lNzIyY2ExNjQ1YTUiLCJjbGllbnRfaWQiOiI1MjE3NjhhYTc1OGQxMWU4YWE2YjAwNTA1NjlkMTU4NSJ9.HRYXZFATkIcI2_LJ1W_xo67IfBnbN9atyYNzyHqseLxYUxzgwBsAV5rNqCixKemOrDIeQLBN4jrwRsBIHDpEvshwBC8XmTodDJzpGmMaU9s1r20RV68X0_d1yTgSDke_Of7VCrVmJRbSuDl7AgsfTqQ1J7nWyu9vcIaER93ms-vadser_Ot9Z68_HAmCJL3DCLpdIFq3PYtBMKKKqXbvhfhSZQZD3b6-aewAnBo0VzpvK6tREqw1rv9_73oAvYcW2aHAj79ILr8viWMM40LyDKMMYOYkneg3hJUQsUVeh9WzztYUJKzERYNXje9fYIGN-eofoLvX7OZJ3eXmIfkrfQ' \

-H 'Cache-Control: no-cache' \

-H 'Content-Type: application/json' \2. Create Payment Token (CCBill Advanced Widget)

The CCBill Advanced Widget makes the creation of payment tokens easier by encapsulating the API calls that need to be made into a JavaScript function that can be used from within your web page.

The library is hosted on CCBill's content distribution network (CDN), which makes import into the merchants' websites quick and easy from any location in the world.

The following instructions describe how to set up and use the CCBill Advanced Widget library.

Step 1. Add Preload Link and HTML Elements

Add a preload link and script HTML elements to the client HTML page that will connect to the CCBill Advanced Widget.

<link rel="preload" href="https://js.ccbill.com/v1.3.0/ccbill-advanced-widget.js" as="script"/>

<script type="text/javascript" src="https://js.ccbill.com/v1.3.0/ccbill-advanced-widget.js"></script>The API version in this URI example is v1.3.0. Pay special attention to the version in the URI path as the version number may be subject to change.

Step 2. Define Field IDs

The Advanced Widget is able to extract the relevant form fields by relying on default ID attributes or by utilizing the data-ccbill custom HTML element attribute. The data-ccbill attribute is recommended as it is less intrusive and provides more flexibility.

When using the custom attribute the correct format is:

Format

<input type="text" data-ccbill="[corresponding field name]" />When using the default IDs the correct format is:

<input type="text" id="_ccbillId_[corresponding field name]" />The table shows the values that should be set for the data-ccbill attribute or, alternatively, in the default ID attribute fields.

| data-ccbill | Default IDs |

|---|---|

| nameOnCard | _ccbillId_nameOnCard |

| cardNumber | _ccbillId_cardNumber |

| expMonth | _ccbillId_expMonth |

| expYear | _ccbillId_expYear |

| firstName | _ccbillId_firstName |

| lastName | _ccbillId_lastName |

| address1 (optional) | _ccbillId_address1 (optional) |

| address2 (optional) | _ccbillId_address2 (optional) |

| city (optional) | _ccbillId_city (optional) |

| country | _ccbillId_country |

| state (optional) | _ccbillId_state (optional) |

| postalCode | _ccbillId_postalCode |

| phoneNumber (optional) | _ccbillId_phoneNumber (optional) |

| _ccbillId_email | |

| currencyCode (A three-digit currency code for the currency used in the transaction. Required for SCA.) | _ccbillId_currencyCode (A three-digit currency code for the currency used in the transaction. Required for SCA.) |

| ipAddress (required, recommended hidden field auto-populated by JavaScript) | _ccbillId_ipAddress (required, recommended hidden field auto-populated by JavaScript) |

| browserHttpAccept (optional, recommended hidden field auto-populated by JavaScript) | _ccbillId_browserHttpAccept (optional, recommended hidden field auto-populated by JavaScript) |

| browserHttpAcceptEncoding (optional, recommended hidden field auto-populated by javascript) | _ccbillId_browserHttpAcceptEncoding (optional, recommended hidden field auto-populated by javascript) |

| browserHttpAcceptLanguage (optional, recommended hidden field auto-populated by javascript) | _ccbillId_browserHttpAcceptLanguage (optional, recommended hidden field auto-populated by javascript) |

Step 3. Create JavaScript Method

Create a JavaScript method that will call the CCBill Advanced Widget createPaymentToken() function. The provided example can be modified as required.

This is the main function that Merchants need to incorporate into their JavaScript calls in order to create Payment Tokens.

To generate a token, multiple parameters need to be passed using the function:

| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| authToken | string (required) | Required input that uses an Oauth token to perform the creation of the Payment Token. This must be a valid Oauth Token for the client account provided. |

| clientAccnum | integer (required) | Merchant account number. |

| clientSubacc | integer (required) | Merchant subaccount number. |

| clearPaymentInfo | boolean (optional) | An optional flag that will, if set to true, result in clearance of the customer information fields when the createPaymentToken function is called. If null is provided, this will default to false, and the payment information fields will not be cleared. Note: Even though this parameter is optional, this field should be set to 'null' if not used. |

| clearCustomerInfo | boolean (optional) | An optional flag that will, if set to true, result in clearance of the customer information fields when the createPaymentToken function is called. If null is provided, this will default to false, and the Customer Information fields will not be cleared. Note: Even though this parameter is optional, this field should be set to 'null' if not used. |

| timeToLive | integer (optional) | The time interval that defines how long the token should be valid (hours). |

| numberOfUse | integer (optional) | Total number of times the Payment Token can be used for purchases. Note: Even though this parameter is optional, this field should be set to 'null' if not used. |

createPaymentToken() Example

const widget = new ccbill.CCBillAdvancedWidget(applicationId);

try {

const result = widget.createPaymentToken(oauthToken, clientAccnum, clientSubacc, clearPaymentInfo, clearCustomerInfo, timeToLive, numberOfUse);

result.then(

(data) => {

console.log("SUCCESS");

return data.json();

},

(error) => {

console.log("ERROR");

return error.json();

}).then(json => {

console.log("RESULT :[" + JSON.stringify(json) + "]");

}).catch((error) => {

console.error("ERROR2 [" + error + "]");

});

console.log(`FINISHED`);

} catch (error) {

const errors = [];

error.forEach(function(item) {

const msg = item.message.split(".");

errors.push(msg[1]);

});

console.error(`ERROR ` + JSON.stringify(errors));

alert("ERROR: Unable to generate Payment Token: " + JSON.stringify(errors));

}Using Only Required Parameters

const result = widget.createPaymentToken(oauthToken, clientAccnum, clientSubacc);Using Field Clearing Flags

const result = widget.createPaymentToken(oauthToken, clientAccnum, clientSubacc, clearPaymentInfo, clearCustomerInfo);Using numberOfUse and timeToLive but no Flags

const result = widget.createPaymentToken(oauthToken, clientAccnum, clientSubacc, null, null, timeToLive, numberOfUse);Using All Parameters

const result = widget.createPaymentToken(oauthToken, clientAccnum, clientSubacc, clearPaymentInfo, clearCustomer, timeToLive, numberOfUse);Step 4. Payment Token Generated

The result will contain the newly created payment token, which can be stringified into JSON.

In case of any invalid input, the response will include validation errors that were found during input validation.

It may also include any errors that might have happened during the process of payment token generation.

Field Data Validation

The createPaymentToken function will validate field values. If any of the values do not pass validation, no token will be created. If that is the case, the system will generate a violations array indicating which fields are invalid.

| PARAMETER | TYPE | REQUIREMENT |

|---|---|---|

| clientAccnum | integer (required) | Merchant account number. A range between 90000 and 999999 and must be a number. |

| clientSubacc | integer (required) | Merchant subaccount number. A range of 0-9999 and must be a number. |

| timeToLive | integer (optional) | Has a range of 0-2147483647 and must be a number. If the max value is desired, then leave this out (or pass null). |

| numberOfUse | integer (optional) | The total number of times the Payment Token can be used for purchases. Has a range of 0-2147483647 and must be a number. If the max value is desired, then leave this out (or pass null). |

| cardNum | string (required) | Must be a valid credit card number. |

| expMonth | string (required) | Card expiration month in mm format. A range of 1-12, is required and must be a number. |

| expYear | string (required) | Card expiration year in yyyy format. A range of 2018-2100, is required and must be a number. |

| firstName | string (required) | Customer's first name. |

| lastName | string (required) | Customer's last name. |

| address1 | string (optional) | Customer's address. |

| city | string (optional) | Customer's city. |

| country | string (required) | Customer's country. Must be represented as a two-letter country code as defined in ISO 3166-1. |

| state | string (optional) | Customer's state. If provided must be a two-letter state code as defined in ISO 3166-2. |

| postalCode | string (required) | Customer's zip code. Is a valid postal code for the country provided. |

| phoneNumber | string (optional) | Customer's phone number. If provided, it must be a valid telephone number. |

| string (required) | Customer's email address. | |

| ipAddress | string (required) | Customer's IP address. Valid IPv4 addresses must be provided as a request parameter or through the X-Origin-IP header. |

The violations array is an object of the following object:

{

target: Object,

message: string,

propertyName: string

}At this time, the Client Page will need to either resolve any errors, display the right message on which fields were invalid, or use the new payment token provided.

Strong Customer Authentication

The CCBill Advanced Widget also enables merchants to integrate with CCBill's 3DS vendor and incorporate strong customer authentication in their transactions.

Alternatively, merchants can send SCA (3DS) results obtained from a 3DS vendor of their choice. To initiate charges using a payment token the SCA parameters need to be submitted along with other required parameters.

isScaRequired Function

The isScaRequired function determines whether strong customer authentication is needed. The system checks the provided credit card number, merchant account number, subaccount number, and currency code.

A valid input results in a Promise, that will eventually resolve to a response with SCA parameters or will turn into a rejection, due to an error.

Example

const result = widget.isScaRequired(authToken, clientAccnum, clientSubacc);| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| authToken | string (required) | Must be a valid Oauth Token for the provided Merchant Account. |

| clientAccnum | integer (required) | Merchant account number. |

| clientSubacc | integer (required) | Merchant subaccount number. |

The merchant payment form needs to contain a text input field (hidden if necessary) or select element (hidden if necessary) for the currencyCode value. The value represents a three-digit currency code (ISO 4217 standard) for the currency used in the transaction.

The Advanced Widget will automatically collect the currencyCode value if it follows standard naming conventions. Merchants can:

- Use the default ID attribute.

- Specify the currency code ID using the library.

- Utilize the data-ccbill attribute to specify the currency code field.

data-ccbill attribute example (input)

<input data-ccbill="currencyCode" type="text" />data-ccbill attribute example (select)

<select data-ccbill="currencyCode" />

<option>…</option>

<option>…</option>

…

</select>Default _ccbillId_currencyCode attribute example (input)

<input id="_ccbillId_currencyCode" type="text" />Default _ccbillId_currencyCode attribute example (select)

<select id="_ccbillId_currencyCode" />

<option>…</option>

<option>…</option>

…

</select>Field Data Validation

| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| clientAccnum | integer (required) | Has a range of 900000-999999 and must be a number. |

| clientSubacc | integer (required) | Has a range of 0-9999 and must be a number. |

| currencyCode | string (required) | Has to match regular expression ^\\d{3}$ |

| Credit Card Number (form input) | integer (required) | Must be a valid credit card number. |

The violations object is an array of the following object:

{

target: Object,

message: string,

propertyName: string

}isScaRequiredForPaymentToken Function

The isScaRequiredForPaymentToken function determines whether strong customer authentication is required based on the provided payment token ID and currency code.

A valid input results in a Promise, that will eventually resolve to a response with SCA parameters or will turn into a rejection, due to an error.

| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| authToken | string (required) | Must be a valid Oauth Token for the provided Merchant Account. |

| paymentTokenId | string (required) | The payment token ID. A unique string identifying the payment token, must match regular expression <strong><em>[a-zA-Z0-9]+$</em></strong> |

Example

const result = widget.isScaRequiredForPaymentToken(authToken, paymentTokenId);The merchant payment form needs to contain a text input field or select element for the currencyCode value. The value represents a three-digit currency code (ISO 4217 standard) for the currency used in the transaction.

The Advanced Widget will automatically collect the currencyCode value if it follows standard naming conventions. Merchants can:

- Use the default ID attribute.

- Specify the currency code ID using the library.

- Utilize the data-ccbill attribute to specify the currency code field.

data-ccbill attribute example (input)

<input data-ccbill=”currencyCode” type=”text” />data-ccbill attribute example (select)

<select data-ccbill=”currencyCode” />

<option>…</option>

<option>…</option>

…

</select>Default _ccbillId_currencyCode attribute example (input)

<input id=“_ccbillId_currencyCode” type=”text” />Default _ccbillId_currencyCode attribute example (select)

<select id=“_ccbillId_currencyCode” />

<option>…</option>

<option>…</option>

…

</select>Field Data Validation

| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| paymentTokenId | string (required) | Must match regular expression ^[a-zA-Z0-9]+$ |

| currencyCode | string (required) | Has to match regular expression ^\\d{3}$ |

The violations object is an array of the following object:

{

target: Object,

message: string,

propertyName: string

}authenticateCustomer Function

The authenticateCustomer function enables merchants to obtain the customer authentication result before initiating a 3DS transaction and calling CCBill's Merchant Connect (RESTful) API endpoint. If the call fails, it is going to return an error.

Several parameters need to be passed to facilitate a strong customer authentication.

| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| authToken | string (required) | Must be a valid Oauth Token for the provided Merchant Account. |

| clientAccnum | number (required) | The clientAccnum value must correspond to the one used in generating the OAuth token and must be a number within the 900000-999999 range. |

| clientSubacc | number (required) | The clientSubacc value must correspond to the one used in generating the OAuth token and should be a number within the 0-9999 range. |

| form | string (optional) | A form reference should either be a valid selector or an HTML Form Element that exists on the merchant's web page. Please note that if the formId is not provided, the Widget will find the first form HTML element on the page and assume that that is the payment form. |

| iframeId | string (optional) | The 3DS authentication process presents an iframe on the web page to perform its functionality. The Advanced Widget script generates an iframe and injects it into the merchant's web page if the parameter is undefined. If the provided value is null or an empty string, it is regenerated to fit the minimum technical requirements. |

| paymentTokenId | string (optional) | Use this optional field instead of the card number, card expiry month, and card expiry year. The card information must be present in the associated HTML form if the token ID is not provided. |

Example using only required parameters

const result = widget.authenticateCustomer(authToken, clientAccnum,

clientSubacc);Example using form

const result = widget.authenticateCustomer(authToken, clientAccnum,

clientSubacc, form);Example using iframeId and form

const result = widget.authenticateCustomer(authToken, clientAccnum,

clientSubacc, form, iframeId);Example using all parameters

const result = widget.authenticateCustomer(authToken, clientAccnum,

clientSubacc, form, iframeId, paymentTokenId);Field Data Validation

| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| paymentTokenId | string (required) | Must match regular expression ^[a-zA-Z0-9]+$ |

| clientAccnum | number (required) | A number within the 900000-999999 range. It must match the value used to create the OAuth token. |

| clientSubacc | number (required) | A number within the 0-9999 range. It must match the value used to create the OAuth token. |

| form | string (optional) | A form reference should either be a valid selector or an HTML Form Element that exists on the merchant's web page. If it's not provided, the system will attempt to collect the required SCA inputs from the first HTML form it finds on the page. |

| iframeId | string (optional) | The 3DS authentication process presents an iframe on the web page to perform its functionality. The Advanced Widget script generates an iframe and injects it into the merchant's web page if the parameter is undefined. If the provided value is null or an empty string, it is regenerated to fit the minimum technical requirements. |

Visit the 3DS Authentication Error Codes page for a comprehensive list of error codes.

3. Charge Payment Token

After you have generated a new OAuth token, and after you have generated a payment token, you can use those two new tokens to charge the consumer’s credit card.

Charge Payment Token (Without 3DS Authentication)

HTTP Request URL

Header

Accept: application/vnd.mcn.transaction-service.api.v.1+jsonRequest Parameters

| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| clientAccnum | integer (required) | Merchant account number. |

| clientSubacc | integer (required) | Merchant subaccount number. |

| initialPrice | float (required) | Initial transaction price. |

| initialPeriod | integer (required) | The length (in days) of the initial billing period. |

| currencyCode | string (optional) | Three-digit currency code (ISO 4217 standard) for the currency used in the transaction. |

| recurringPrice | float (optional) | The amount the consumer will be charged for each recurring bill. |

| recurringPeriod | integer (optional) | The length of time between rebills. |

| rebills | integer (optional) | The total number of times the subscription will rebill. |

| lifeTimeSubscription | boolean (optional) | The presence of this variable with a value of 1 indicates that the transaction is a lifetime subscription. |

| createNewPaymentToken | boolean (optional) | Return new payment token for subsequent transactions or not. |

| passThroughInfo | Array[any] (optional) | Key/value pairs that can be passed through to the transaction service and received in the webhook response. |

cURL

curl -X POST \

https://api.ccbill.com/transactions/payment-tokens/01047ed6f3b440c7a2ccc6abc1ad0a84 \

-H 'Authorization: Bearer eyJhbGciOiJSUzI1NiIsInR5cCI6IkpXVCJ9.eyJhdWQiOlsibWNuLXRyYW5zYWN0aW9uLXNlcnZpY2UiLCJtY24tYWRtaW4tc2VydmljZSJdLCJzY29wZSI6WyJjcmVhdGVfdG9rZW4iLCJyZWFkX3Rva2VuIiwiY2hhcmdlX3RvaiwiY3JlYXRlX3Byb2dyYW0iLCJyZWFkX3Byb2dyYW0iLCJjcmVhdGVfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIiwicmVhZF9wcm9ncmFtX3BhcnRpY2lwYXRpb24iLCJtb2RpZnlfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIl0sImV4cCI6MTUzNzM4MDczNiwiYXV0aG9yaXRpZXMiOlsiTUNOX0FQSV9UT0tFTl9DSEFSR0VSIiwiTUNOX0FQSV9UT0tFTl9DUkVBVE9SIiwiTUNOX0FQSV9BRE1JTiJdLCJqdGkiOiI4YzI2Njg1MC00NjMzLTQzZDMtYjZjOC1lNzIyY2ExNjQ1YTUiLCJjbGllbnRfaWQiOiI1MjE3NjhhYTc1OGQxMWU4YWE2YjAwNTA1NjlkMTU4NSJ9.HRYXZFATkIcI2_LJ1W_xo67IfBnbN9atyYNzyHqseLxYUxzgwBsAV5rNqCixKemOrDIeQLBN4jrwRsBIHDpEvshwBC8XmTodDJzpGmMaU9s1r20RV68X0_d1yTgSDke_Of7VCrVmJRbSuDl7AgsfTqQ1J7nWyu9vcIaER93ms-vadser_Ot9Z68_HAmCJL3DCLpdIFq3PYtBMKKKqXbvhfhSZQZD3b6-aewAnBo0VzpvK6tREqw1rv9_73oAvYcW2aHAj79ILr8viWMM40LyDKMMYOYkneg3hJUQsUVeh9WzztYUJKzERYNXje9fYIGN-eofoLvX7OZJ3eXmIfkrfQ' \

-H 'Cache-Control: no-cache' \

-H 'Content-Type: application/json' \

-d '{ "clientAccnum":900123, "clientSubacc":10, "initialPrice": 9.99, "initialPeriod": 10, "recurringPrice": 15.00, "recurringPeriod": 30, "rebills": 99, "currencyCode": 840, "lifeTimeSubscription": false, "createNewPaymentToken": false, "passThroughInfo": [ { "name": "val1", "value": "val2" } ] }'JavaScript

var data = JSON.stringify({

"clientAccnum": 900123,

"clientSubacc": 10,

"initialPrice": 9.99,

"initialPeriod": 10,

"recurringPrice": 15,

"recurringPeriod": 30,

"rebills": 99,

"currencyCode": 840,

"lifeTimeSubscription": false,

"createNewPaymentToken": false,

"passThroughInfo": [

{

"name": "val1",

"value": "val2"

}

]

});

var xhr = new XMLHttpRequest();

xhr.withCredentials = true;

xhr.addEventListener("readystatechange", function () {

if (this.readyState === 4) {

console.log(this.responseText);

}

});

xhr.open("POST", "https://api.ccbill.com/transactions/payment-tokens/01047ed6f3b440c7a2ccc6abc1ad0a84");

xhr.setRequestHeader("Content-Type", "application/json");

xhr.setRequestHeader("Authorization", "Bearer eyJhbGciOiJSUzI1NiIsInR5cCI6IkpXVCJ9.eyJhdWQiOlsibWNuLXRyYW5zYWN0aW9uLXNlcnZpY2UiLCJtY24tYWRtaW4tc2VydmljZSJdLCJzY29wZSI6WyJjcVfdG9rZW4iLCJyZWFkX3Rva2VuIiwiY2hhcmdlX3Rva2VuIiwiY3JlYXRlX3Byb2dyYW0iLCJyZWFkX3Byb2dyYW0iLCJjcmVhdGVfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIiwicmVhZF9wcm9ncmFtX3BhcnRpY2lwYXRpb24iLCJtb2RpZnlfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIl0sImV4cCI6MTUzNzM4MDczNiwiYXV0aG9yaXRpZXMiOlsiTUNOX0FQSV9UT0tFTl9DSEFSR0VSIiwiTUNOX0FQSV9UT0tFTl9DUkVBVE9SIiwiTUNOX0FQSV9BRE1JTiJdLCJqdGkiOiI4YzI2Njg1MC00NjMzLTQzZDMtYjZjOC1lNzIyY2ExNjQ1YTUiLCJjbGllbnRfaWQiOiI1MjE3NjhhYTc1OGQxMWU4YWE2YjAwNTA1NjlkMTU4NSJ9.HRYXZFATkIcI2_LJ1W_xo67IfBnbN9atyYNzyHqseLxYUxzgwBsAV5rNqCixKemOrDIeQLBN4jrwRsBIHDpEvshwBC8XmTodDJzpGmMaU9s1r20RV68X0_d1yTgSDke_Of7VCrVmJRbSuDl7AgsfTqQ1J7nWyu9vcIaER93ms-vadser_Ot9Z68_HAmCJL3DCLpdIFq3PYtBMKKKqXbvhfhSZQZD3b6-aewAnBo0VzpvK6tREqw1rv9_73oAvYcW2aHAj79ILr8viWMM40LyDKMMYOYkneg3hJUQsUVeh9WzztYUJKzERYNXje9fYIGN-eofoLvX7OZJ3eXmIfkrfQ");

xhr.setRequestHeader("Cache-Control", "no-cache");

xhr.send(data);PHP

<?php

$request = new HttpRequest();

$request->setUrl('https://api.ccbill.com/transactions/payment-tokens/01047ed6f3b440c7a2ccc6abc1ad0a84');

$request->setMethod(HTTP_METH_POST);

$request->setHeaders(array(

'Cache-Control' => 'no-cache',

'Authorization' => 'Bearer eyJhbGciOiJSUzI1NiIsInR5cCI6IkpXVCJ9.eyJhdWQiOlsibWNuLXRyYW5zYWN0aW9uLXNlcnZpY2UiLCJtY24tYWRtaW4tc2VydmljZSJdLCJzY29wZSI6WyJjcmVhdGrZW4ilYXRlX3Byb2dyYW0iLCJyZWFkX3Byb2dyYW0iLCJjcmVhdGVfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIiwicmVhZF9wcm9ncmFtX3BhcnRpY2lwYXRpb24iLCJtb2RpZnlfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIl0sImV4cCI6MTUzNzM4MDczNiwiYXV0aG9yaXRpZXMiOlsiTUNOX0FQSV9UT0tFTl9DSEFSR0VSIiwiTUNOX0FQSV9UT0tFTl9DUkVBVE9SIiwiTUNOX0FQSV9BRE1JTiJdLCJqdGkiOiI4YzI2Njg1MC00NjMzLTQzZDMtYjZjOC1lNzIyY2ExNjQ1YTUiLCJjbGllbnRfaWQiOiI1MjE3NjhhYTc1OGQxMWU4YWE2YjAwNTA1NjlkMTU4NSJ9.HRYXZFATkIcI2_LJ1W_xo67IfBnbN9atyYNzyHqseLxYUxzgwBsAV5rNqCixKemOrDIeQLBN4jrwRsBIHDpEvshwBC8XmTodDJzpGmMaU9s1r20RV68X0_d1yTgSDke_Of7VCrVmJRbSuDl7AgsfTqQ1J7nWyu9vcIaER93ms-vadser_Ot9Z68_HAmCJL3DCLpdIFq3PYtBMKKKqXbvhfhSZQZD3b6-aewAnBo0VzpvK6tREqw1rv9_73oAvYcW2aHAj79ILr8viWMM40LyDKMMYOYkneg3hJUQsUVeh9WzztYUJKzERYNXje9fYIGN-eofoLvX7OZJ3eXmIfkrfQ',

'Content-Type' => 'application/json'

));

$request->setBody('{ "clientAccnum":900123, "clientSubacc":10, "initialPrice": 9.99, "initialPeriod": 10, "recurringPrice": 15.00, "recurringPeriod": 30, "rebills": 99, "currencyCode": 840, "lifeTimeSubscription": false, "createNewPaymentToken": false, "passThroughInfo": [ { "name": "val1", "value": "val2" } ] }');

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

?>Decline Response Parameters

| Parameter | Type | Description |

|---|---|---|

| declineCode | string | The error code pertains to the error that has caused the transaction failure. |

| declineText | boolean | Description of decline. |

| denialId | string | Randomly generated GUID. |

| approved | boolean | Approval status of the transaction. |

| paymentUniqueId | string | Unique key connected to payment account. |

| sessionId | string | Unique session ID value for transaction. |

| subscriptionId | integer | Subscription ID to which the transaction belongs. |

| newPaymentTokenId | string | New payment token for subsequent transactions. |

Example Response

{"declineCode":null,"declineText":null,"denialId":null,"approved":true,"paymentUniqueId":"dG4P1t8dL58pA3rNxE+Phw","sessionId":null,"subscriptionId":121095101000018190,"newPaymentTokenId":null}Charge Payment Token (With 3DS Authentication)

Endpoint URL

Headers

Accept: application/vnd.mcn.transaction-service.api.v.1+jsonRequest Parameters

| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| createNewPaymentToken | boolean (optional) | Return new payment token for subsequent transactions or not. |

| clientAccnum | integer (required) | Merchant account number. |

| clientSubacc | integer (required) | Merchant subaccount number. |

| initialPrice | float (required) | Initial transaction price. |

| initialPeriod | integer (required) | The length (in days) of the initial billing period. |

| currencyCode | string (optional) | Three-digit currency code (ISO 4217 standard) for the currency used in the transaction. |

| recurringPrice | float (optional) | The amount the consumer will be charged for each recurring bill. |

| recurringPeriod | integer (optional) | The length of time between rebills. |

| rebills | integer (optional) | The total number of times the subscription will rebill. |

| lifeTimeSubscription | boolean (optional) | The presence of this variable with a value of 1 indicates that the transaction is a lifetime subscription. |

| createNewPaymentToken | boolean (optional) | Return new payment token for subsequent transactions or not. |

| passThroughInfo | Array[any] (optional) | Paired information being passed through to the transaction service. |

| threedsCardToken | string (required) | The encrypted cardToken you receive through the 3DS verification process. As we require only the first 16 characters, trim the string to that length before sending it to the CCBill API. Sending a string longer than 16 characters results in an error. Example value: gjeoB5NdJ1r6p0dG |

| threedsEci | string (required) | An Electronic Commerce Indicator (ECI). Values: '0', '1', '2', '5', '6', or '7'. |

| threedsStatus | string (required) | The status of the 3DS verification ('Y', 'N', 'A', etc.) |

| threedsVersion | string (required) | The version of the 3DS protocol to be followed for this specific card and transaction. Available versions are 1.0.2 and 2.1.0 |

| threedsXid | string (optional/required) | The transaction identifier (XID) is a unique tracking number set by the merchant for 3DS. It is a required parameter for threedsVersion 1.0.2 |

| threedsCavv | string (optional/required) | A digital signature that proves that the transaction has been 3DS verified. The signature is obtained through a 3DS verification flow and is a required parameter for threedsVersion 1.0.2 |

| threedsCavvAlgorithm | string (optional/required) | CAVV Algorithm for threeds request. The threedsCavvAlgorithm parameter is required for threedsVersion 1.0.2 |

| threedsDsTransId | string (optional/required) | Directory Server Transaction ID. The threedsDsTransId parameter is required for threedsVersion 2.1.0 |

| threedsAcsTransId | string (optional/required) | Access Control Server Transaction ID. The threedsAcsTransId parameter is required for threedsVersion 2.1.0 |

| threedsSdkTransId | string (optional) | The 3DS vendor's transaction ID. |

| threedsAuthenticationType | string (optional) | A digital signature that proves that the transaction has been 3DS verified. The signature is obtained through a 3DS verification flow (v2.1.0). |

| threedsAuthenticationValue | string (optional/required) | A digital signature that proves that the transaction has been 3DS verified. The threedsAuthenticationValue parameter is required for threedsVersion 2.1.0 |

| threedsClientTransactionId | string (required) | The parameter is automatically generated by the Advanced Widget. Its purpose is to identify the origin of the 3DS authentication transaction. |

| threedsSuccess | boolean (required) | Verification of 3DS authentication success or failure. |

| threedsAmount | integer (optional) | The amount to be charged (same as initialPrice). |

| threedsCurrency | integer (optional) | The 3-digit currency code for the currency to be used in this transaction. Example value: 840 |

| threedsError | string (optional/required) | Error received from the 3DS vendor during the strong customer authentication process. The parameter is required if no threedsVersion is provided. |

| threedsErrorDetail | string (optional) | Error details related to the threedsError. |

| threedsErrorCode | string (optional) | Error code. |

| threedsResponse | string (optional) | The complete response in case of an error. |

cURL

curl -X POST \

https://api.ccbill.com/transactions/payment-tokens/threeds/01047ed6f3b440c7a2ccc6abc1ad0a84 \

-H 'Authorization: Bearer eyJhbGciOiJSUzI1NiIsInR5cCI6IkpXVCJ9.eyJhdWQiOlsibWNuLXRyYW5zYWN0aW9uLXNlcnZpY2UiLCJtY24tYWRtaW4tc2VydmljZSJdLCJzY29wZSI6WyJjcmVhdGVfdG9rZW4iLCJyZWFkX3Rva2VuIiwiY2hhcmdlX3Rva2VuIiwiY3JlYXRlX3Byb2dyYW0iLCJyZWFkX3Byb2dyYW0iLCJjcmVhdGVfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIiwicmVhZF9wcm9ncmFtX3BhcnRpY2lwYXRpb24iLCJtb2RpZnlfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIl0sImV4cCI6MTUzNzM4MDczNiwiYXV0aG9yaXRpZXMiOlsiTUNOX0FQSV9UT0tFTl9DSEFSR0VSIiwiTUNOX0FQSV9UT0tFTl9DUkVBVE9SIiwiTUNOX0FQSV9BRE1dLCJqdGkiOiI4YzI2Njg1MC00NjMzLTQzZDMtYjZjOC1lNzIyY2ExNjQ1YTUiLCJjbGllbnRfaWQiOiI1MjE3NjhhYTc1OGQxMWU4YWE2YjAwNTA1NjlkMTU4NSJ9.HRYXZFATkIcI2_LJ1W_xo67IfBnbN9atyYNzyHqseLxYUxzgwBsAV5rNqCixKemOrDIeQLBN4jrwRsBIHDpEvshwBC8XmTodDJzpGmMaU9s1r20RV68X0_d1yTgSDke_Of7VCrVmJRbSuDl7AgsfTqQ1J7nWyu9vcIaER93ms-vadser_Ot9Z68_HAmCJL3DCLpdIFq3PYtBMKKKqXbvhfhSZQZD3b6-aewAnBo0VzpvK6tREqw1rv9_73oAvYcW2aHAj79ILr8viWMM40LyDKMMYOYkneg3hJUQsUVeh9WzztYUJKzERYNXje9fYIGN-eofoLvX7OZJ3eXmIfkrfQ' \

-H 'Cache-Control: no-cache' \

-H 'Content-Type: application/json' \

-d '{"clientAccnum":"901505","clientSubacc":"0","initialPrice":"10.00","initialPeriod":"30","currencyCode":"840","threedsEci":"05","threedsError":"","threedsStatus":"Y","threedsSuccess":"true","threedsVersion":"1.0.2","threedsXid":"aWQteHc4ajJnNGIxZW8gICAgICA=","threedsCavv":"cGFzc3dvcmQxMjM0NTZwYXNzd28=","threedsCavvAlgorithm":"SHA-256","threedsAmount":"10","threedsClientTransactionId":"id-wl9r6duc5zj","threedsCurrency":"USD","threedsSdkTransId":"","threedsAcsTransId":"","threedsDsTransId":"","threedsAuthenticationType":"","threedsCardToken":"gjeoB5NdJ1r6p0dG","threedsErrorDetail":"","threedsErrorCode":"","threedsResponse":""}'JavaScript

var data = JSON.stringify({

"clientAccnum": "901505",

"clientSubacc": "0",

"initialPrice": "10.00",

"initialPeriod": "30",

"currencyCode": "840",

"threedsEci": "05",

"threedsError": "",

"threedsStatus": "Y",

"threedsSuccess": "true",

"threedsVersion": "1.0.2",

"threedsXid": "aWQteHc4ajJnNGIxZW8gICAgICA=",

"threedsCavv": "cGFzc3dvcmQxMjM0NTZwYXNzd28=",

"threedsCavvAlgorithm": "SHA-256",

"threedsAmount": "10",

"threedsClientTransactionId": "id-wl9r6duc5zj",

"threedsCurrency": "USD",

"threedsSdkTransId": "",

"threedsAcsTransId": "",

"threedsDsTransId": "",

"threedsAuthenticationType": "",

"threedsCardToken": "gjeoB5NdJ1r6p0dG",

"threedsErrorDetail": "",

"threedsErrorCode": "",

"threedsResponse": ""

});

var xhr = new XMLHttpRequest();

xhr.withCredentials = true;

xhr.addEventListener("readystatechange", function () {

if (this.readyState === 4) {

console.log(this.responseText);

}

});

xhr.open("POST", "https://api.ccbill.com/transactions/payment-tokens/threeds/01047ed6f3b440c7a2ccc6abc1ad0a84");

xhr.setRequestHeader("Content-Type", "application/json");

xhr.setRequestHeader("Authorization", "Bearer eyJhbGciOiJSUzI1NiIsInR5cCI6IkpXVCyJhdWQiOlsibWNuLXRyN0aW9uLXNlcnZpY2UiLCJtY24tYWRtaW4tc2VydmljZSJdLCJzY29wZSI6WyJjcmVhdGVfdG9rZW4iLCJyZWFkX3Rva2VuIiwiY2hhcmdlX3Rva2VuIiwiY3JlYXRlX3Byb2dyYW0iLCJyZWFkX3Byb2dyYW0iLCJjcmVhdGVfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIiwicmVhZF9wcm9ncmFtX3BhcnRpY2lwYXRpb24iLCJtb2RpZnlfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIl0sImV4cCI6MTUzNzM4MDczNiwiYXV0aG9yaXRpZXMiOlsiTUNOX0FQSV9UT0tFTl9DSEFSR0VSIiwiTUNOX0FQSV9UT0tFTl9DUkVBVE9SIiwiTUNOX0FQSV9BRE1JTiJdLCJqdGkiOiI4YzI2Njg1MC00NjMzLTQzZDMtYjZjOC1lNzIyY2ExNjQ1YTUiLCJjbGllbnRfaWQiOiI1MjE3NjhhYTc1OGQxMWU4YWE2YjAwNTA1NjlkMTU4NSJ9.HRYXZFATkIcI2_LJ1W_xo67IfBnbN9atyYNzyHqseLxYUxzgwBsAV5rNqCixKemOrDIeQLBN4jrwRsBIHDpEvshwBC8XmTodDJzpGmMaU9s1r20RV68X0_d1yTgSDke_Of7VCrVmJRbSuDl7AgsfTqQ1J7nWyu9vcIaER93ms-vadser_Ot9Z68_HAmCJL3DCLpdIFq3PYtBMKKKqXbvhfhSZQZD3b6-aewAnBo0VzpvK6tREqw1rv9_73oAvYcW2aHAj79ILr8viWMM40LyDKMMYOYkneg3hJUQsUVeh9WzztYUJKzERYNXje9fYIGN-eofoLvX7OZJ3eXmIfkrfQ");

xhr.setRequestHeader("Cache-Control", "no-cache");

xhr.send(data);PHP

<?php

$request = new HttpRequest();

$request->setUrl('https://api.ccbill.com/transactions/payment-tokens/threeds/01047ed6f3b440c7a2ccc6abc1ad0a84');

$request->setMethod(HTTP_METH_POST);

$request->setHeaders(array(

'Cache-Control' => 'no-cache',

'Authorization' => 'Bearer eyJhbGciOiJSUzI1NiIsInR5cCI6IkpXVCJ9.eyJhdWQiOlsibWNuLXRyYW5zYWN0aW9uLXNlcnZpY24tYWRtaW4tc2VydmljZSJdLCJzY29wZSI6WyJjcmVhdGVfdG9rZW4iLCJyZWFkX3Rva2VuIiwiY2hhcmdlX3Rva2VuIiwiY3JlYXRlX3Byb2dyYW0iLCJyZWFkX3Byb2dyYW0iLCJjcmVhdGVfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIiwicmVhZF9wcm9ncmFtX3BhcnRpY2lwYXRpb24iLCJtb2RpZnlfcHJvZ3JhbV9wYXJ0aWNpcGF0aW9uIl0sImV4cCI6MTUzNzM4MDczNiwiYXV0aG9yaXRpZXMiOlsiTUNOX0FQSV9UT0tFTl9DSEFSR0VSIiwiTUNOX0FQSV9UT0tFTl9DUkVBVE9SIiwiTUNOX0FQSV9BRE1JTiJdLCJqdGkiOiI4YzI2Njg1MC00NjMzLTQzZDMtYjZjOC1lNzIyY2ExNjQ1YTUiLCJjbGllbnRfaWQiOiI1MjE3NjhhYTc1OGQxMWU4YWE2YjAwNTA1NjlkMTU4NSJ9.HRYXZFATkIcI2_LJ1W_xo67IfBnbN9atyYNzyHqseLxYUxzgwBsAV5rNqCixKemOrDIeQLBN4jrwRsBIHDpEvshwBC8XmTodDJzpGmMaU9s1r20RV68X0_d1yTgSDke_Of7VCrVmJRbSuDl7AgsfTqQ1J7nWyu9vcIaER93ms-vadser_Ot9Z68_HAmCJL3DCLpdIFq3PYtBMKKKqXbvhfhSZQZD3b6-aewAnBo0VzpvK6tREqw1rv9_73oAvYcW2aHAj79ILr8viWMM40LyDKMMYOYkneg3hJUQsUVeh9WzztYUJKzERYNXje9fYIGN-eofoLvX7OZJ3eXmIfkrfQ',

'Content-Type' => 'application/json'

));

$request->setBody('{"clientAccnum":"901505","clientSubacc":"0","initialPrice":"10.00","initialPeriod":"30","currencyCode":"840","threedsEci":"05","threedsError":"","threedsStatus":"Y","threedsSuccess":"true","threedsVersion":"1.0.2","threedsXid":"aWQteHc4ajJnNGIxZW8gICAgICA=","threedsCavv":"cGFzc3dvcmQxMjM0NTZwYXNzd28=","threedsCavvAlgorithm":"SHA-256","threedsAmount":"10","threedsClientTransactionId":"id-wl9r6duc5zj","threedsCurrency":"USD","threedsSdkTransId":"","threedsAcsTransId":"","threedsDsTransId":"","threedsAuthenticationType":"","threedsCardToken":"gjeoB5NdJ1r6p0dG","threedsErrorDetail":"","threedsErrorCode":"","threedsResponse":""}');

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

?>Decline Response Parameters

| Parameter | Type | Description |

|---|---|---|

| errorCode | integer | Error condition value of the transaction. |

| approved | boolean | Approval status of the transaction. |

| paymentUniqueId | string | Unique key connected to payment account. |

| sessionId | string | Unique session ID value for transaction. |

| subscriptionId | integer | Subscription ID to which the transaction belongs. |

| newPaymentTokenId | string | New payment token for subsequent transactions. |

Example Response

{

"errorCode": "integer",

"approved": "boolean",

"paymentUniqueId": "string",

"sessionId": "string",

"subscriptionId": "integer",

"newPaymentTokenId": "string"

}Once the payment token has been charged, a webhooks HTTP POST notification will be triggered so that you may capture the transaction information. This webhooks event will be a “UpSaleSuccess”.

Read Payment Token ID

Use this API call to obtain data on a previously made charge. You will need to identify the charge by the payment token ID and include the ID as an URI element.

Example Request

GET 'https://api.ccbill.com/payment-tokens/{{PAYMENT_TOKEN_ID}}' \

--header 'Authorization: Bearer {{BACKEND_ACCESS_TOKEN}}' \

--header 'Accept: application/vnd.mcn.transaction-service.api.v.2+json'

HTTP Request URL

Header

Accept: application/vnd.mcn.transaction-service.api.v.2+jsonResponse Parameters

| PARAMETER | TYPE | DESCRIPTION |

|---|---|---|

| paymentTokenId | string (required) | Complex representation of Payment Token ID. |

| programParticipationId | integer (required) | The Program connected to the Payment Token. |

| originalPaymentTokenId | string (optional) | Reference to a previous Token ID. |

| clientAccnum | integer (required) | Merchant account number. |

| clientSubacc | integer (required) | Merchant subaccount number. |

| createdDatetime | datetime-only (required) | Date and time of creation of the Payment Token. |

| timeToLive | integer (required) | Time for the token to exist (hours). |

| validNumberOfUse | integer (required) | Total number of times the Payment Token can be used for purchases. |

| paymentInfoId | string (optional) | Information associated with the payment. |

| subscriptionId | integer (required) | Identification of the subscription associated with the transaction. |

Example Response

{"paymentTokenId":"01390f2aae864749a6437e007936529b","programParticipationId":null,"originalPaymentTokenId":null,"clientAccnum":999999,"clientSubacc":0,"createdDatetime":"2021-04-02T23:09:02","timeToLive":30,"validNumberOfUse":3,"paymentInfoId":null,"errors":null,"subscriptionId":"121092501000146223"}Visit the following page for a complete list of CCBill RESTful API Error Codes.