If you have ever made an international payment, chances are you have been asked to provide an IBAN. Many are not sure what an IBAN is or how they can obtain their bank account’s IBAN.

This article aims to explain what an IBAN is, what IBAN stands for, and how it works.

What Does IBAN Stand For?

IBAN stands for International Bank Account Number. It is a unique code used to identify a bank account for cross-border payments. An IBAN is not a separate bank account—rather, this code represents your national bank account in payment processes with other countries.

The European Committee for Banking Standards (ECBS) created IBANs in 1997 to streamline international money transfers by allowing banks to register account details in a standardized format.

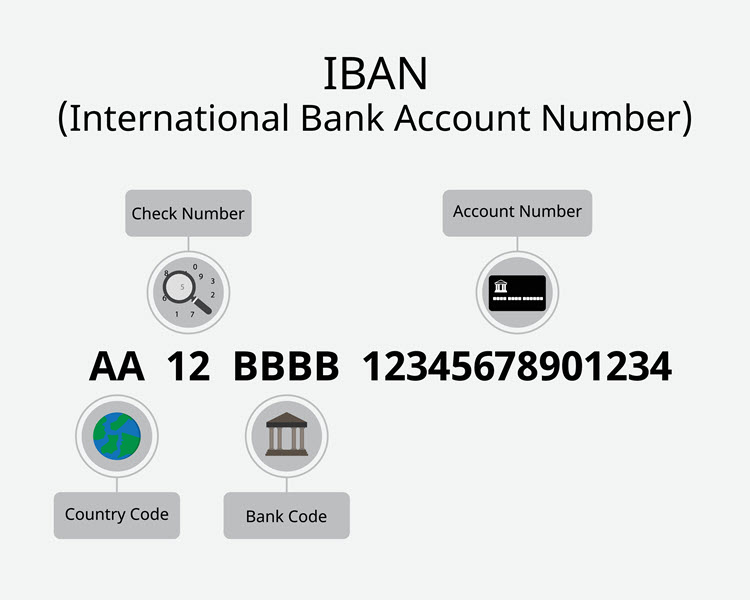

What Does an IBAN Look Like?

IBAN codes consist of a maximum of 34 alphanumerical characters. The letters and numbers encode the country, bank, and account details banks need to transfer money internationally.

The 34 alphanumeric characters that an IBAN consists of are as follows:

- Country Code: 2 letters.

- Check digit: 2 numbers.

- Up to 30 letters and numbers outlining the domestic bank identifier and account number.

IBAN Number Examples

Here are 5 examples of IBAN numbers:

- Serbia: RS 35 2600 0560 1001 6113 79

- Cyprus: CY 17 002 00128 00020012005276102

- Kuwait: KW 81CBKU00000000000012345601213

- Luxembourg: LU 28 001 94036457510204

- Finland: FI 21 1234 5600 0007 85

How are IBAN Numbers Used?

You need an IBAN for cross-border payments if the beneficiary’s bank is in a country that participates in the IBAN system. To use an IBAN to send international payments:

- Request the beneficiary’s IBAN.

- Enter the IBAN as the beneficiary’s bank account number. At the very least, you also need to provide the beneficiary’s full name. Some banks may request a BIC/SWIFT number too.

- The bank may request additional information, such as the beneficiary’s address, their bank, and bank address.

What Countries Use IBAN?

The ECBS initially developed the IBAN for transactions between European banks. Today, more than 70 countries across the globe use IBAN for processing cross-border payments.

Although the United States and Canada do not apply this solution in their national payment processing, they still recognize it and process international payments accordingly.

FAQ

This FAQ guide will tell you what you need to know about IBANs.

Do US Banks Use IBAN Numbers?

The United States and Canada do not use IBAN. They instead use SWIFT codes and routing numbers to process cross-border payments. However, both countries recognize the system and process payments with IBANs.

Is IBAN Different from an Account Number?

An IBAN holds more information than an account number, and the two are different.

The IBAN has a maximum length of 34 characters, starting with a two-digit country code, then two numerals, followed by up to 30 alphanumeric characters that designate the bank, bank branch, and bank account.

Account numbers, on the other hand, do not provide any additional information beyond identifying the account.

Is IBAN the Same as Routing Number?

An IBAN is not the same as a routing number. A routing number is a nine-digit code that American banks use to identify themselves.

Also called a Routing Transit Number (RTN) or American Bankers Association (ABA) routing number, they are used on everything from paper cheques to automated and wire payments online, both domestically and internationally.

Can I Find my IBAN Number Online?

You can find your IBAN on bank statements or by logging into your online/mobile banking account. Alternatively, look up the IBAN on your bank’s website or call or visit your local bank branch.

If for any reason, you are struggling to find your account’s IBAN, there are several IBAN calculators available online.

Is It Safe to Give an IBAN Number?

Giving your IBAN is perfectly safe - they are meant to be shared. People cannot draw funds from your account based on the IBAN. They can only use an IBAN to send payments to an account.

Summary

An IBAN is an essential part of secure, efficient, and fast money transactions across the globe. It simplifies the payment process by providing a numeric code representing your domestic bank account number in international transactions.

While this system is widely accepted, some countries, such as the US and Canada, do not apply it, but still recognize it in their payment processing.