ODFI and RDFI are the two principal entities participating in processing ACH payments. ACH transfers are electronic transfers of funds between two back accounts. It is one of the most popular ways to send and receive money in the U.S. because it is often cheaper and more convenient than other types of money transfer.

This article explains what an ODFI and RDFI are and what their roles are in ACH payment processing.

See how ACH compares to another popular payment method in our article ACH vs. Wire Transfers.

ODFI vs. RDFI: What Are the Differences?

ODFI and RDFI are the two financial institutions that initiate, finalize, and deliver ACH payments. While an ODFI initiates an ACH transaction, the RDFI completes the payment process.

Let us look at what each entity does in ACH payment processing.

What Is an ODFI?

ODFI stands for Originating Depository Financial Institution. This is the bank that initiates the ACH transfer at the request of the originator of the transaction – an individual, business, or institution.

ODFI is part of the ACH (Automated Clearing House) network, which oversees the entire transaction, ensuring all data is valid and the payment is legitimate.

A financial institution or bank can choose whether they want to serve as an ODFI and provide their customers with an option to send ACH payments.

ODFI’s Role in ACH Payment Processing

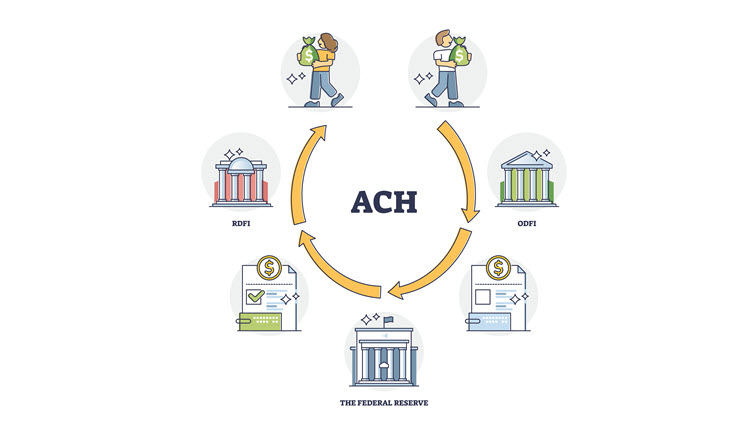

Here is a step-by-step overview of what the ODFI does for each ACH payment:

- The originator sends an ACH request to their bank (the ODFI).

- The ODFI submits ACH payment files to an ACH Operator (The Reserve Banks and Electronic Payment Network).

- The ACH Operator inspects the payment data, delivers the payment to the RDFI if the data is in order, and settles the transaction.

- The ODFI safeguards payment data during the transaction.

ODFI Example

Whenever an individual wants to make an ACH payment to another individual or entity, they employ an ODFI to initiate the transaction.

Online utility payments are a common example of engaging an ODFI. When a customer pays recurring bills online, the utility company sends an ACH debit entry to their ODFI to debit the client’s bank account.

Similarly, companies that pay their employees via direct deposit or the government that sends tax returns to citizens first send an ACH request to their ODFI to debit their accounts.

What Is an RDFI?

RDFI stands for Receiving Depository Financial Institution, and it is the bank of the ACH transaction’s recipient (an individual or organization). Unlike ODFI participation, which is optional, all financial institutions must assume the role of RDFI to enable their customers to receive ACH payments.

How Does RDFI Work?

RDFI oversees the following aspects of each ACH payment:

- Receiving ACH payment entries from ACH operators.

- Checking their validity.

- Delivering the received funds to their customers’ accounts

RDFI also reports an ACH return code to the ODFI if an ACH operator notifies them of inaccurate information or insufficient funds.

RDFI Example

Automatic payments are a good example of engaging an RDFI. Many utility companies provide the option of automatic payments as a quicker, more convenient way to pay bills. When an individual authorizes their bank to pay the bills on a recurring basis, the funds are automatically pulled (or debited) from the client’s account at the RDFI.

Receiving ACH payments provides many benefits to merchants. For a guide on how to start accepting them and what advantages you can expect, refer to our article How to Accept ACH Payments.

Conclusion

ACH payments are a popular electronic money transfer solution. The ODFI is the institution that initiates the process, while the RDFI sends the funds to the receiver’s account.

Each institution has distinct responsibilities to make the transaction work, but they have the same purpose – to transfer the funds securely and promptly via the ACH network.