Markup percentage and gross profit margin (or margin, for short) are two important accounting terms every ecommerce merchant should know. The terms are often used interchangeably but even though they use the same input, the results they show are substantially different.

It is essential to understand the difference between markup and margin because confusing the two can cause mistakes in price setting. Over — or underpricing, in turn, means a business runs the risk of being pushed out of the market.

In this article, learn about the difference between markup and margin, how to calculate them, and which to use depending on your needs.

Markup vs. Margin: An Overview

To understand markup and margin, a merchant first needs to establish the following:

- Cost of goods sold (or COGS). The cost of manufacturing a product or service.

- Revenue. The amount the merchant earns by selling a product or service (before deducting costs). The term selling price is used interchangeably in the context of markup and margin.

- Gross profit. The amount that is left when the COGS is subtracted from revenue.

Now let us look at the differences between markup and margin through the example of a sweater that costs $50 to manufacture and is sold for $75.

- COGS = $50

- Revenue = $75

- Gross profit = $25.

To obtain the markup percentage, the gross profit is divided by the COGS ($50) and multiplied by 100. Thus, the markup percentage of the sweater is 50%.

On the other hand, margin is obtained by dividing gross profit ($25) by revenue ($75) and multiplying the result by 100. With this calculation we see that the margin for the sweater is 33%.

The main difference between markup and margin is in how they asses gross profit and establish profitability. Markup sees gross profit it as a percentage of the cost of the product, while margin expresses it as a percentage of revenue. So even if the dollar amount is the same, the percentage is different.

The above example shows that if profitability is measured on the basis of markup, the number will be higher than if margin is considered. That is why, it is essential not to confuse the two since misunderstanding can lead to accounting and pricing errors that negatively impact a business’s bottom line.

Note: Explore the most common pricing models for ecommerce merchants in our article Tiered Pricing vs. Volume Pricing Explained.

Markup vs. Margin: The Formula

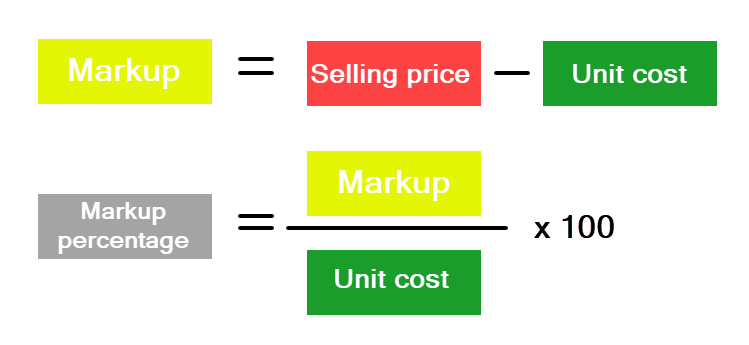

Markup is the difference between the selling price of a product and the costs it took to manufacture it. To calculate the markup percentage, you need to divide the markup by the COGS of a single unit and multiply it by a 100.

For example, a merchant sells a bag for $90. The cost of manufacturing, packaging, and shipping a single unit is $50, so the profit they make is $40. Based on this, we can calculate the markup percentage as follows:

[(Selling price – unit cost) / unit cost] x 100 = markup percentage

[($90 - $50) / $50] x 100 = 80% markup

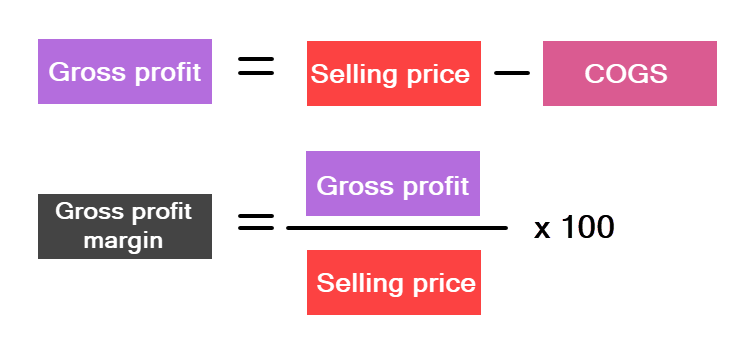

Margin is the difference between the price and the costs of the goods sold. Since it is calculated as the percentage of the price, the formula goes as follows:

In the same example, we can calculate the gross profit margin by looking at the price as:

[(Selling price – COGS) / selling price)] x 100 = gross profit margin

[($90 - $50) / $90] x 100 = 44.44% margin

To conclude – with an 80% markup added on the price of the product, you will earn 44.44% in gross profit.

Markup vs. Margin: When to Use Them?

To determine a selling price that covers production costs and ensures the business makes a profit without sending customers to the competition, merchants should use markup percentage. As a pricing strategy, markup is particularly useful for companies that sell many products and have to set prices quickly.

However, markup should be revised regularly since market conditions change and the indirect expenses of selling a product can vary. Failing to do so, can hurt a business in the long run.

On the other hand, merchants wanting to keep oversight of their business health, financial performance, and growth potential, should use gross profit margin. Margin is better for keeping an eye on a business’s bottom line as it does not neglect the indirect expenses of sales.

Note: See also how we defined Gross Merchandise Value (GMV), an ecommerce metric that assesses how well a business is performing in the market.

Conclusion

Markup and margin are two of the most common ways to analyze profit. While markup is useful for quickly determining the appropriate price for your products, margin shows you the long-term results of your business efforts, such as growth, health, and performance.