With the rise of online shopping, the number of customers disputing their purchases has also grown. While chargebacks seem like an unavoidable consequence of taking a business online, merchants do have mechanisms to dispute them.

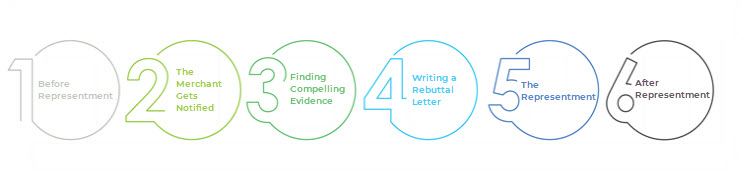

To contest a chargeback, merchants need to navigate a series of predefined steps in a process called chargeback representment.

This article will explain in detail what chargeback representment is, how it works, and how to maximize your chances of winning.

What Is Representment in Chargebacks?

A chargeback occurs when a customer (cardholder) disputes a charge by contacting their bank. During the process, they explain why they should not pay for a product or service a merchant provided.

Banks do try to discourage customers from filing fraudulent disputes, but as they work for the customers, the bar for evidence is not high. This leaves the burden of proof that the charge was legitimate on merchants, who also have to foot the bill.

Chargeback representment is when a merchant disagrees with the customer’s claims and does not accept a chargeback request. Merchants contest the chargeback by convincing the bank to reverse it and return the disputed funds. This process is called representment because a merchant presents the charge a second time.

Why Do You Need Chargeback Representment?

Consumers are increasingly abusing chargebacks to get both the product and their money back. Roughly two-thirds of merchants reported a rise in chargeback fraud in the last three years. A significant factor contributing to this type of fraudulent activity is the unprecedented rise of ecommerce during the COVID-19 pandemic.

Friendly Fraud

Friendly fraud is when a consumer makes a purchase, receives the product or service, and then proceeds to dispute the purchase, asking for their money back.

This type of fraud is accidental when customers don't recognize the charge on their bank statement. However, friendly fraud can also be intentional. Sometimes a customer requests a chargeback with the desire to abuse the merchant and get a product or service for free.

In 2021, nearly 40% of online merchants worldwide reported experiencing friendly fraud, with losses estimated at $20 billion globally, increasing over 14% compared to the previous year.

Note: For more on ecommerce fraud and how to prevent it, consult our article Ecommerce Fraud Types You Should Be Aware Of.

As daunting as those figures seem, merchants can and, in a lot of cases, do fight back against friendly fraud. The key to success is timely access to the relevant facts, supporting evidence, and details about the disputed purchase. The more accessible this information, the easier it is to contest a chargeback request and win a representment.

How Does Representment Work?

This is a step-by-step breakdown of the representment process.

1. Before Representment

It all starts when a customer files a dispute with their issuing bank. The issuing bank reviews the claim and determines its legitimacy, which can take two to six weeks. Visa, for example, allows issuing banks up to 30 days for the review process.

If the bank deems the claim legitimate, they notify the merchant’s acquiring bank or payment processor. The acquiring bank now notifies the merchant via a chargeback notice containing the transaction’s details.

2. The Merchant Gets Notified

The ball is in the merchant’s court now, and they need to work fast as the deadlines to respond to chargebacks are very tight. The first thing merchants must check is how much time they have to submit a chargeback representation, as being even a day late means they automatically forfeit the case.

The deadline can change depending on various factors, such as the reason code or card network. To be sure, consult your chargeback notification and check with your acquiring bank or payment processor.

3. Finding Compelling Evidence

The product and business type, as well as the reason for the chargeback, determines what evidence is appropriate for the case.

A useful hint for merchants is the reason code. This is the status code that describes the cardholder’s grounds for contesting the transaction. Any piece of evidence can make or break a merchant’s case, so it is important to be thorough.

Depending on the circumstances, the merchant may need to provide evidence such as:

- The receipt and order forms for the transaction.

- A comparison of the ship-to and bill-to addresses.

- Tracking numbers and proof of delivery.

- A positive Address Verification Service (AVS) response.

- Any correspondence with the client or proof that the merchant completed the transaction.

- A copy of your sales terms and conditions with highlighted relevant sections and proof that the customers were aware of them when they placed their order.

- A customer’s past order history showing that they previously had no issue with similar or identical purchases.

- Any digital proof that the customer has already used the software or subscription they purchased.

- A signed service agreement.

Importantly, many customers rush to submit chargebacks without trying first to resolve the issue with the merchant. Copies of correspondence between the merchant and customer are useful if they demonstrate that the merchant honestly attempted to address the customer’s issues.

Note: Learn what how to address AVS mismatch i.e. AVS rejected.

Importantly, many customers rush to submit chargebacks without trying first to resolve the issue with the merchant. Copies of correspondence between the merchant and customer are useful if they demonstrate that the merchant honestly attempted to address the customer’s issues.

4. Writing a Rebuttal Letter

A rebuttal letter outlines the merchant’s position in the dispute and lays out why they contest the chargeback. The letter needs to include specific details of how the provided evidence disproves the customer’s claims.

Every case demands a rebuttal letter unique to the details of the chargeback, but all rebuttals must be:

- Brief and direct.

- Without exaggeration and complaining.

- Objective but persuasive.

- Professional and dispassionate in delivering the facts.

Above all, the letter needs to demonstrate that the merchant performed their due diligence.

The following points should be addressed in the chargeback rebuttal letter:

- The reason code for the chargeback.

- The monetary amount the merchant is disputing.

- An explanation of how the submitted evidence supports the validity of the initial transaction.

5. The Representment

If the merchant has followed all the steps correctly, the evidence is sent to his acquiring bank, which then forwards the documents to the customer’s issuing bank. The issuing bank reviews the case and judges whether the merchant completed the transaction as described.

This process can take between 4-6 weeks and has three distinct outcomes:

- Merchant lacks evidence. The issuing bank decides in favor of the cardholder and upholds the chargeback since the merchant has not presented convincing proof.

- Chargeback reversed. The merchant successfully contests the chargeback and reverses it.

- New evidence. The cardholder presents new evidence after a successful chargeback reversal, and the case moves on to pre-arbitration or a second chargeback.

6. After Representment

Second-cycle disputes (also known as a second chargeback or pre-arbitration) are chargebacks that are decided in favor of the merchant but are now contested by the cardholder. This can happen if there is new evidence from the cardholder, there is change in the chargeback reason, or the issuer believes that more evidence is required. In some cases, the merchant can contest the second chargeback.

The final step in the chargeback process is arbitration. In arbitration, the card association is called to resolve the dispute between the acquiring and issuing banks and, by extension, the merchant and customer. After the card association has made a decision, the dispute is closed, and the losing side must pay the arbitration fees.

Note: Chargebacks are not the same as disputes. For more on the differences between a chargeback and a dispute, refer to our article Chargeback vs. Dispute: Understanding the Difference.

Chargeback Representment Tips for Merchants

With the right approach and know-how, you can fight and win against chargebacks.

To get the most out of chargeback representment, follow these tips:

- Have clear refund policies and communicate with customers. The best way to deal with chargebacks is to limit their occurrence.

- Be informed of the most current chargeback representation rules and requirements.

- Write a great rebuttal letter – it is crucial to winning the case.

- Create a method for gathering and organizing evidence and important documents so you can find them easily.

- Keep up to date on the reason codes for each card network, as they will help you know what kind of evidence to submit.

- Collect the evidence as fast as you can to meet the short deadlines.

- Double-check everything to make sure you are not making any costly mistakes or skipping vital steps.

- Analyze your customer’s transactions and behaviors. Understanding them will help you better identify the risks for chargeback fraud.

- Use a billing system with clear statement descriptors. Customers often initiate a chargeback because they do not recognize the charge on their bank statement.

- Consider getting help from professional chargeback experts.

Note: In the case of client disputes, Merchant Statements provide all the necessary information that merchants need in order to settle the dispute.

Representment FAQ

Here are some frequently asked questions about chargeback representation:

Can You Ignore Chargebacks?

Do not ignore chargebacks. If there is no response from the merchant, chargebacks are accepted by default. Not only that, but merchants are charged a non-response fee in addition to the other fees they incur during the chargeback process.

In the longer term, if chargeback requests are left unchecked, a merchant’s chargeback rate rises, impacting the terms they have with their payment processor. Businesses receiving large numbers of chargeback requests are deemed high-risk merchants and pay higher fees even for everyday business transactions.

What Happens If You Lose a Chargeback?

Accepting chargebacks without a fuss can damage your reputation with the issuing bank, making it harder to win future disputes. When a merchant loses or does not fight chargebacks, the implication is that customers’ claims are valid.

Losing a chargeback also allows fraudsters to get away with theft, encouraging them to repeat this harmful practice.

Note: With over 20 years of experience in high-risk payments processing, CCBill is an industry leader in fraud protection, content compliance, data protection, and personal privacy. Sign up for our high-risk payment processing plan for merchants.

Are the Representment Process and Documentation the Same for all Merchants?

The representment process and documentation are roughly the same for all merchants, although different types of evidence are required depending on the type of merchant and their product.

For example:

- Physical goods merchants must provide invoices, product descriptions, shipping information, and copies of any interactions between the customer and the merchant.

- Digital goods merchants must provide proof that the customer has, in fact, used the software or subscription they purchased. This can be IP logs, internal data, or social media postings.

- Service merchants must present a written agreement of service with the customer, either physically or electronically signed.

What are The Differences Between a Chargeback and a Refund?

Chargebacks and refunds both require the disputed funds to be paid back to the customer. The main difference between the two types of disputes are the parties involved.

In the case of a refund, the customer and the merchant communicate directly without involving the banks. With a chargeback, the customer lodges a complaint to their issuing bank, which then contacts the merchant’s acquiring bank. With the 3 main parties involved in a chargeback (customer, merchant, issuing bank) the whole process is lengthened and costs the merchant more money.

Note: To learn more, read our article Chargebacks vs. Refunds.

What Is Pre-Arbitration Chargeback?

A second chargeback, also called pre-arbitration, can happen after a merchant disputes the first chargeback, and the issuing bank pushes another chargeback on the same disputed transaction.

The merchant’s options, in this case, are to accept arbitration from the card network or provide new evidence. The best way to avoid pre-arbitration is to present complete and compelling evidence in the first phase of chargeback representment. If the merchant loses the chargeback representment, they can request arbitration themselves.

How Often Do Merchants Win Chargeback Disputes?

According to a 2021 Chargeback Field Report, an average of 72% of merchants reported challenging invalid chargebacks through representment, with 42% of chargebacks stemming from friendly fraud. The merchants participating in the survey won a chargeback reversal in 10% of friendly fraud cases.

Do You Need a Chargeback Specialist?

Fighting chargebacks with an in-house team is a good idea if you have a high volume or large dollar amount of chargebacks. The advantages are security and cost, but it can be difficult for an in-house team to keep up with all the policy changes banks and card networks make.

Hiring the right chargeback management company can give you an edge if they have a solid knowledge of the industry and the tools and resources to fight chargebacks effectively. They can also provide valuable insights into your vulnerabilities and help you incur fewer chargebacks overall.

However, they can be expensive, and the wrong company can drain your money while providing little value.

Conclusion

In the battle against chargebacks, it is up to the merchant to submit compelling evidence in a timely matter if they wish to contest the request. Keep in mind that submitting the wrong evidence or fighting unwinnable chargebacks can do more harm than good.

In the long run, merchants must follow best practices to ensure that chargeback rates are kept at a minimum. However, when the inevitable happens and a customer requests a chargeback, knowing the ins and outs of chargeback representment gives merchants a good chance of curbing friendly fraud and maintaining their reputation.