The online payments market has experienced tremendous growth, leading to stronger connectivity between merchants, customers, and payment facilitators.

To remain competitive in the global environment, merchants need to ensure seamless and smooth payment processing. This procedure involves cardholders, merchants, credit card associations, issuing banks and merchant acquirers, among others.

This article explains what a merchant acquirer is, how it works, and how to choose the right merchant acquirer.

What Is a Merchant Acquirer?

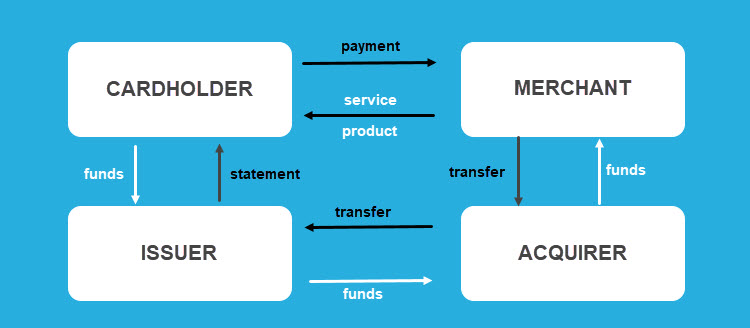

A merchant acquirer, also known as an acquiring bank, receives and verifies credit card transaction data from cardholders that are making a purchase, and transfers that data to the cardholder’s issuing bank. To facilitate payment processing and process payments on behalf of a merchant, acquiring banks maintain merchant accounts, a prerequisite for accepting credit card payments.

Merchant acquirers act as a link between merchants, cardholders, credit card associations, and card issuing banks.

Not every bank is a merchant acquirer. Acquiring banks have special contractual agreements with major credit card associations, such as Visa and Mastercard. They must adhere to strict rules and regulations imposed by credit card associations to be able to mediate in electronic payment processing.

Note: Check out our article Issuer vs. Acquirer: What Is the Difference to learn more about how an issuer and an acquirer work.

Payment Processor vs. Merchant Acquirer

Payment processors mediate between merchants and all other financial institutions involved, including merchant acquirers. They provide the technology necessary to encrypt payment card information and distribute it to relevant participants in payment processing.

A merchant acquirer, on the other hand, maintains the merchant’s account. They also work with the payment processor to ensure all payment processing rules and regulations are met at all times. They take on the financial responsibility for every payment initiated on the merchant’s behalf.

Note: Some merchant acquirers also provide payment processing services. Sometimes it is difficult to draw the line between payment processors and acquiring banks. However, ultimately, having a one-stop-shop makes it easier for businesses to start accepting credit card payments.

What Does a Merchant Acquirer Do?

The main responsibility of merchant acquirers is to authorize and authenticate transactions to assist merchants in receiving funds from their customers’ payment cards.

When an acquirer receives the card transaction data from the merchant’s terminal or payment gateway, they forward this information to the card-issuing bank through the card association in question, for payment authorization and completion.

The acquirer is a liable payment mediator that completes the transaction and debits the funds to the merchant’s nominated account.

Additional Services

Some merchant acquirers act as payment facilitators (i.e., payment processor) and provide an additional scope of services.

- Recruitment. A merchant acquirer analyzes the merchant’s needs and offers a set of services relevant to the merchant’s business model.

- Underwriting. Depending on the span of services offered by merchant acquirers, either they or the payment processor underwrites the merchant to assess and mitigate payment fraud risks. During underwriting, the acquirer establishes whether the merchant meets a certain number of conditions which prove that the business can handle financial and other business operations safely and smoothly. It helps acquirers predict if the merchant won’t be financially liable or if they do not operate according to rules and regulations.

- Chargebacks. When a customer is not satisfied with a product or service, they typically ask for a refund or chargeback. Refunds are handled by merchants. However, customers occasionally demand a chargeback. In this case, the acquirer reviews the chargeback request and the payment details obtained from the issuing bank.

- Account termination. Merchants typically close a merchant account when they switch to another merchant acquirer, shut down the business, or go bankrupt. In the first two cases, the acquirer can collect the processing fees and handle in-progress chargebacks. However, in the case of business liquidation, the acquirer doesn’t usually get paid for the provided services and has to cushion the loss.

How to Choose the Right Merchant Acquirer?

There is no one-size-fits-all merchant acquirer.

Some acquirers focus on low-risk merchants and industries only, other focus on businesses requiring monthly recurring payments or merchants selling tangible goods online.

Merchants from high-risk industries need to find an acquirer ready to work with their type of business. They can also expect a demanding underwriting process and high-risk merchant fees (typically higher than regular processing fees).

Note: Read our article to find out more about the risk difference between high-risk and low-risk merchant accounts.

Whether high-risk or low-risk, here are the things that a merchant needs to consider when choosing a merchant acquirer:

- Geographical limitations and currencies. Ask the acquirer if there are any geographical regions from which they don’t accept payments. If aiming at a global audience, choose an acquirer that offers multi-currency payment options.

- Accepted card types. Inquire about the card associations and card types that the merchant acquirer accepts.

- Payment security. Work only with a merchant acquirer that strictly adheres to the Payment Card Industry Data Security Standard (PCI DSS) and uses adequate security tools.

- Main and additional charges. Find out how much the acquirer charges per transaction. Ask them to provide you with thresholds for different payment volumes and daily transactions if they have any. Analyze your first merchant statement when you receive it and check if everything has been charged as agreed.

- Payment gateway. If the merchant doesn’t provide payment gateway services, check if they work with a payment gateway that suits your needs.

- Automatic billing. Subscription-based merchants typically need automatic payments and recurring billing.

- Customer support. Make sure to choose a merchant acquirer that provides continuous and responsive support.

Conclusion

Merchant acquirers are integral participants in payment processing. They enact policies based on credit card associations’ rules in order to facilitate payments between customers and merchants.

Their role is also to make sure the merchant is PCI compliant at all times, monitor the merchant’s chargeback rate, and handle other potential disputes.

Use this guide when choosing a merchant acquirer for your ecommerce business and ensure efficient and safe payment processing.