Credit and debit cards are the preferred payment methods for online payments. As a result, one of the key priorities for emerging online businesses is making credit cards an available payment option.

What do ecommerce merchants need to do to start accepting card payments?

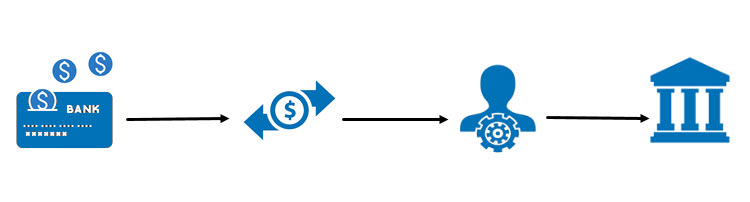

This guide explains how to accept credit card payments online and establish a smooth payment processing flow.

What Do You Need to Accept Credit Cards Online?

To start accepting credit card payments online, businesses must:

- Open a merchant account.

- Build an ecommerce website or choose an ecommerce platform.

- Choose a payment processor.

- Enable a payment gateway.

Merchant Account

A merchant account allows merchants to receive electronic payments – payments made by credit and debit cards, digital wallets, bank transfers, and mobile pay. Businesses can open a dedicated merchant account at a bank (also called a merchant acquirer), or partner with a payment processor and let them handle the process.

After applying for a merchant account, every business undergoes a merchant underwriting process. This is a risk-assessment procedure undertaken by the payment processor or merchant acquirer to establish whether a merchant runs a business securely and reliably.

Note: Check out our article What Is Merchant Account Underwriting and How Does It Work? to prepare in advance.

Ecommerce Website/Platform

Every online payment starts with a website or mobile application. Businesses either choose to develop a website from scratch or employ an all-in-one ecommerce platform.

Developing an ecommerce website gives businesses full creative freedom but comes with a downside. Regardless of whether businesses opt for in-house development or decide to hire a third-party company for the job, building an ecommerce website tends to be costly and time-consuming.

On the other hand, all-in-one ecommerce platforms handle all the challenging parts of website development and launch. Ecommerce platforms cost significantly less than in-house development but feature limited, ready-made design templates and website elements. In addition, platforms differ in the options they offer, most of which are often insufficient on their own. As a result, businesses must resort to various third-party integrations to make the platform work as desired.

Note: For more information about ecommerce platforms, refer to the article How to Start an Online Shop.

Payment Processor

A payment processor is a financial institution that allows merchants to accept payments from customers by intermediating between them and card associations.

Payment processors help merchants avoid the hassle of opening a dedicated merchant account with a bank and offer lower processing fees. They achieve this by using aggregated merchant accounts – merchant accounts shared by several companies – and scheduling weekly or monthly payouts.

With so many payment processors nowadays, choosing one may seem overwhelming. When choosing a payment processor, consider the following criteria:

- PCI compliance. The Payment Cards Industry (PCI) has established a strict set of regulations that protect cardholder data. Every payment processor processing credit card payments has to be fully compliant with these standards.

- Industry or business model. Payment processors frequently specialize in a particular industry or niche, allowing them to cater to merchant and consumer preferences and offer the most competitive processing fees.

- Supported payment methods and currencies. When choosing a payment processor, make sure they support the payment methods and currencies favored by your customers.

- Flexibility. The ideal payment processor for a business is one that can support the business’s growth, as well as downscale operations if needed.

Payment Gateway

The term payment gateway refers to software used to collect, encrypt, and forward sensitive payment data to a payment processor.

With the number of available payment gateways constantly growing, businesses struggle to find the optimal solution. Consider the following factors when choosing a payment gateway:

- The business model the gateway is designed for

- The scalability of the solution

- Payment options

- Automatization potential

- Ease of integration and integration partners

- Pricing plans

- Payout method

- Merchant and customer support

- The extent to which the gateway provider keeps up with fraud trends

- Fraud risk mitigation practices

- Innovative features

- Global presence

- Affiliate systems

Note: Read our article How to Choose a Payment Gateway for Your Ecommerce Store to find out how each of these factors impacts merchants.

Payment Compliance

Payment compliance refers to a set of laws and regulations merchants must meet to receive payments. These regulations aim to protect sensitive payment data and reduce the chances of fraud.

The regulations a merchant must comply with depend on the following factors:

- Country or region where the business is registered

- Location of the customer’s bank

- Payment methods the merchant wants to accept

- Location of the merchant’s bank

- Types of products and services the merchant sells

In addition to the listed regulations, every business must comply with local tax laws as well as the rules set by card issuers and financial institutions.

New regulations are constantly being developed, and existing ones are being updated. Keeping track of those changes is challenging and often requires hiring new staff and deploying costly technical solutions. Partnering with a payment processor transfers that responsibility to the processor and saves merchants’ resources.

Note: Find out how much it costs to become PCI compliant and use our PCI Compliance Checklist for Merchants to ensure your business has all the technical prerequisites in place

Credit Card Processing Fees

Credit card processing fees are the amount of money charged for every processed credit card transaction. The exact amount of money charged is determined by:

- Card issuers (banks)

- Credit card associations

- Payment processors

Note: Find out how these fees are calculated and what merchants are paying for by reading our article Merchant Credit Card Processing Fees.

Credit Card Payment Fraud Protection

From chargebacks to various types of suspicious transactions, credit card payment fraud is a daily concern of every online business. Therefore, detecting and preventing fraud before it occurs must be every online business’s top priority.

There is no surefire way to detect a fraudulent transaction, but the following are considered warning signs:

- Large orders from first-time customers.

- Orders with expedited international shipping (especially if the shipping cost is significantly higher than the cost of the purchased item).

- Mismatches between IP addresses and the shipping addresses of customers

- Multiple purchases made with the same card within a short period of time.

- Large orders from the same location within a short period of time.

- Multiple declined transactions within a short time frame (especially if followed by smaller successful purchases).

Recommended practices for credit card fraud prevention include:

- Enabling a CVV fraud filter.

- Partnering with PCI-compliant payment processors.

- Limiting transactions from the same card or account per day.

- Implementing 3D secure authentication.

- Offering credit card protection resources to customers.

CCBill Payment Services

CCBill is a global payment processor dedicated to developing agile, PSD2-compliant payment solutions that help merchants achieve business goals while also meeting the needs of their consumers. Our out-of-the-box payment solutions, such as FlexForms hosted payment forms and promotional sales system, and advanced solutions, such as our modern Payment API, power more than 30.000 online businesses operating diverse business models in various industries.

With CCBill payment processing, merchants can rest assured that every transaction is processed according to the highest security standards. Should any issue arise, our merchant support and consumer support teams are available for immediate assistance 24/7/365.

Start accepting payments now – contact us and find out how our merchant services support your business goals.

Frequently Asked Questions

Can I Accept Credit Card Payments Without a Merchant Account?

Yes, a business can accept credit card payments without a merchant account if they partner with a payment processor that uses aggregated merchant accounts – accounts used to process payments of sub merchants.

Not having a dedicated merchant account suits businesses with smaller transaction volumes. However, once a business grows beyond a certain point, an individual merchant account makes it easier to keep track of card payments.

Can I Accept Credit Card Payments for Free?

There is no way for businesses to accept credit card payments free of charge. However, partnering with the right payment processor allows businesses to enjoy lower credit card processing fees and save money that way.

Payment processors calculate processing fees based on:

- The risk category the business belongs to.

- The industry and niche the business belongs to.

- The total monthly transaction volume.

How Can I Accept Credit Card Payments if I Am a High-Risk Business?

All businesses have the same options for accepting credit card payments at their disposal. However, businesses considered high-risk, especially in industries with high chargeback rates, often face difficulties in the form of:

- Strict onboarding criteria set by financial institutions.

- Higher merchant account fees.

- Banks not wanting to process payments for the merchant.

How Long Does It Take for a Credit Card Payment to Complete?

Credit card payment processing takes anywhere from one to three business days to complete, but most payments clear within two business days.

Merchants processing payments via a payment processor may wait longer to receive their funds because some payment processors have a weekly or monthly payout schedule.

Conclusion

Customers today expect to be able to pay for goods and services online and their preferred method of doing this is with credit or debit cards. Merchants need to ensure that the payment process is both smooth and secure.

Use this article as a guide and start accepting card payments online.