Credit cards are still the most popular payment method for online payments in the U.S. and Canada according to Statista.

Issued by credit card associations, such as Visa or Mastercard, payment cards enable customers to pay for goods and services quickly and safely, both offline and online.

Timely and cost-effective credit card processing is a critical prerequisite for merchants as it enables a steady cash flow and efficient financial management. To achieve this, merchants need to work with a merchant acquirer or payment processor.

This article explains what credit card processing is, how it works, and how to choose a credit card payment processor.

What Is Credit Card Payment Processing?

Credit card payment processing refers to a set of procedures necessary to complete a credit card transaction online, in person, over the phone, or by mail.

It is important to understand that swiping a payment card or entering payment data manually (card-not-present transactions) is only the tip of the payment iceberg. In every transaction, several operations are happening in the background to ensure that the transaction is authorized and completed securely and quickly.

How Credit Card Processing Works

Credit card processing starts when the customer uses their card (whether physically or by entering payment data) to complete a purchase and ends when the transaction is approved. The process involves several parties and steps.

To accept credit card payments, merchants must have a merchant account at an acquiring bank. They also need a payment processor to let the payments through to the merchant account and eventually to the merchant’s business bank account.

Credit Card Processing Parties

Credit card processing involves the following parties:

- Merchant. A merchant is a company or individual that accepts credit card payments for their products or services.

- Cardholder. A cardholder or customer is a company or individual who buys a merchant's products or services.

- Issuing bank. An issuing bank is the bank that issued the cardholder’s payment card. When the customer (i.e., cardholder) makes a payment, their account at the issuing bank is debited.

- Acquiring bank. A merchant acquirer, also known as an acquiring bank, manages the merchant’s account, accepts and authorizes credit card payments data from customers paying for goods or services, and forwards that information to the issuing bank. Merchant acquirers are the connective tissue between merchants, customers, card-issuing banks, and credit card associations. Merchant acquirers are financially liable for every payment handled for merchants and they ensure the payment processor meets all payment processing and legal standards

- Bank card associations. A bank card association is an organization that facilitates transactions between the issuing bank and the acquiring bank. Banks associations, like Mastercard or Visa, provide a virtual payment framework through which payments are made.

- Payment processor. A payment processor is a mediator between merchants and other financial entities participating in payment processing, merchant acquirers included. They provide and maintain the technological background that encrypts payment card data and forwards it to all payment processing parties.

- Payment gateway. A payment gateway is a software service that obtains and encrypts the cardholder’s payment card data and sends it to the payment processor.

Note: Learn everything you need to know about payment processors in our article What Is a Payment Processor.

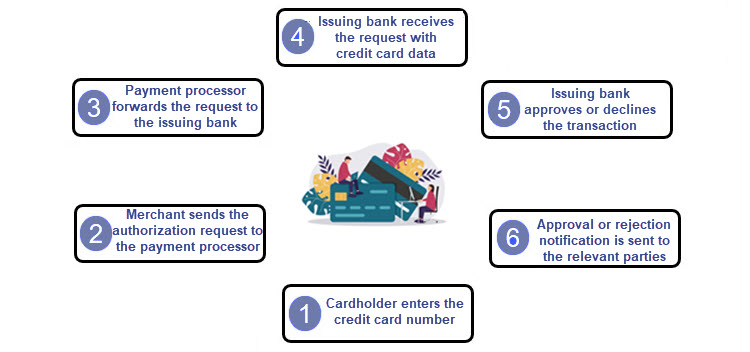

Credit Card Payment Processing Steps

Every successfully processed credit card payment starts with an authorization and ends with settlement and funding.

Authorization

Authorization confirms that all participants in a credit card processing procedure are eligible to take part in it. It includes the following stages:

- The cardholder enters the credit card number to purchase a product or service from the merchant. Electronic payments are made through a payment gateway. Brick-and-mortar merchants use point-of-sale (POS) terminals to receive such payments.

- The merchant sends the payment authorization request to the payment processor. For customers using a digital wallet, like CCBill Pay, Google Pay, or Apple Pay, the merchant first sends the payment data to the wallet operator, after which the information is submitted to the payment processor.

- The payment processor forwards the payment authorization request to the issuing bank through the relevant card association.

- The issuing bank receives the request with the critical credit card elements, such as the expiration date, the card verification value (CVV), and the address verification service (AVS).

- The issuing bank either approves or declines the transaction. The bank may reject the transaction for the following reasons: insufficient funds, unauthorized request, or reached card limit.

- If the payment has been approved, the funds are transferred from the issuing bank to the merchant account. The issuing bank submits the approval or rejection notification to the card association, the acquiring bank, and the merchant.

Settlement and Funding

Settlement is the last stage of credit card payment processing. This is when the merchant receives the money paid by the customer for the products or services in question.

Within the settlement procedure, the merchant sends a batch of released payments to the payment processor. This information is forwarded to the card association, which then notifies the issuing bank of the demanded debit.

The issuing bank debits the cardholder’s account with the requested amount of money.

The acquiring bank is credited with the funds by the issuing bank. Interchange fees are also collected at this stage. In the final step, the acquiring bank transfers the money to the merchant account.

Note: Some but not all merchant acquirers offer payment processing services. Alternatively, some payment processors also manage merchant accounts. Having all services available from a single provider helps merchants start accepting credit card payments as fast as possible.

Credit Card Payment Processing Times

It takes between 24 and 72 hours to process credit card payments. Most credit card transfers are completed within 48 hours.

Payment processors and other similar financial parties receive and process payments in batches, which may affect the processing speed. Also, they usually make payouts once a week, according to an arranged schedule, or when a predefined amount has been reached.

Not all credit card payments are handled at equal speeds. In practice, electronic payments and credit card transactions made by phone are processed more quickly than mailed payments. Still, none of them is instant.

Note: Find out more about the credit card payment processing time from our article How Long Does a Credit Card Payment Take to Process?

Credit Card Payment Processing Costs

Merchants pay credit card processing fees to the issuing bank, the payment processor, and the credit card association for every payment made to their account.

These are the main three types of processing fees:

- Interchange fee. The interchange fee, also known as the wholesale fee, is a standard processing fee charged by the issuing bank and the relevant card association. The merchant’s bank (acquiring bank) pays the fee to the issuing bank, which then forwards the relevant part to the card association. This fee consists of a percentage of every purchase and a predefined transaction fee set by each card association.

| Credit Card Association | Processing Fees |

|---|---|

| Mastercard | 1.55% - 2.6% |

| Visa | 1.43% - 2.4% |

| Discover | 1.56% - 2.3% |

| American Express | 2.5% – 3.6% |

- Markup fee. Payment processors charge markup fees for their services. The amount depends on the processor’s pricing model and the merchant’s requirements.

- Dues and assessments. Dues and assessments are fees that credit card associations charge for the use of their cards and infrastructure. Payment processors collect these fees and send them to card associations. Dues and assessments are paid for the total volume of monthly transactions that a merchant receives. They depend on the transaction type (domestic or international), the payment volume, and the card payment type (higher for premium and reward cards).

Additional Fees

The total fee of accepting credit card payments may include additional fees.

For instance, some payment processors charge an extra fee to ensure the merchant’s PCI compliance. Also, each chargeback request incurs additional costs.

Usually, processing fees are lower for point-of-sale (POS) transactions than for card-not-present (CNP) payments due to security and chargeback concerns. Namely, every credit card has a chip that generates a unique digital token for every POS payment. The chip and the unique PIN that the customer enters for a POS payment ensure a higher level of protection. On the other hand, card-not-present payments are more susceptible to fraud and require additional protection.

Note: Read our article Credit Card Processing Fees for Merchants Explained to learn more about some other potential processing fees.

How to Choose a Payment Processor for Credit Cards

Choosing the right payment processor is critical for every merchant. The payment processor ensures that all your customers’ payments are received, processed, and settled in a timely and secure manner.

When selecting a suitable payment processor to accept credit card payments, it’s not only their fees that you should consider.

Here are other factors to keep in mind when searching for a payment processor:

PCI Compliance

Payment processors must adhere to Payment Card Industry Data Security Standards (PCI DSS), enforced by the PCI DSS Council, to keep the sensitive card payment data safe. Compliance with these standards is a mandatory requirement for processing credit card payments. Therefore, ask the processor to prove they are fully PCI compliant to ensure they can process your payments.

Business Model

Payment processors typically concentrate on a certain number of business models.

Inquire about the most reliable payment providers for your business model to check whether they can process the payments for all the products or services you offer.

International Presence and Payment Types

If you ship products worldwide, make sure that the payment processor has an international presence and is able to process payments from cardholders in different geographical regions. Ideally, the payment processor needs to accept all the major international currencies using an integrated system that ensures smooth conversion.

Note: If you have numerous customers from a region where credit cards are not the preferred payment method, choose a processor that accepts alternative payment methods.

Chargebacks

A chargeback is an official complaint that a customer submits against a merchant to their card-issuing bank asking for a transaction reversal. Merchants who receive a lot of chargebacks are considered high-risk businesses and pay higher fees to have their customers’ payments processed. Join forces with a reliable and experienced payment processor that uses a secure payment system based on credit card tokenization and encryption of cardholders’ information to prevent payment fraud.

Note: CCBill utilizes a cutting-edge fraud-scrubbing system to help its merchants avoid chargebacks. This system relies on hundreds of different checks for each transaction before the payment information is forwarded to banks and credit card associations. CCBill’s anti-fraud system mitigates the risk of fraud and chargeback.

Additional Factors

There are additional features and services that a payment processor can offer:

- Modern, merchant-friendly payment API solutions.

- 24/7 customer service support.

- A straightforward reporting system with sales and customer statistics.

- Adaptable and customizable payment forms for additional features, from cross-selling and upselling to promotional banners.

- A full-fledged affiliate and referral program.

- Simple integration with other third-party solutions, like tax and ecommerce accounting solutions, Google Analytics, ecommerce platforms, CRMs, etc.

Conclusion

Even though new payment options are on the horizon, credit cards are still one of the most secure and convenient methods of paying for goods and services. Customers like credit cards because they have clear security rules and regulations, adopted and enforced by reliable international financial institutions.

Merchants work with credit card payments because they have a long tradition and there are well-established procedures for every potential issue between the participating parties.

A seamless user experience is necessary to acquire and retain customers and credit cards provide just that.