Introduction

Every ecommerce merchant knows how much effort and hard work it takes to attract customers to an online store. A confusing and drawn-out payment process can turn customers away even if they initially decided to purchase a product or service.

It is essential to choose a payment gateway that delivers a smooth payment flow. It also must provide the flexibility and support an ecommerce store needs for future growth and development.

The number of payment gateways and payment processors is increasing, and it can be challenging to find a solution that perfectly fits your store’s requirements.

Find out how to choose a payment gateway and what features and tools to prioritize.

Why Is Finding a Good Payment Gateway Important?

Payment gateways use advanced software solutions to encrypt and protect sensitive customer information. They facilitate the transfer of data between an ecommerce store, payment processors, and acquiring banks. An ecommerce store cannot accept credit card payments without a payment gateway.

Note: Learn more about how payment processing works and what role the payment gateway plays in our article How Does Payment Processing Work?

A first-rate payment gateway needs to deliver features and tools that help merchants create added value. Choosing an efficient payment gateway can:

- Reduce risk levels associated with online payments - Payment gateways can afford to invest heavily in expensive and sophisticated fraud prevention tools and techniques.

- Decrease payment form abandonment rates - A diligent payment gateway spends time and effort on payment form design and continuously upgrades its functionality.

- Improve conversion rates - A seamlessly integrated payment form is central to the payment process. Completing purchases in fewer steps with less required information improves customer experience.

- Lower overhead costs - For example, if a payment gateway provides around-the-clock technical and customer support, a merchant can significantly cut back on investments in these areas.

- Open up new business opportunities - Payment gateways with a global presence can help merchants expand in previously unavailable countries and regions. They should also encourage close cooperation between merchants with complementary business models.

- Provide easier access to third-party tools - Ecommerce stores need to integrate a variety of third-party solutions to improve store functionality. If a payment gateway supports the technical integration with popular ecommerce extensions by default, a merchant is going to spend fewer resources and time implementing these solutions.

Ecommerce merchants communicate with their payment gateway every day. A lack of trust and cooperation is going to lead to lost revenue and reputation on both sides.

Select the right payment gateway to guarantee the long-term success of your ecommerce store.

Choosing a Payment Gateway - 13 Things to Consider

When opening an account with a payment gateway, merchants often encounter legal constraints, compliance-related issues, high initial costs, and a prolonged integration process. To avoid these pitfalls, extensively research multiple payment gateway solutions.

Refer to the following 13 factors when choosing the best payment gateway for your ecommerce store.

1. Choose Based On Business Model

A single payment gateway can provide payment processing services for a variety of business models. However, gateways often specialize in processing for particular types of businesses.

It is not easy to find one solution that caters to a subscription-based website, a streaming platform selling tokens, or an ecommerce store that ships goods. For example, a high-risk payment processor needs to invest in risk and fraud prevention systems and can help merchants settle legal and compliance issues. That same processor may not have a viable solution for selling tangible items.

Choose an established payment gateway with a proven track record relevant to your business model.

Payment gateways with extensive experience in ecommerce develop tools specific to the type of products and services you sell. They can provide valuable advice and suggest new features and store improvements.

2. Scalable API Solution

An Application Programming Interface (API) is essential for automating repeated back-end tasks in an ecommerce store. The payment gateway needs to guarantee that it can provide consistent transaction event data in real-time.

An API solution can have a significant impact on customer experience and the entire payment process. If a customer pays and the payment gateway’s API is unreliable, your system may not register the sale. This invariably leads to a loss of reputation and an increase in refund and chargeback requests.

Advanced APIs can transform the checkout process on an ecommerce website. Instead of redirecting the customer to a gateway’s payment form (hosted payment gateway), the customer can enter their payment details on the ecommerce website (integrated payment gateway). The API solution facilitates the entire authentication and verification process in the background. The customer experiences an uninterrupted payment flow without leaving the ecommerce website.

Sales volumes and website traffic can fluctuate due to successful marketing campaigns or during the holiday season. This forces ecommerce merchants to scale API solutions quickly. A massive influx of customers during Christmas or Black Friday can overwhelm an inadequate API solution and result in a direct loss of income.

3. Efficient Integration Process

The efficiency of the integration process is an excellent way to gauge the competence of a payment gateway.

Besides the technical aspects, integrations also consist of fulfilling legal and contractual requirements. Every ecommerce store has a specific setup, and the gateway must be willing and able to adapt to the merchant needs or suggest creative alternatives.

The speed of the integration depends on both the merchant and the payment gateway. Establishing a solid business relationship and timely communication from the get-go is going to result in a swift integration.

It can be challenging to integrate your store with a payment gateway if you plan on offering unorthodox services and payment arrangements.

Note: If you are new to the world of merchants, read our post Merchant Account Vs. Payment Gateway to learn more about the differences between these two concepts.

4. Pricing Plans

Payment gateways frequently advertise the lowest pricing plan to attract merchants to use their services. However, pricing plans often vary based on the type of product being sold, business model, associated risk factors, or even the merchant’s previous reputation.

Ensure that the fee structure is straightforward and easy to understand. Most payment gateways offer percentage-based and tiered pricing conditional on sales volumes.

Pay special attention to fixed costs and provisional fees. For example, if there are any fees associated with processing refund requests. These fees are often not advertised or actively disclosed outside of processing agreements.

5. Payout Method

Cash flow disruptions are a severe limiting factor for any ecommerce business. Ask the payment gateway how often they pay out their merchants. It makes a huge difference if earnings are transferred on a weekly or monthly basis.

Gather as much information as possible about the payment methods used for the payouts. The location of the payment gateway’s acquiring bank is significant. International bank transfers are more expensive and take longer than local direct deposits. Also, electronic transfers are faster but more expensive than mailing checks.

Wiring funds between two different countries may even be impossible due to legal restrictions, or the costs of the transfer may be too high to be feasible.

6. Merchant and Customer Support Services

An ecommerce merchant needs to be able to contact the payment gateway any time of day or night. Ensure that the payment gateway has 24/7 support for their merchants, is responsive to merchant requests, and provides timely support.

This is especially important during busy weekends and holiday seasons.

An ideal payment gateway should offer customer support to your customers as well. The payment gateway has a better understanding of how their systems work and can resolve potential technical issues much faster.

It is worth paying extra for this service as it reduces overhead costs and saves time when dealing with customer complaints.

7. Risk Mitigation

Participants in the payment process must do their utmost to prevent fraud. Sophisticated attacks such as social engineering and account takeover fraud are ever-present. An ecommerce merchant can do little to prevent these attacks as they do not occur within the confines of an ecommerce store.

Choose a payment gateway that has a proven track record at proactively protecting customers and storeowners.

Fraud prevention tools and methods are expensive to implement. Rely on payment gateways and processors to handle the bulk of the verification and authentication processes. Your store is going to be protected with advanced tools at a fraction of the cost.

Note: It's paramount to stay up-to-date with ecommerce fraud trends.

8. New Features and Products

The ecommerce industry is known for spotting new opportunities and avenues for growth. A payment gateway should continuously adopt and develop features that streamline the payment process. An ecommerce store needs to offer customers coupons, upsells, cross-sells, discounts, and flexible payment forms. Only a wide variety of features and products allow merchants to stay competitive.

Additionally, a payment gateway needs to have a user-friendly reporting system, a comprehensive graphical interface, and responsive databases that help merchants retrieve valuable statistics and manage customer data.

9. Automation

Many ecommerce merchants fulfill customer requests and troubleshoot technical issues manually. This is sustainable in smaller stores. However, as a store becomes more successful and the number of customers increases, it becomes impossible to resolve each issue personally.

A payment gateway must offer solutions that automate everyday tasks. For example, implement an API solution that allows customers to cancel their orders directly on the store’s website without contacting customer support.

Note: Learn everything you need to know about canceled transactions in our post Understanding Void Payments.

Merchants may need to hire developers to implement some of these solutions, but the long-term benefits far outweigh the initial investment.

10. Global Presence

Payment gateways regularly limit their operations to specific countries or continents. Ecommerce merchants also market their products and services to certain regions. This is mainly due to copyright, high delivery costs, language barriers, and conserving marketing resources. However, even if you do not plan to sell products outside a region, you should leave that option open.

A successful store always looks to expand the number of potential customers. If the payment gateway cannot support payments from a region, it can be expensive and technically challenging to look for an alternative solution.

Select a payment gateway that can accept payments from any country. If your store expands into new markets, the gateway can support these payments without any additional costs.

11. Affiliate Program

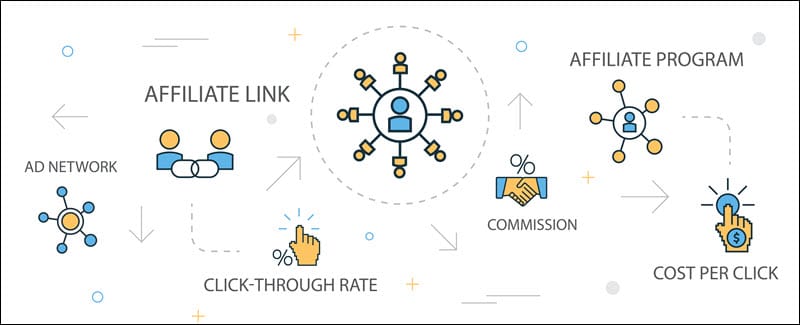

Affiliates are very efficient in promoting websites and drawing new customers to ecommerce stores. The affiliate’s incentive is a small percentage of a successful referred sale. There are numerous third-party affiliate systems for online merchants.

If a payment gateway has a built-in and developed affiliate program, it can save merchants time and is much more cost-effective than integrating a third-party solution.

12. Integration Partners

Check if the payment gateway cooperates with popular third-party solutions in the payment service industry. An extensive list of integration partners makes it easier to find and implement out-of-the-box tools.

For example, if you need a third-party reporting tool, you can install an approved and tested solution that perfectly suits the chosen payment gateway. Since the gateway guarantees for their partners, you can also receive technical support during the integration process and when troubleshooting potential issues.

13. Multiple Payment Options

The payment gateway needs to offer as many payment options on a single payment form as possible.

Customers are much less likely to abandon the payment form when they can choose between various payment methods. The payment options should include major credit and debit cards, non-credit card payment options (ACH, check, SEPA), and digital wallets (PayPal, Apple Pay, CCBillPay, etc.).

The number of payment options directly affects conversion rates and payment form abandonments.

Conclusion

Choosing the right payment gateway for your ecommerce store is now much more straightforward.

Forming a lasting partnership with a payment gateway and payment processor ensures that your store is going to receive professional support for rapid growth and development.