Introduction

Most clients receive a debit card from their bank when they open an account. The debit card is tied to the cardholder’s current account and can be used to withdraw cash at ATMs, pay in stores or initiate secure online payments.

Merchants who want to accept card payments must have a good grasp of debit card processing flows, fees, and the different entities participating in the payment process.

Learn how debit card processing works and what happens, from the moment the customer initiates the payment until the funds reach your account.

What is Debit Card Processing?

To process debit card payments, merchants, banks, PSPs, and card networks need to collect, exchange, and validate customer payment data in a series of actions called debit card processing.

The 5 key participants in debit card processing include the:

- Cardholder. The person who owns the debit card and uses it to purchase goods or services. The cardholder initiates a payment by presenting their debit card at the point-of-sale (POS) terminal or by entering their payment information in an online payment form.

- Merchant. The business that accepts the debit card as a payment method for its goods or services. The merchant, which may be a physical store or an online retailer, accepts the card and submits the transaction details to the acquiring bank.

- Merchant acquirer. The financial institution that processes the debit card transaction on behalf of the merchant (the merchant’s bank). The acquiring bank acts as an intermediary between the merchant and the card association, forwarding the transaction for authorization.

- Card association. A payment card network that oversees and facilitates card transactions, i.e., Visa or Mastercard.

- Issuer. The financial institution that issued the debit card to the cardholder (the customer’s bank). The issuing bank authenticates the transaction and either approves or declines it.

Note: Read our comparison article issuer vs. acquirer and find out their differences and responsibilities in payment processing.

How Does Debit Card Processing Work?

To ensure the secure transfer of data and funds, debit card processing includes the following steps:

- Cardholder initiates transaction. The cardholder presents the debit card to the merchant. The customer swipes the card, inserts it into a card reader, or enters card information in a payment form.

- Authorization. The merchant’s system sends a request for authorization to the acquiring bank. This request includes essential details such as the card number, transaction amount, and merchant identification.

- Authentication. The acquiring bank forwards the authorization request to the card association, which verifies the card's validity and the cardholder's available balance. The card association then communicates with the issuing bank to authenticate the transaction.

- Approval. The issuing bank evaluates the transaction based on factors such as available funds, potential fraud, and any restrictions imposed by the cardholder. If the transaction is approved, the issuing bank sends an authorization code back to the acquiring bank through the card association.

- Clearing. Once the transaction is authorized, the acquiring bank captures the necessary information and sends it to the card association for clearing. Clearing involves exchanging information and settling the transaction between the acquiring and issuing banks.

- Settlement. Settlement is the process of transferring funds from the issuing bank to the acquiring bank. Typically, this occurs in batches at the end of the business day. The card association facilitates the settlement by coordinating the exchange of funds between the banks, ensuring accurate and timely transfers.

Are Debit Card Payments Secure?

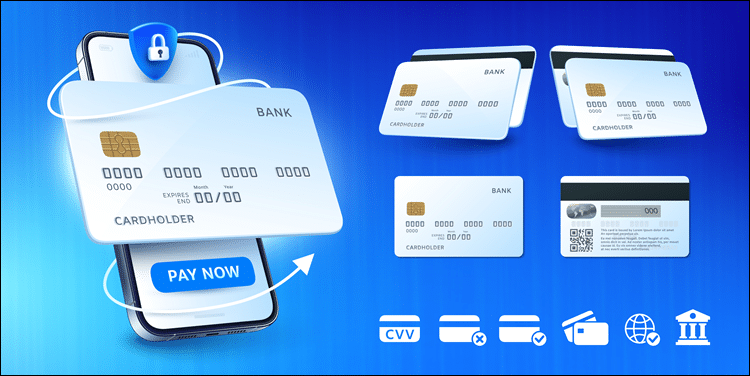

Debit card transactions are encrypted and protected by industry-standard security protocols. These measures aim to prevent fraud, safeguard sensitive cardholder data, and ensure the integrity of the transaction process. Essential security measures and authentication methods include:

- Encryption. Cardholder data, including the card number and personal identification information, is encrypted during transmission to prevent unauthorized access.

- Tokenization. Tokenization replaces the actual card data with a unique identifier called a token. This token is used for transaction processing, minimizing the risk of exposing sensitive information.

- EMV Chip Technology. EMV chip technology adds an extra layer of security to debit card transactions. The chip generates a unique transaction code for each transaction, making it difficult for attackers to duplicate cards or steal card data. The use of chip-enabled debit cards and the implementation of EMV standards have reduced instances of debit card fraud considerably.

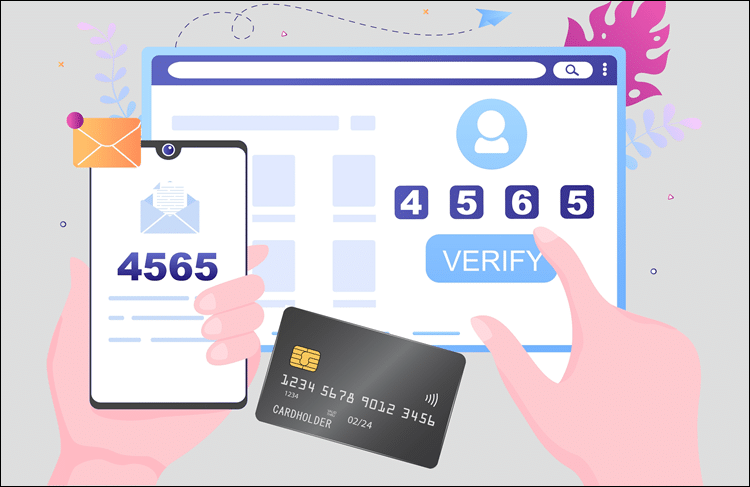

- Two-Factor Authentication (2FA). Securing online payments through the use of different authentication methods and tools has become a priority for businesses. In some regions, like the EU, strong customer authentication is a legal obligation. 3DS verification has become the preferred method used to confirm that an online card transaction is being initiated by the cardholder.

Note: Find out the differences between tokenization and encryption and how they protect your customers.

Types of Debit Card Processing

The way cardholders use their debit cards to interact with the merchant’s system affects how transactional data is authenticated and transmitted and can have a significant impact on processing fees.

Some of the most common types of debit card processing include:

Online Debit Card Processing

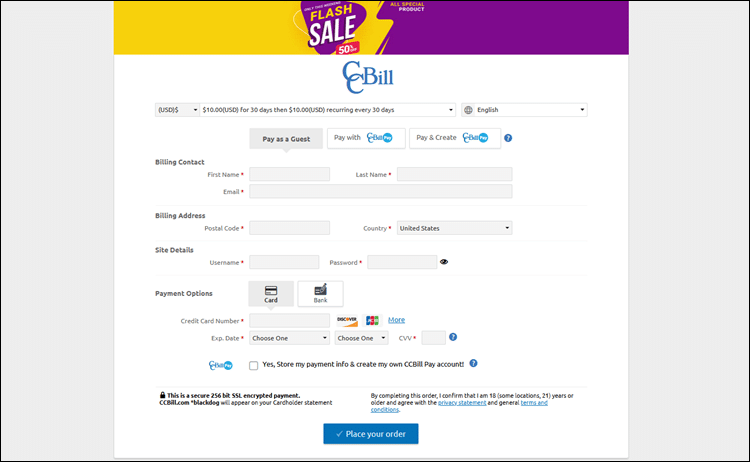

When customers buy products online, they are asked to enter payment information from their debit card. This includes the cardholder’s name, card number, expiration date, and CVV code. Since the debit card and cardholder are not in the merchant’s store, this type of transaction is called a card-not-present transaction.

CNP transactions typically incur higher processing fees due to the increased risk of payment fraud, chargebacks, and returns. Merchants can expect that their bank, payment processor, and card associations are going to charge a flat fee plus a percentage when processing a CNP transaction.

Note: Read our comparison on CVC vs. CVV and find out how they reduce fraudulent transactions.

Point-of-Sale (POS) Debit Card Processing

Customers who opt for in-person transactions need to present their debit cards at the merchant’s POS terminal.

Merchants can obtain a POS terminal from their bank or a third-party processor, like a PSP. Payment processing services and features are bundled with the device which is integrated with the provider’s system.

Depending on the capabilities of the debit card and terminal, customers can initiate contactless payments (NFC), swipe the card’s magnetic stripe, or insert the card allowing the terminal to read its EMV chip.

Customers are required to authenticate the payment by signing a slip (magnetic stripe) or by entering a PIN (EMV chip). Typically, contactless payments do not require the customer to enter a PIN unless the amount is above a certain threshold.

The transaction data is forwarded to the acquiring bank, which verifies the payment information and sets debit card processing in motion.

POS terminals are fully integrated with the payment processing flow. The added layer of security and authentication allows banks and PSPs to charge lower processing fees for POS transactions.

Digital Wallets

When cardholders create an account with a e-wallet provider, they can register a payment card (debit or credit) as a source of funding. The provider tokenizes the cardholder’s data and uses the token to charge the customer’s account.

A mobile device, such as a phone or smartwatch can be used to initiate an NFC transaction as it is linked to the debit card through the digital wallet mobile app.

Activating the payment token prompts the same debit processing flow as with other types of debit transactions. If the wallet is used for a POS transaction the corresponding fee is applied, while an online payment is treated as a card-not-present transaction.

Merchants who want to accept payments from a digital wallet need to count on additional fees charged by the digital wallet service provider.

Card-on-File Processing

Card-On-File (COF) transactions are payments initiated using stored cardholder data. Customers can authorize merchants to collect their payment debit card data under the understanding that the data is going to be used to expedite future transactions.

Card-on-file transactions allow merchants to charge customers without additional payment authentication. A prime example of this type of charge is a recurring subscription.

Card-on-file transactions are a type of CNP transaction, and the associated fees reflect the added risks of online transactions.

Debit Card Processing vs. Credit Card Processing

From a customer’s perspective, there are significant differences between credit and debit cards.

A debit card owner needs to have enough money in their account or an active overdraft before initiating a payment. The transaction requires authorization from the customer's bank to ensure that sufficient funds are available.

Debit card transactions may offer some consumer protections, such as the ability to dispute unauthorized charges or fraudulent transactions. However, these protections vary depending on the card issuer and local regulations.

Merchants can expect lower processing fees when accepting debit card payments.

Credit card transactions also require authorization, but instead of checking available funds, the issuer typically verifies the customer's credit limit and account status.

Credit cards generally offer more extensive consumer protection compared to debit card transactions. This includes safeguards against fraudulent charges, the ability to initiate chargebacks, and various purchase protections provided by the card issuer.

Credit card transactions incur higher processing fees for merchants compared to debit card transactions. The fees may vary based on factors such as the card type, transaction volume, and the agreement between the merchant and the payment processor.

To accommodate a wider range of customer preferences and payment options merchants should accept both card types.

Debit Card Processing Fees

The fee merchants pay for the processing of debit card payments depends on their MCC code, issuing and acquiring bank, type of authentication used, card network, and payment processor.

The following fees are a significant component of debit card processing fees:

- Interchange fees. Interchange fees are charged by the card networks (such as Visa or Mastercard) and are paid by the merchant's bank to the cardholder's bank. Interchange fees are typically expressed as a percentage of the transaction amount, plus a flat fee. The exact interchange fee rates can vary depending on factors such as the card brand, card type (e.g., basic debit, rewards debit), and the merchant's industry. The average interchange fee per debit card transaction was $0.34, according to 2021 data from the US Federal Reserve System.

- Payment processor fees. Payment service providers charge fees for processing debit card transactions. These fees can be structured in various ways, including a percentage of the transaction amount or a flat fee per transaction. Payment processor fees may also include additional charges, such as monthly fees, statement fees, or account maintenance fees. The specific fee structure depends on the agreement between the merchant and the payment processor.

- Network fees. In addition to interchange fees, some debit card networks may charge separate fees for accessing their network and utilizing their services. These network fees are typically passed on to the merchant by the payment processor.

Fees can vary significantly, and it is advisable to compare offerings before choosing a payment processor that best fits your business needs.

How to Accept Debit Card Payments

Merchants who want to accept debit card payments must complete the following steps:

1. Open Merchant Account. To process debit card payments, merchants need to open a merchant account with a payment service provider. Research different payment processors and compare the services, fees, and features they offer.

2. Choose a Payment Processing Method. If you have a physical store or location, you can use a POS system that includes a card reader or terminal. Merchants who have an ecommerce store and want to accept payments online can integrate an online payment gateway with their website. A payment gateway guarantees that the payment information customers provide is secure and mitigates many of the risks associated with handling sensitive data.

3. Integration and Payment Flow. The integration process may be as simple as adding a hosted payment page or as complex as designing a custom payment flows via an API integration.

4. Security and Compliance. It is crucial to prioritize security and comply with relevant data protection regulations. The fastest way to ensure that your payment processing system meets PCI DSS requirements and that customer card data is transmitted and stored securely is to choose an established payment processor with an impeccable track record.

Conclusion

You now know how debit card processing works, what technologies are used, and who the participants facilitating the payment process are.

Once you integrate your system with a PSP, test your card payments thoroughly and experiment with different payment flows before accepting live debit card payments. Even small adjustments to payment forms and flows can result in considerably higher conversion rates.