Introduction

Customers want a straightforward and secure checkout process, and they expect to pay using a preferred payment method on their favorite device.

Developing a custom payment page from scratch is time-consuming and is not a viable option for merchants with limited resources.

A hosted payment page allows merchants to quickly set up a secure online payment form at a fraction of the cost.

Learn how hosted payment pages work and use them to create seamless payment flows on your website.

What Is a Hosted Payment Page?

A hosted payment page is an external checkout page managed by a third-party provider.

When a customer wants to pay for a product or service online, they're redirected from the merchant's website to the protected payment page, where they complete their purchase.

The payment is processed on the third-party provider's servers. The merchant does not need to handle or store customer payment details.

The payment service provider also conducts risk management assessments, provides technical and business solutions, and ensures compliance with PCI standards.

Merchants that implement a hosted payment page can focus on their core business activities and rely on their PSP to create a secure payment environment that meets all regulatory requirements.

How Does a Hosted Payment Page Work?

Before implementing a hosted payment form, the merchant needs to open a processing account with a payment services provider.

The integration process depends on the merchants' business model, content management system (CMS), and customer relationship management (CRM) solution. The process can be as simple as placing a payment form link on the website or as challenging as integrating various APIs to facilitate advanced CRMs.

Once a hosted payment page link is placed on the merchant's website:

- The customer clicks a call-to-action (CTA) button, for example, Buy, to confirm they want to purchase a product or service.

- The buyer is redirected to the hosted payment page.

- The customer enters their payment data on the payment form.

- The PSP processes the payment information.

- The payment details are sent back to the merchant. If the payment was successful, the merchant provides the service or product to the customer.

It is important to emphasize that the PSP is the entity charging the customer. The merchant's earnings are subsequently transferred to the merchant's bank account by the payment service provider.

The processing fees and the timetable for payouts depend on the merchant's processing agreement.

Benefits of a Hosted Payment Page

Using a hosted form to accept payments has several clear advantages:

- Low Initial Costs - Opening a processing account with a PSP may involve an initial registration or setup fee. However, using a hosted payment form is much less expensive than developing and implementing custom payment flows and forms.

- Simple Setup -Merchants using a hosted payment page do not need advanced technical knowledge. They can easily integrate a ready-made checkout page on their existing website.

- Secure Payments - Payment data neither go through the merchant’s website nor are they kept by the merchant. The payment form provider facilitates secure online payments and uses sophisticated tools to combat fraud and protect customer data.

- Form Design and User Experience (UX) -PSPscollect lots of data about customer preferences and purchasing behavior. Established PSPs invest heavily in payment form design and functionalities. A ready-made checkout solution is designed and managed by professionals to maximize payment conversion rates.

- Technical Support - Card networks, PSPs, banks, and merchants need to coordinate their efforts to process payments successfully. The system is complex and technical issues are not uncommon. Having a dedicated PSP support service to troubleshoot these issues is a major asset.

- New Features - PSPs continuously work on improving the payment process. The merchant does not need to develop custom solutions. The PSP provides the necessary tools and forms that help merchants keep up with market trends.

How To Choose a Hosted Payment Page Provider?

Processing fees and implementation costs are key factors when choosing a payment processor.

However, not all hosted payment page providers offer the same level of service. There are several functionalities payment forms must support to meet customer expectations.

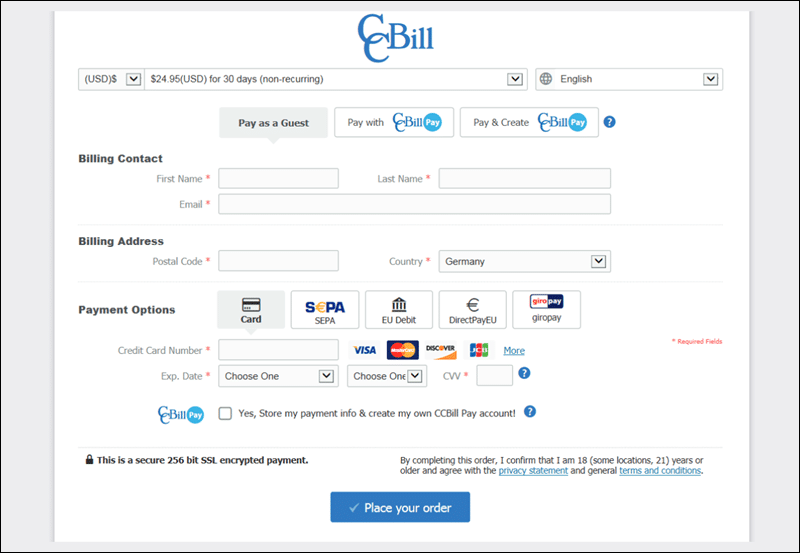

Fully Responsive

The number of different devices customers use when buying products is increasing. The payment form needs to be responsive and recognize the customer's device and browser to provide an engaging payment experience.

A payment page also needs to take into account the customer's location. The form should present its content in a language the customer understands and automatically display the currency specific to the customer's region.

Multiple Payment Options

Creating and updating individual forms for each payment method can be a long and drawn-out process. A good payment form solution should include all relevant payment options on a single form.

This allows merchants to manage their forms much more efficiently, while customers can opt for a different payment method without leaving the payment page.

It is essential that the payment form acknowledges the customer's IP and displays payment options specific to their region. For example, the form should not display ACH payment options for non-US customers. Likewise, European payment methods, like SEPA, should only be available for European customers.

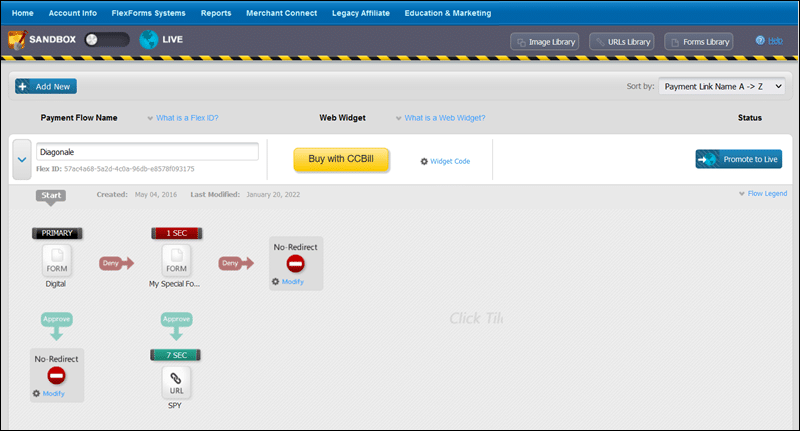

Easy to Use

Check if the payment processor has a user-friendly interface for creating payment flows and customizing forms.

Features like drag-and-drop are essential for merchants with limited technical expertise when creating dynamic checkout forms, flows, and cascades.

A good example is CCBill's FlexForms system. FlexForms is CCBill's environment for creating fully responsive payment forms and engaging payment flows.

The visual representation helps you design a custom payment flow and micromanage the checkout process with ease.

Customization Options

A hosted payment form is a third-party solution. However, it needs to feel like part of the merchant's website and give customers an immersive purchasing experience.

Find out if the payment processor allows merchants to edit the form CSS and to what extent. Merchants need to be able to change the form's layout, color, and add images.

Some payment processors allow merchants to place payment forms in an HTML Iframe. Iframes enable merchants to embed the payment form into a frame located on their website. This means that customers can complete the payment form without leaving the merchant’s website.

Testing Environment

Merchants need to test the checkout process before placing payment forms on their website. Look for a payment provider with a practical sandbox environment for testing different form versions.

Once the payment pages are live, collect data about form conversion rates, compare their performance and adjust form designs accordingly.

If you plan to use the services of several payment processors, check if they provide tools for comparing and testing forms from outside processors.

Note: Refer to our guide Test Credit Card Numbers to learn how to test payments.

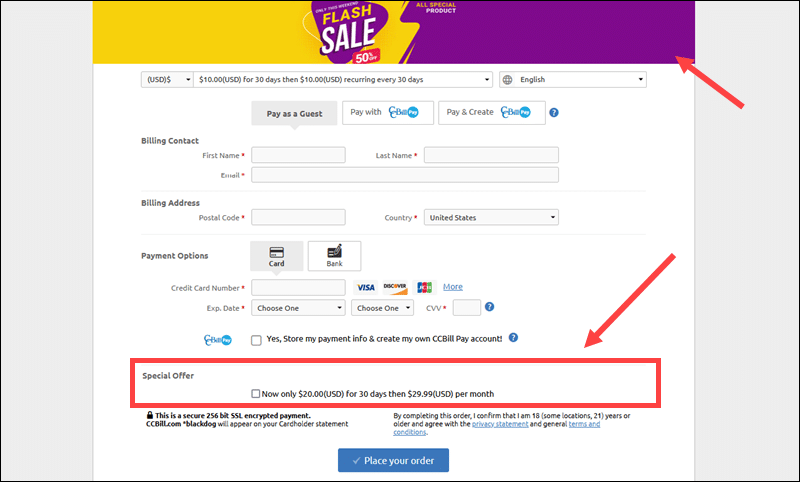

Promotions and Upsells

Offering cross-sells and upsells during the checkout process is an effective way to increase revenue.

Confirm that the hosted payment page supports the publication of additional offerings and permits promotional banners.

Placing banners and other visuals is also an opportunity to raise brand awareness and turn the payment page into a natural extension of your website.

Conclusion

You know how hosted payment pages work and the advantages of using the services of a payment service provider.

Choosing the right hosted payment page provider helps you strengthen customer data security, improve conversion rates, and gain access to sophisticated payment processing tools and features.

Consider implementing dynamic pricing if you need to readjust prices on your payment forms frequently.