Introduction

Prices change all the time as businesses rush to adjust to market trends and outmaneuver the competition.

Merchants that sell products and services online need to use innovative solutions and pricing strategies, like dynamic pricing.

Dynamic pricing allows merchants to offer the best possible price, to the right customer, at the appropriate moment.

Find out how to implement dynamic pricing and turn it into a competitive advantage.

Dynamic Pricing Definition

Dynamic pricing is a strategy that businesses adopt when they need to readjust prices frequently.

Proactively changing the prices of products and services ensures that the price always reflects current market demand.

Merchants that have a flexible pricing policy can:

- Instantly match or beat competitor prices.

- Incentivize core customer segments.

- Reward customer loyalty.

- Micromanage prices to stimulate or curb demand.

Businesses often use advanced software solutions to analyze market events and automatically optimize prices in real-time.

Dynamic Pricing Types and Examples

Consumers encounter dynamic pricing every time they book a vacation, buy an airplane ticket, or fill up a gas tank.

Smart devices and automation motivated ecommerce websites, food delivery services, and other industries to explore how they can use dynamic pricing to maximize profits and increase their market share.

There are many different ways to utilize dynamic pricing. The type of dynamic pricing a business should implement depends on their industry, products, and business objectives.

Time-Based Pricing

Companies that use time-based pricing change prices depending on the time of the day. Many electricity companies, for example, charge less for night-time consumption.

Time-based pricing aims to stimulate consumers to buy when demand is low and benefit from surges in demand.

Ride-sharing apps (Uber, Lyft, DiDi, etc.) and food delivery apps (DoorDash, Grubhub, etc.) resort to surge pricing when demand is high. At the same time, they offer discounts to incentivize consumers to spend outside of peak hours.

Cost-Plus Pricing

Most merchants that sell tangible products decide to use cost-plus pricing. The price is set by calculating production and marketing costs and adding the desired profit margin.

Businesses need to change prices only if there are fluctuations in the production costs of a commodity. For example, gas stations adjust the price of gasoline to reflect oil prices on the global market.

Cost-plus pricing is straightforward to apply, and it is usually not necessary to use external customer-based data to define prices.

Penetration Pricing

A penetration pricing strategy is used when businesses want to increase their market share. Companies often set tempting prices initially and then start to increase them steadily.

For example, streaming services have started offering their services for a relatively low price. They have gradually started increasing subscription fees even though the competition in the field is escalating.

Competitor-Based Pricing

Consumers visit multiple websites, comparing prices and looking for the best deals before they make their purchase.

Ecommerce is a highly saturated market, and even a fractionally lower price can sway a consumer and result in a sale.

Ecommerce merchants use competitor prices as a reference point for forming their own prices. Automated systems and bots continuously check the prices set by large platforms, like Amazon and other competitors, and mirror their prices.

Prices on ecommerce websites that use competitor-based pricing can change several times a day.

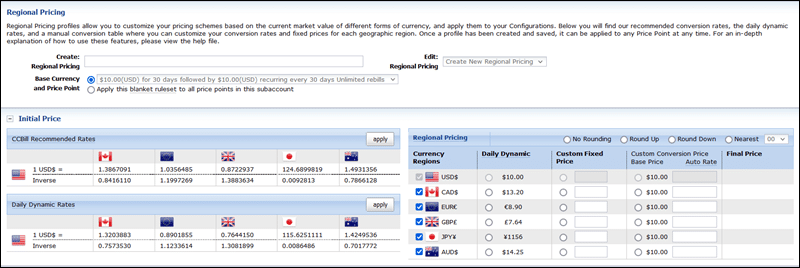

Regional Pricing

Businesses that sell products across many countries often need to set different prices based on location. Purchasing power and conversion rates are the main factors that influence these price adjustments.

If merchants want to display prices in local currencies, they need to ensure that conversion rates do not stifle profits. Using automated algorithms can help merchants carefully calculate and apply favorable conversion rates.

For example, the CCBill Regional Pricing feature can turn currency conversion from a liability into an asset and increase revenue.

Value-Based Pricing

Trying to set prices based on what the consumer is willing to pay is difficult to implement.

Value-based pricing demands a substantial investment in advanced software and qualified staff. This approach depends on collecting and analyzing large amounts of consumer data and adjusting price points to reflect that data.

Merchants attempt to segment consumers into groups and test price points or predict consumer behavior based on location, demographics, purchasing history, etc.

This pricing strategy is very effective but should be used with care as some consumers do not like being targeted by dynamic pricing.

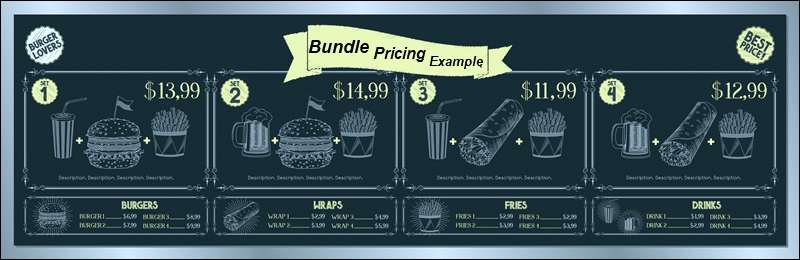

Product Bundling

Several products are packaged into a single price point. For example, paying for a monthly website subscription provides access to a paid premium mobile app. The cost of each service separately would be greater than the bundled product.

This pricing strategy is similar to quantity discounts and is commonly used in brick-and-mortar stores.

Dynamic Pricing Advantages

The most important benefits of dynamic pricing are:

- Optimized Pricing - Data collection and analysis tools help businesses pinpoint the maximum price consumers are willing to pay. Dynamic pricing allows merchants to match or beat this price in real-time.

- Flexibility - Merchants can respond to external market events and change prices much faster.

- Creating Demand - Businesses can take charge of their pricing and use it to promote new products or clear slow-moving stock.

- Staying Competitive - Keeping track of and instantly matching competitor prices is essential for long-term success in a fast-paced market.

Dynamic Pricing Disadvantages

Implementing dynamic pricing may cause:

- Consumer Alienation - Consumers want to feel good about their purchases. If they find out that other consumers received a more favorable price due to a dynamic pricing strategy, it can intensify the feeling that they were overcharged.

- Increased Overhead Costs - Developing or buying a dynamic pricing solution can be expensive. It may be necessary to hire skilled staff and spend many hours in development to create and maintain an advanced software solution.

- Distorted Stats - Dynamic pricing relies on the quality of the collected data. Private browsers, VPNs, and other features that distort the actual behavior of customers can lead to mistakes or missed opportunities when defining prices.

- Tough Competition - Automated systems and intense competition may lead to businesses reducing prices below cost levels for specific products.

How to Implement Dynamic Pricing?

Treat dynamic pricing as a means to achieve broader company objectives. Clearly define your company's targets and intent and before implementing dynamic pricing.

- Create a Pricing Strategy - Use value metrics, customer segmentation, and market research to develop a pricing strategy that is best suited for your industry, product, and company goals. Do not be afraid to experiment. Utilize one or combine several dynamic pricing types.

- Develop Or Buy a Dynamic Pricing Tool - Many dynamic pricing tools on the market provide sophisticated features for merchants on a tight budget. Make sure to choose a solution with features that correspond to your dynamic pricing strategy. Developing a solution is expensive but can deliver a level of customization that results in a well-rounded system.

- Integrate with Payment Processor - Whether you plan to use a ready-made or custom dynamic pricing solution, you need to ensure that it works with your payment processor's system. For example, Dynamic Pricing is a CCBill Feature that allows merchants to pass through custom pricing options to the payment form. The feature is easy to integrate, and it is not necessary to set up fixed price points in advance.

- Establish Pricing Rules - Use the endless stream of consumer and market data to establish accurate pricing rules. Your software solution applies these rules to set optimal prices for products at any given time automatically.

- Analyze Results - Regularly test and modify pricing rules and occasionally reevaluate the pricing strategy to ensure that you are on track to meet company targets.

Conclusion

You know how dynamic pricing works and how it can benefit your business. By implementing dynamic pricing, you automate the manual hit-and-miss pricing process and turn it into a valuable asset.

Use webhooks to supply your dynamic pricing solution with data from social media platforms, payment processor APIs, and other third-party services.