Introduction

Customers expect a convenient, reliable, and fast checkout when paying online. Merchants need to work with PSPs, banks, ecommerce platforms, and other third-party providers to deliver engaging payment flows.

Integrating billing solutions can be challenging and requires extensive development and testing.

Conducting test card transactions is the easiest way to identify and resolve technical issues within the payment process.

Find out how test transactions work and ensure that your customers always complete their payments.

Why Do You Need Test Credit Card Numbers?

Merchants need to conduct many transactions in quick succession when testing or troubleshooting payment issues. Every transaction triggers a transactional event on a processing account.

Test credit card numbers enable merchants to perform an unlimited number of test transactions.

Using real credit cards for test transactions is not recommended. For security reasons, payment processors and banks typically limit the number of transactions a customer can make in a short period.

Additionally, merchants may need to refund or cancel these transactions, which introduces errors in merchant transaction reports and may raise a concern with the issuing bank.

Payment service providers (PSPs) have specific test card numbers for triggering individual transactional events. Merchants need to obtain the correct test credit card numbers and test transaction procedures from their PSP to generate specific events and receive the expected results.

Note: Refer to our post What Is a Payment Processor to learn everything you need to know about how a processor works.

When to Use Test Credit Card Numbers?

Test transactions are essential for identifying technical issues in the payment process and confirming that transactional events unfold as intended. They are an integral part of the development process and vital for facilitating third-party integrations.

Merchants use test card numbers to:

- Ensure that all systems work correctly.

- Test new online payment forms and flows.

- Identify possible issues before launching a new project.

- Check if a third-party service was successfully integrated.

- Test event-driven APIs to ensure that scripts and endpoints are working.

- Develop new services or products.

- Address complaints from customers when they were not able to complete their purchases.

- Test payment flows if the web host, payment processor, or third-party software introduces new features.

Test transactions need to be conducted regularly and thoroughly. Merchants should test card numbers for all major card brands and try to emulate all relevant payment scenarios.

How to Use Test Credit Card Numbers?

CCBill provides a broad set of test card numbers that merchants can utilize to conduct test transactions on their accounts. Test card numbers include different card types from major payment card brands and can be used to generate different approval or denial responses.

CCBill requires merchants to create a unique test user in the CCBill Admin to prevent unauthorized individuals from conducting test transactions.

When processing test transactions, CCBill’s system checks if:

- The test user is utilizing the registered email address.

- The test user is accessing the payment form from the registered IP address.

- The test credit card number is correct.

Once a merchant creates a test transaction user with the corresponding IP and email address, they can use a payment form to conduct test transactions.

Set Up a Test Transaction User

To create a test transaction user in the CCBill Admin panel:

1. Access the CCBill Admin.

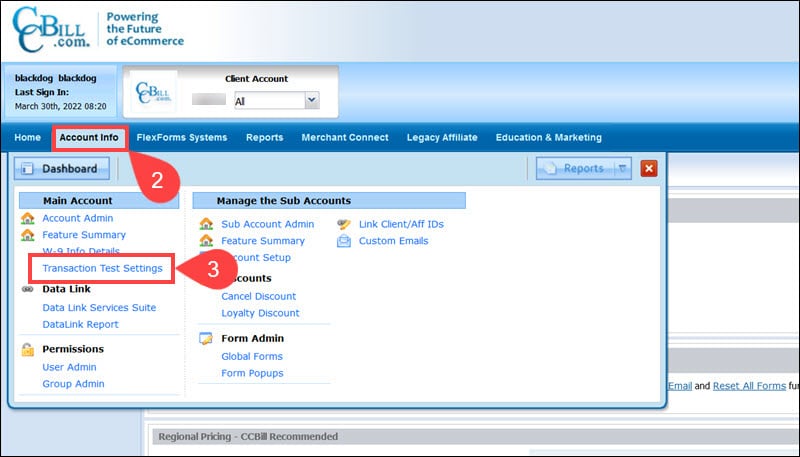

2. Expand the Account Info tab.

3. Select Transaction Test Settings.

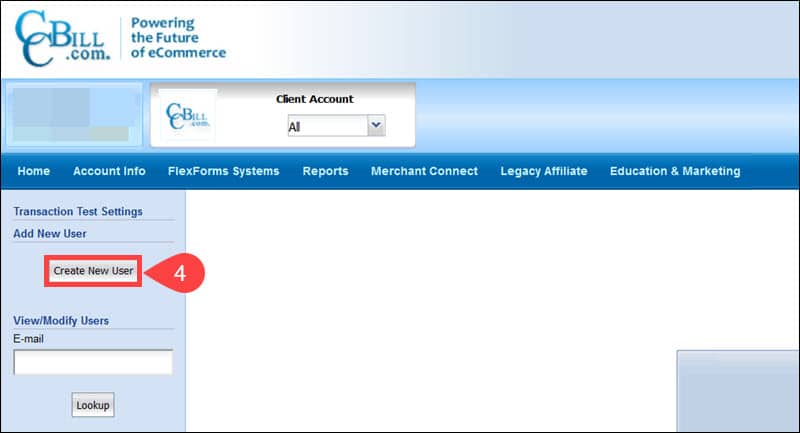

4. Click Create New User.

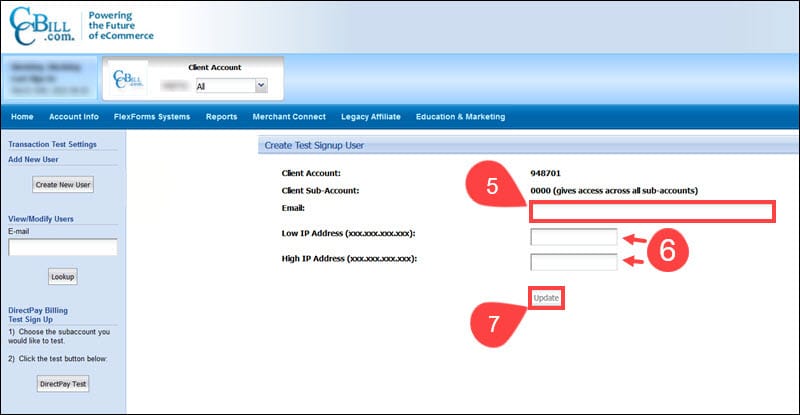

5. Type the Email address that you plan to use for test transactions.

6. Enter a Low and High IP Address. You can enter the same IP address in both fields or define an IP range.

7. Click Update to create the test user.

Successful test transactions can only be performed by individuals that access the payment form from the registered IP and use the correct email address.

Conduct Test Transaction

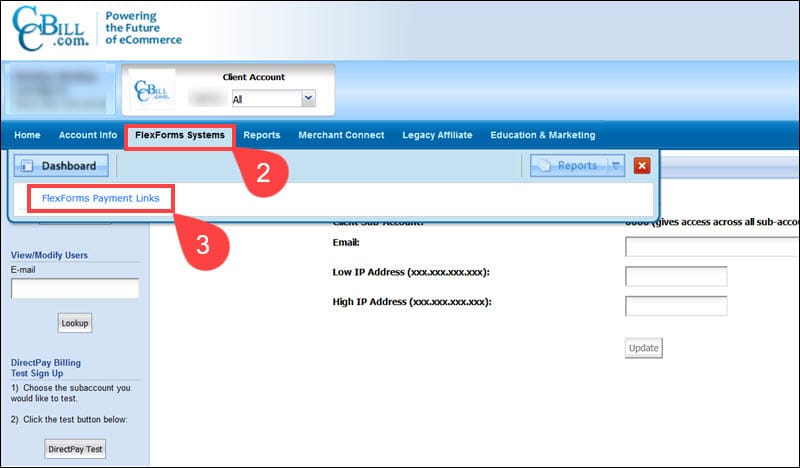

After setting up a Test Transactions User, merchants can visit a payment form and perform a test transaction. This example shows how to complete a test transaction using CCBill FlexForms:

1. Access the CCBill Admin.

2. Select FlexForms Systems.

3. Click FlexForms Payment Links.

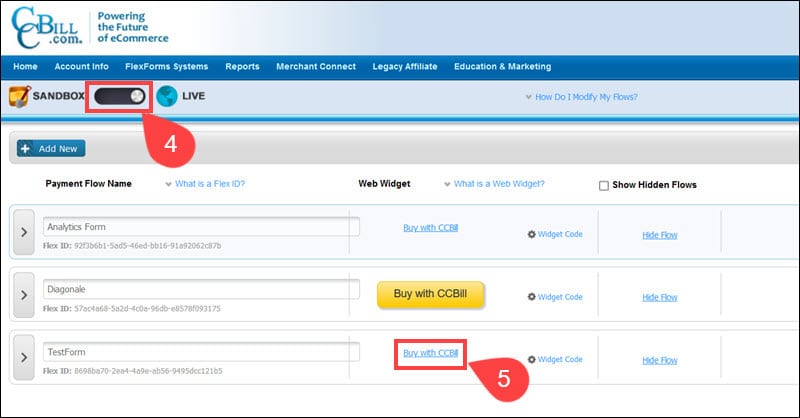

4. Toggle the switch to select Sandbox or Live mode. It is possible to run tests in both modes. If testing FlexForms in Sandbox mode, use a CVV value above 300. All values below 300 result in a denied transaction.

Note: To learn what is CVV and CVC and how they differ, check out our CVV vs CVC article.

5. Access a FlexForm by clicking the corresponding Web Widget link.

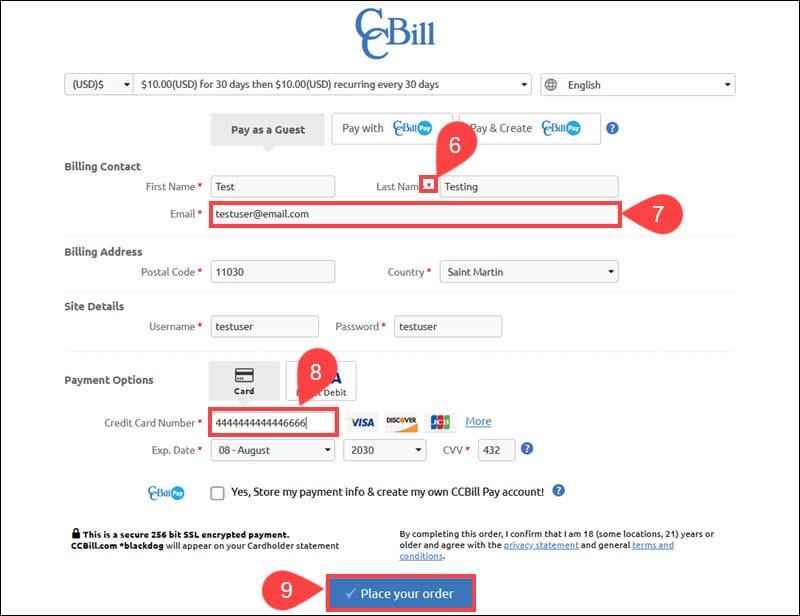

6. Enter the required information in the fields marked with a red asterisk.

7. The email address in the Email field needs to correspond to the test user’s email.

8. Enter the desired test card number in the Credit Card Number field.

9. Click Place your order to complete the test transaction.

The individual conducting the test transaction must always access the payment form from the IP address registered for the test user.

Test Credit Card Numbers

Merchants can use the following test card types and numbers to perform test transactions and generate specific responses.

| Card Type | Card Number | Results |

|---|---|---|

| Visa | 4444444444446666 | Approval |

| Visa | 4444444444444422 | Denial (Risk) |

| Visa | 4444444444444455 | Denial (Banking) |

| Mastercard | 5555555555557777 | Approval |

| Mastercard | 5555555555559922 | Denial (Risk) |

| Mastercard | 5555555555559955 | Denial (Banking) |

| Diner's | 30333333333333 | Approval |

| Diner's | 30666666666666 | Denial (Risk) |

| Diner's | 30000000000004 | Denial (Banking) |

| Discover | 6555555555555555 | Approval |

| Discover | 6444444444444443 | Denial (Risk) |

| Discover | 6222222222222225 | Denial (Banking) |

| JCB | 3555555555555552 | Approval |

| JCB | 3544444444444449 | Denial (Risk) |

| JCB | 3533333333333339 | Denial (Banking) |

| Maestro | 6304444444444442 | Approval |

| Maestro | 6759999999999991 | Denial (Risk) |

| Maestro | 6761111111111119 | Denial (Banking) |

Conclusion

You know what test payment card numbers to use and how to perform test transactions with CCBill payment forms. These tools are going to help you resolve payment issues quickly and develop engaging payment flows for your customers.

Find out why hosted payment pages are crucial for optimizing the payment process on your website.