An acquirer (acquiring bank) and issuer (issuing bank) play crucial roles in payment processing by ensuring all payment card transactions are processed correctly. An acquirer facilitates the payment process by accepting electronic payments for the merchant, while the issuer does the same for authorized payment card users.

In this article, learn about the differences between an acquirer and issuer, and their key responsibilities in processing payments and resolving chargebacks.

What Is an Acquiring Bank?

An acquiring bank provides the merchant with a merchant account and enables them to process and accept electronic payments, typically via credit and debit cards. Acquirers function as the linking element between cardholders, merchants, credit card networks and issuers.

As the name suggests, this financial entity acquires funds from cardholders’ accounts via issuing banks and deposits them into the relevant merchant account.

Additionally, acquirers are involved in chargeback management and fraud detection.

What Is an Issuing Bank?

An issuing bank issues credit and debit cards to authorized cardholders. When a cardholder initiates a transaction, the issuer verifies the payment request. If the payment is authorized, the issuer transfers the funds from the cardholder’s account to a merchant account in the acquiring bank.

Additionally, the issuing bank provides dispute resolution services to cardholders in case of a chargeback.

Acquirer vs. Issuer: Roles and Responsibilities

Here is an overview of the key differences between an acquirer and an issuer:

| Point of Comparison | Issuer | Acquirer |

|---|---|---|

| Scope | - Handles payment card applications. - Issues payment cards to authorized cardholders. - Maintains consumer credit and debit accounts. - Enables cardholders to make payments via payment cards. |

- Maintains merchant accounts for electronic payment processing. - Enables merchants to process POS and online transactions. - Depending on the type of business relationship, the acquirer may verify the merchant’s compliance with payment processing regulations. |

| Payment Processing | - Approves or declines payment requests based on the provided payment information and funds availability. - Releases the approved funds to the acquirer |

- Conveys cardholder information to the relevant card association. - Acquires funds from the issuer. - Deposits the funds into a merchant account. |

| Chargebacks | - Initiates the chargeback process on behalf of the cardholder. - Reverses the payment in a chargeback. - Reviews chargeback responses and determines liability. |

- Receives, reviews, and forwards chargeback requests and responses. - Some may provide merchants with a line of credit to cover unexpected costs, such as chargebacks. |

The Role of Issuers and Acquirers in Payment Processing

The issuer and acquirer have key roles in each step of the payment processing.

Initiating the Payment

When a customer makes an electronic payment, they authorize it by providing their payment card information and unique PIN or one-time authorization code. The payment gateway collects the provided payment information. It then encrypts the data and forwards it to the payment processor.

Note: Payment gateways are necessary for enabling smooth transactions for your customers. Learn all about them in our article How to Choose a Payment Gateway for Your Ecommerce Store.

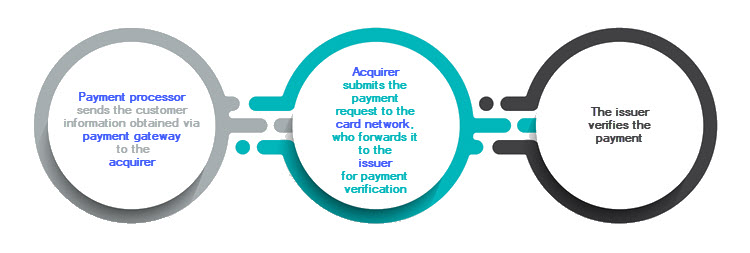

Verifying the Payment

- The payment processor sends the information obtained via the payment gateway to the acquirer.

- The acquirer submits the payment request to the card network, which forwards it to the issuer for payment verification.

- The issuer verifies the payment by confirming the customer information is accurate, and whether there are sufficient funds on their account, and the card is not invalid or expired.

Note: Merchants in high-risk industries may find opening a merchant account more challenging than others. CCBill has over two decades of experience in enabling businesses to process online payments by providing them high-risk merchant accounts.

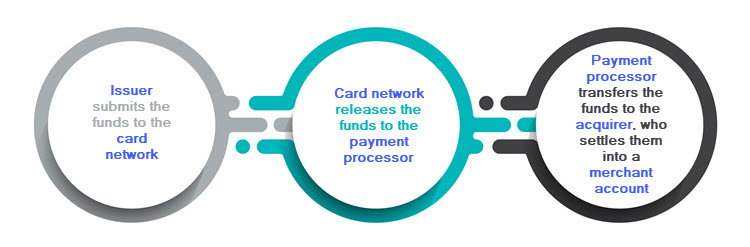

Settling the Payment

- After the issuer verifies and approves the payment request, it submits the funds to the card network.

- The card network then releases the funds to the payment processor to finalize the payment.

- The payment processor transfers the funds to the acquirer, who settles them into the merchant account.

The Role of Issuers and Acquirers in a Chargeback Case

The issuer and acquirer are heavily involved in resolving chargeback cases.

Initiating a Chargeback

To dispute a transaction, the cardholder submits a chargeback request and supporting evidence to their issuing bank.

There are many reasons why cardholders would initiate a chargeback:

- Unauthorized payment.

- Inaccurate amount charged.

- Recurring billing not stopped.

- Friendly fraud.

- Goods and services not received or not as described.

- Refund for returned goods not processed.

- Online payment fraud.

Processing a Chargeback

The issuer reviews the chargeback request and labels it with a reason code. If the issuer concludes that a chargeback request is valid, they reverse the payment and return the funds to the cardholder’s account. The acquiring bank reviews the chargeback information received from the issuer and forwards it to the merchant via their payment processor.

Contesting a Chargeback

If the merchant wants to contest a chargeback and claim it invalid, they do so in a process called representment. To start the process, the merchant submits a chargeback response to the acquirer with a rebuttal letter and supporting evidence disproving the customer’s claims. The acquirer reviews the chargeback response and forwards it to the issuer, who makes a final decision.

Resolving a Chargeback

The issuer reviews the chargeback response and supporting evidence. They will debit the cardholder's account again if the chargeback response is valid (and the merchant is right). However, if the issuer confirms the chargeback, the money stays in the cardholder’s account. In either case, the merchant covers any chargeback-related costs.

Note: Chargebacks and disputes are not the same. Learn how to recognize them in our article Chargeback vs. Dispute: Understand the Difference.

Frequently Asked Questions

Here are some frequently asked questions merchants have about issuers and acquirers.

Do Merchants Need an Acquirer to Accept Payments?

All merchants need an acquirer to accept payments online or via POS terminals. Credit card payments that merchants collect from their consumers are settled in their merchant accounts with their acquiring banks.

Some payment service providers (PSPs) integrate their services to also serve as acquirers, lowering the costs of opening and maintaining merchant accounts for businesses.

Can a Bank be Both an Issuer and an Acquirer?

Many banks cater to both merchants as acquirers and to consumers as issuers.

As issuers, they issue payment cards to users on behalf of card companies. On the other hand, as acquirers, they acquire authorized funds from consumer bank accounts and settle them into merchant accounts.

What Are the Largest Credit Card Networks?

The four largest credit card networks in the United States are American Express, Discover, MasterCard, and Visa.

Credit card networks often work separately from the issuing banks, but not always. American Express and Discover are both credit card networks and issuing banks. They have their proprietary payment card network and can approve or deny credit card applications and payment requests.

MasterCard and Visa only provide the infrastructure for handling payments and transferring payment information and funds. In this case, banks are the issuers and also manage consumer bank accounts and customer relations on behalf of credit card networks.

Can Payment Platforms be Acquirers?

Payment platforms can serve as intermediaries between merchants and acquirers. Payment platforms that offer these services are payment aggregators or payment facilitators. They enable merchants to collect payments from their consumers via sub-merchant accounts. These platforms open merchant accounts with an acquiring bank and then onboard businesses as sub-merchants to enable them to process online and POS payments.

This option is beneficial for small and medium businesses with low transaction volumes. This way, they can avoid paying huge amounts for opening a merchant account.

Conclusion

The acquirer and issuer play key roles in payment processing and chargeback resolution. They are responsible for verifying and forwarding payment information during each electronic transaction. Similarly, they review all the payment information in case of a chargeback.

As a merchant, you would need to work with an acquirer or with a payment services provider, such as CCBill, to open a merchant account and process electronic payments.