All businesses, regardless of their size or industry, need to collect customers’ payments as smoothly as possible. To reach that objective, merchants use various tools and strategies that simplify payment processing.

Recurring payments belong to this collection of business-enhancing tactics. They help merchants ensure a steady cash flow, streamline the payment process, and easily track customer payments.

This article describes what recurring payments are and how they work. Also, it explains how to implement recurring payments, and what their benefits and downsides are for both merchants and recurring customers.

What Are Recurring Payments?

A recurring payment is a billing agreement by which a merchant automatically collects funds from a customer on a specified due date in regular, predefined intervals. Such automatic payments can be processed with direct debit, standing order or via the customer’s payment card.

Customers need to officially authorize merchants to withdraw money from their payment cards.

When a merchant receives such permission, they can start collecting funds from the customer’s card until the customer cancels the authorization and stops using the merchant’s services.

Who Uses Recurring Payments?

Business owners use recurring payments for a number of business models:

- Subscription-based businesses. Subscription businesses, such as delivery companies, publishing companies, or streaming services rely on recurring payments. Combined with the tiered pricing model, such payments incentivize customers to subscribe to certain services and pay them monthly or annually, in line with their current needs.

- Memberships. Memberships sites and businesses, like gyms, sports clubs, or learning platforms, often collect fixed membership fees from customers via automatic billing.

- Financial services. Merchants operating in the financial sector typically charge their customers through recurring payments. From insurance policies and mortgages to loan installments, recurring payments are a handy option for merchants providing various financial services.

- Utilities and public services. Utility companies, like electricity, gas, Internet, or telephone providers, also benefit from recurring payments. Merchants save time and assets since they don’t have to send numerous reminder notices, and customers avoid paying default interests on potential late payments.

Consumers opt for recurring payments as a convenient set-it-and-forget-about-it payment method.

Types of Recurring Payments

Based on the paid amount, there are two main types of recurring payments:

- Fixed or regular recurring payments. In a fixed recurring payment, the merchant withdraws the exact agreed amount of money from the customer’s account on pre-arranged due dates. Such payments are commonly used for subscriptions, memberships, and loan installments.

- Variable or irregular recurring payments. In a variable recurring payment, the amount of money the merchant automatically collects from the customer’s account may vary. It’s based on the consumption of products or services for the billed period. Automatic payments for utilities and public services are commonly irregular recurring payments.

How Do Recurring Payments Work?

A merchant can collect funds via recurring payments only if the customer authorizes them to bill their account.

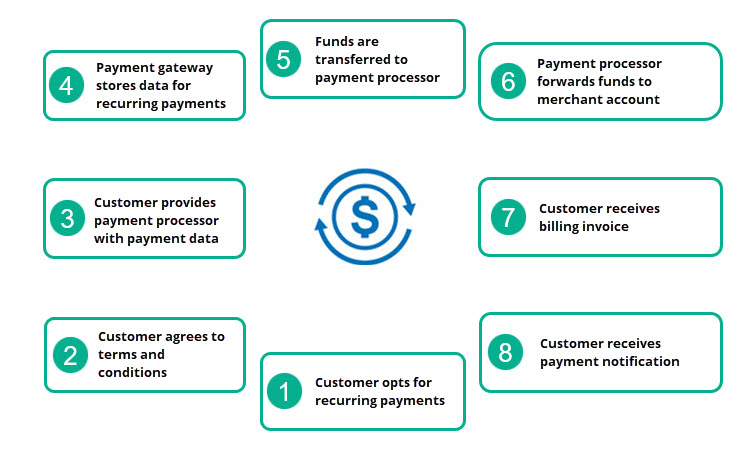

Collecting recurring payments consists of the following steps:

- The customer decides to accept recurring payments via a payment service provider (payment processor).

- The customer agrees to the terms and conditions for making recurring payments.

- The customer provides their payment data (credit card or bank account number, or alternative payment methods) for the initial transaction.

- The payment gateway stores the banking information to enable future automated transactions.

- Funds are sent to the payment processor.

- Upon approval, the funds are transferred to the merchant account.

- The customer receives the billing invoice.

- When the payment is finalized, the customer receives a notification.

Note: Most merchants carry out automated billing via credit card payments and ACH transactions. However, as the global payments market is changing, offering alternative payment methods, such as eWallets and mobile payments, is a wise move for merchants who want to attract a wider international audience.

Best Practices for Implementing Recurring Payments

There are several prerequisites that every merchant needs to meet to start receiving recurring payments.

Acquiring a Merchant Account and a Payment Processor

First of all, a merchant needs to open a merchant account. A merchant account is a commercial business account where the merchant receives the funds from customer transactions, including recurring payments.

The funds are forwarded from that account to the merchant’s checking account on settlement dates

It’s also necessary to find a reliable payment processor that offers recurring payments.

Ensuring PCI Compliance and Payment Security

Ensuring payment security, preventing fraud, and meeting the Payment Card Industry Data Security Standard (PCI DSS) is essential to start receiving recurring payments. PCI DSS is a set of rules mandated by major card associations and monitored by the PCI DSS Council which specify how cardholder data is used and stored for bank card payments.

Since there are numerous regulations contained within PCI compliance, many merchants opt for a payment gateway which already has all those legal and security features implemented.

For some merchants, the best option is to make an arrangement with a payment processor that offers payment gateway services and provides merchant accounts. That way, they get everything they need to set up recurring payments in one place.

Note: Learn more about the differences between a payment processor and payment gateway from our post Payment Gateway Vs. Payment Processor: What Are the Differences.

Obtaining Written Permissions from Payers

Automatic payments are a practical option for both merchants and customers. However, sometimes misunderstandings can occur. Occasionally a customer may claim that the merchant has withdrawn funds from their account without permission. In this case, unless the merchant has written authorization for automatic billing, they can’t prove they are right.

Therefore, merchants should obtain written permission for all recurring payments, including the agreed payment date, amount (for fixed recurring payments), and the period during which recurring payments will be carried out.

Sending Pre-Payment Notices

Occasionally, a customer doesn’t have enough funds on their account on the recurring payment due date. In that case, both the customer and the merchant have an additional hassle with the issuing bank. The merchant needs to wait longer to receive the payment, and the customer pays additional fees to the bank.

To avoid this, set up pre-payment notices that will remind your customers about their payment dates.

Note: In addition to the conditions above, merchants should let consumers easily update their payment information. Also, consumers need to be notified in advance if their credit card is going to expire soon. This will give them enough time to renew their credit card, update the payment data, and avoid the inconvenience of not having enough funds for a due recurring payment. .

Bringing Straightforward Policies

Merchants need to define clear business policies regarding recurring payments and regularly update them.

Specify the general terms and conditions, as well as the rules on subscriptions, memberships, cancellations, and refunds, and make them easy to understand. Avoid ambiguities and use straightforward language so that customers are reassured that there are no potential additional costs or hidden regulations.

Note: CCBill provides merchants with a cutting-edge automated billing system that ensures smooth implementation of recurring payments, including dynamic FlexForms, regionally adaptable pricing, electronic invoicing, and many other tools, without the need for any additional features.

Pros and Cons of Using Recurring Payments

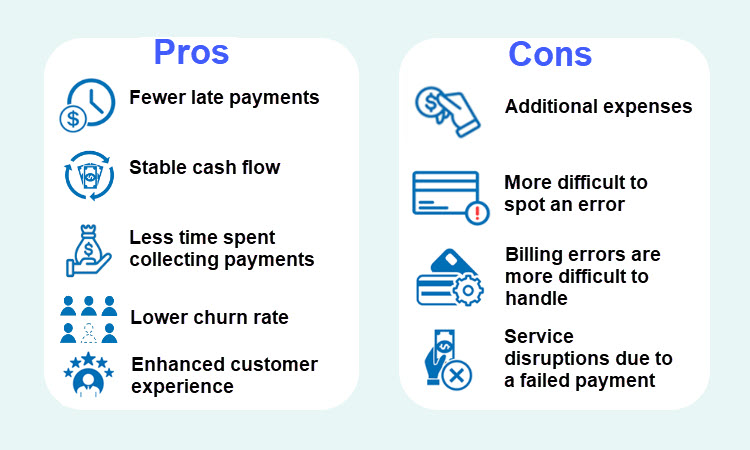

Recurring payments bring numerous benefits to both merchants and customers.

- Fewer late payments. When customers allow automated billing, merchants always carry out agreed transactions on time, avoiding postponed payments. Customers don’t forget to make payments and avoid paying default interests.

- Stable cash flow. Merchants relying on recurring payments ensure stable cash flow and, consequently, plan their business budget more accurately.

- Less time spent collecting payments. Merchants using recurring payments don’t need to chase their customers to pay for the consumed goods or services. Everything happens automatically, which saves their time and assets.

- Lower churn rate. Offering recurring payments improves the overall customer experience with the merchant, facilitates the payment process, and reduces the churn rate.

- Enhanced customer experience. Customers enter their payment information only during the first payment as their data is stored in the payment gateway. From that point on, the merchant automatically collects the funds without the need for the customer’s active participation. Provided the payment information remains the same, the customer does not need to provide any additional information.

The main disadvantages of using automatic billing are:

- Additional expenses. In addition to standard credit card processing fees, some payment providers charge additional costs for automatic payments. Do your research and inquire about any additional fees before closing the deal with your chosen payment processor.

- More difficult to spot an error. Sometimes a customer might want to cancel a subscription, but they forget to inform the merchant, or the merchant overlooks the notification. Consequently, the customer decides to ask for a refund or chargeback, incurring unexpected costs for the merchant.

- Billing errors are more difficult to handle. If a customer is charged for a recurring payment by mistake, they might not notice this error until they receive their account statement. The likelihood of these errors is higher for variable payments because the charged amount is not always the same. The process of correcting this type of mistake is costly and time consuming.

- Service disruptions due to a declined payment. When there are problems with the customer’s account (e.g., insufficient funds or a blocked account), recurring payments can’t be processed, resulting in halted services. Hence, merchants should encourage customers to connect an account with a typically sufficient balance, like a checking account. Sending a reminder to the customer prior to the recurring payment due date is a practical way of avoiding this inconvenience.

Conclusion

Recurring payments enable merchants to diversify their payments system while generating more loyal customers and ensuring higher revenue.

However, they need to calculate all the potential additional fees in advance to check whether offering automated billing benefits their business type.

If implemented and monitored effectively, recurring payments give merchants a steady source of cash and keep their finances stable.

This guide will help you understand how recurring payments work, what benefits they bring to merchants, and what to keep an eye on when implementing these payments.