There is a blurred line when it comes to bill vs. invoice. Bills and invoices are both documents related to payments and provide details of the purchase. However, both serve different purposes.

To understand the key differences between bills vs. invoices, let’s take a look into the meaning of both.

What is an Invoice?

An invoice is a sales document that a business issues to its customers. It outlines the following details:

- Products or services provided

- Total amount the customer owes for those products and services

- Contact details of both - the seller and the buyer

An important feature of invoices is the payment terms. It specifies the number of days within which a buyer needs to make the payment. Generally, this period ranges from 0 to 30 days from the date of supply.

Also, sellers may offer a discount if the customer pays before the due date. Invoicing works well for buyers due to the credit offered and it’s profitable for sellers considering the opportunity cost and cash flow.

Invoices can be issued even if the buyer has already paid for the product or service. All payments are clearly stated on the invoice by the seller to avoid any misunderstandings. Usually, “PAID” is written in such cases.

Note: For a seller, the invoice is called a sales invoice. Sellers compile all the sales invoices to calculate a sales report to know their total sales and turnover.

What is a Bill?

In the most literal sense, a bill is money owed by a buyer or consumer for a purchase. When a buyer makes a purchase, the seller expresses the amount of money that must be paid with a bill. Usually, a bill is issued or given at the same time or immediately after the purchase. In other words, the seller or business expects the buyer to pay immediately.

Traditionally, a bill is written or printed on a piece of paper that enlists the cost of all the items purchased, specifying quantities. With the advent of technology, digital bills are gaining popularity.

Invoice vs. Bill: The Differences

The terms bill and invoice are often confused with one another. So here are some key differences between an invoice and a bill.

Documentation

The first difference in the bill vs. invoice debate is the way in which these two are documented. Bills are simple documents asking for quick or immediate payment.

When buyers are ready with all the items they wish to purchase, they receive a bill to complete the transaction.

On the other hand, an invoice can be prepared and handed over at any point during the transaction. Additionally, the payment doesn’t necessarily have to be made instantly on the receipt of an invoice.

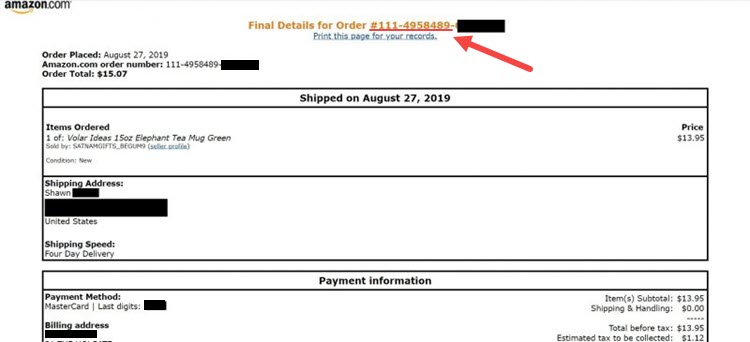

Unique Order Number

Another critical difference here is the unique order or transaction number that’s included in an invoice for record-keeping and financial tracking. With the order number, sellers can locate or view the complete transaction in the future.

On the other hand, a bill might not have any order number. It might, however, include a date of purchase for record-keeping.

Note the order number in the invoice below.

Image via Business Insider

Information About the Transaction

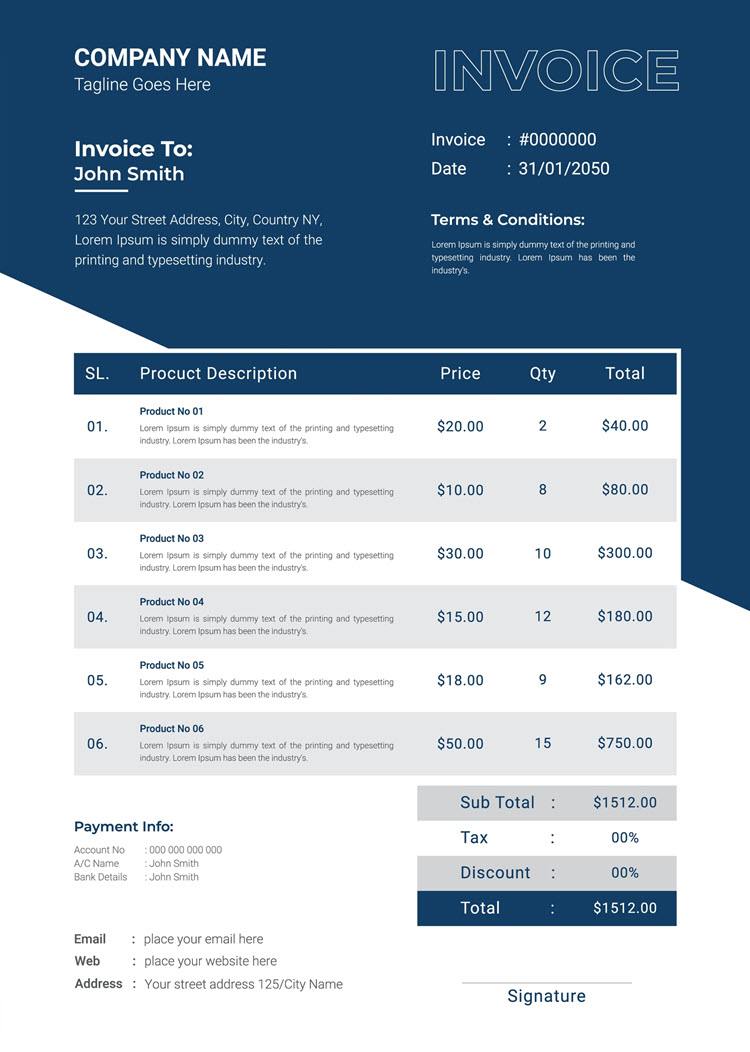

Another important difference between bills and invoices is the information contained in each document. The information or details mentioned on an invoice are quite extensive as compared to a bill.

On the other hand, a bill might not have any order number. It might, however, include a date of purchase for record-keeping.

An invoice lists the following information about a transaction:

- Unique identification number

- Business name, address, and contact information of the seller

- Name and address of the customer/business you’re invoicing

- Breakdown of the goods or services charged

- Supply date

- Date of issue

- Payment terms

- VAT amount, if applicable

- The total amount owed

Here is what a typical invoice looks like:

A bill usually offers limited information about a purchase:

- Lists purchased items

- The cost of each item

- The total amount

- The date of the purchase

In most cases, the buyer reviews the total amount on the bill and makes the payment instantly.

The Side of the Transaction

The side of the transaction you’re on dictates if the document in your hand should be called an invoice or a bill.

A seller sends an invoice to a buyer for goods or services. However, for the buyer, this document is always regarded as a bill since it reflects the amount of money they owe for the goods or services, even if they have a few days to pay it.

Let’s say an e-commerce business hires a consultant to do ecommerce SEO for their website. After completing this particular marketing task, the consultant would send an invoice to the company for the services that they’ve rendered

However, the e-commerce company would regard it as a bill for the SEO services provided by the consultant. They won’t see it as an invoice.

In a nutshell, the seller sends an invoice to a buyer with or without the payment terms. But what the seller receives will always be a bill, irrespective of the payment terms.

When Should You Use an Invoice?

Invoices are more suitable for businesses that have flexible payment cycles that allow buyers to pay on a future date.

Usually, companies that deal with large or bulk purchases of goods or products, and those who provide specific subscription services to customers or other companies, use invoicing to forecast recurring revenue and inventory management.

Here are examples of companies and professionals who opt for invoicing:

- Software and web developer

- Construction companies

- Companies in the metal industry

- Landscaping companies

- Freelance writers and designers

- Educational service providers

Invoicing plays an important role in the inventory tracking process for both the customer and the seller, so it’s practiced by most enterprises.

With an e-invoice, you can request online payments for the delivered products and services. To accept online payments, partner with a reliable payment processor.

When Should You Use a Bill?

Wondering when you should use a bill instead of an invoice? A bill is most suitable for a business that expects an immediate payment for goods or services. There’s not much room for flexibility in the payment cycle here, as mentioned above.

For example, restaurants, bars, and hotels are businesses that tend to use a billing process. For such businesses, everyday capital is of importance as they need to clear bills for the raw material and purchase for the next day.

As a result, they expect immediate payment for goods and services provided. The total amount to be paid can be printed or written on the bill.

Once the buyer pays the bill, the business may issue a receipt to confirm that they recieved payment and that the transaction is complete (this is applicable for invoices too).

Invoice and Bill Management System

Bill and invoice management systems have evolved over the years. Advancements in technology have played a major role in this change. From manually writing down every invoice in spreadsheets to computer-generated invoices/bills, the world has changed drastically.

With the help of bill and invoice management systems, the billing/invoicing process has become more accurate, quick, and cost-efficient.

Most invoice or bill management systems also come with several other features like sales and marketing automation to boost conversion rates, ecommerce accounting, CRM, finance management, etc.

Note: Learn more about creating your own invoices by referring to our guide on How to Make an Invoice.

Conclusion

A thorough understanding of payment systems and documentation plays an important role in running a business. You need to know when to issue an invoice and when to issue a bill.

Additionally, it’s critical to understand that any invoice you receive from a seller is always going to be a bill for you that you need to pay at some point.

While many use these terms interchangeably, knowing the differences between the two can help you make a more informed choice for your business.