Automated Clearing House (ACH) payments play a crucial role in the economy and are widely used by businesses and individuals. While most ACH payments are straightforward, mistakes do happen. Fortunately, there is a way to reverse ACH payments after they settle.

This article will explore how ACH reversals work and how they differ from ACH returns.

What Is an ACH Reversal?

An ACH reversal is a request to undo an ACH payment and return the funds to the sender.

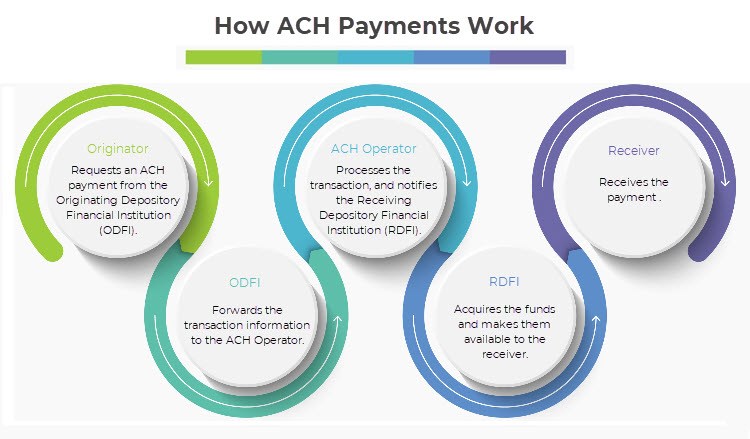

ACH reversals usually occur because the payment originator (ODFI) made a mistake with either the recipient’s account number, transaction amount, or date. To initiate an ACH reversal, the payment sender must contact their bank or payment processor, who will send a request to the receiving financial institution (RDFI) , asking them to return the funds to the sender’s account.

The payment receiver cannot request an ACH return as they did not initiate the transaction.

Note: Learn everything you need to know about the payment processors by reading What Is a Payment Processor.

How Does ACH Reversal Work?

Here are the steps involved in the ACH reversal process:

- The payment originator contacts their bank or payment processor. To proceed with the reversal request, they must provide transaction information, such as the date, the amount, and any relevant details about the reason for the request.

- The bank verifies the request and determines whether the transaction is eligible for reversal.

- If the reversal request is legitimate, the originating bank sends a request to the receiving bank, asking them to return the funds to the sender’s account. The request typically includes information about the original transaction and the reason for the reversal.

- The receiving bank processes the reversal request and returns the funds to the sender’s account.

- The bank or payment processing company notifies the requesting party that they have completed the reversal.

It can take banks up to five business days to complete an ACH reversal, and the process involves fees ranging from $5 to $25.

ACH Reversal Requirements

You can only reverse an ACH payment if you meet the following requirements:

- The request is timely. Payment originators must request a reversal no later than five business days after the transaction is finalized.

- There is a valid reason for the reversal. Valid reasons for ACH reversal include the following:

o Incorrect transfer amount.

o Incorrect date.

o Incorrect account number.

o Duplicate transfers (in which case only the duplicate is reversed).

- The proper documentation is submitted. The payment originator may need to provide receipts, bank statements, or other details showing that the original transaction was in error or was unauthorized.

Note: Read our article on ACH payment processing times to find out how they compare to other electronic payment methods.

ACH Reversal Process

Nacha, or the National Automated Clearing House Association, is responsible for establishing the operating rules that govern the ACH network and enforcing compliance with these rules. However, Nacha is not directly involved in reversing ACH transactions and leaves most customer-facing decisions to the banks.

Subsequently, it is critical to carefully review the terms and conditions of your payment agreement as well as your bank’s rules and procedures before requesting a reversal. For example, some banks allow customers to alter payments over the phone or online, while others require them to write a request or submit a form.

Note: Thinking about processing ACH payments? Learn what it takes for a business to start accepting ACH payments as fast as possible!

ACH Reversal vs. ACH Returns

Although often confused, ACH returns and ACH reversals are quite different.

ACH returns happen when a financial institution rejects a payment and sends it back to the originator. On the other hand, ACH reversals are cancellations of an ACH transaction that has already been processed.

Another key difference is that ACH returns are automatically initiated by banks, while ACH reversals are initiated via request by the payment originator.

ACH Reversal vs. ACH Returns Examples

Let us examine the differences through two examples.

ACH return example scenario:

John runs a small catering business and uses the ACH network to process invoices. One of his clients, Rachel, hired him to cater a wedding and agreed to pay the invoice via ACH transfer. However, when John went to process the payment, he received a notification that the bank had returned it.

Upon investigation, John learned that Rachel’s account had insufficient funds to cover the transaction. Rachel had forgotten to transfer money into her account to cover the payment, so the financial institution rejected it.

John contacted Rachel to let her know about the issue. Rachel apologized for the oversight, transferred the necessary funds into her account, and successfully sent the payment on the second attempt.

Note: Learn about the different ACH return codes and how to understand them.

ACH reversal example scenario:

Sara is a small business owner who uses ACH transactions to pay her employees and vendors. She initiated a payment to one of her vendors, Dan, for $500 to cover the cost of supplies for her business. However, Sara accidentally entered the wrong account number for Dan’s business and sent the payment to the wrong account.

When Dan realizes he has not received the money, he contacts Sara to let her know. Sara quickly discovers that she made a mistake with the account number and contacts her bank to request an ACH reversal. The bank initiates the reversal, contacts the receiving bank to which they mistakenly sent the payment, and asks for a return of the funds.

The receiving bank processes the return request and transfers the $500 back to Sara’s account. Sara then initiates a new ACH payment to Dan with the correct account information and successfully credits the payment to his account.

Conclusion

If you need to reverse an ACH payment, you must act fast to ensure the bank can reverse the payment. Fortunately, it takes up to three business days for an ACH payment to reach the recipient’s account, giving you time to realize any potential mistakes. Remember, the earlier you request the reversal, the more likely it is to be successful.

Remember that having as much information as possible about the transaction is also important. Details such as the transaction date, the amount of the transaction, and the account number that received the payment all help the banks sort out the reversal quickly and efficiently.