Finding unexpected charges on your monthly credit card statement is an unpleasant experience. Fortunately, you can correct these errors using legal guarantees that protect you against fraudulent charges.

This article will explain how the Fair Credit Billing Act works and how to benefit from it.

Fair Credit Billing Act Definition

The Fair Credit Billing Act (FCBA) protects consumers from predatory practices and payment processing errors for which they were not at fault. It is a U.S. federal law passed in 1974 as an amendment to the Truth in Lending Act, and covers charges over $50.

Thanks to the FCBA, consumers can dispute a charge for any of the following reasons:

- An unauthorized individual made the transaction.

- There was a billing error (i.e., the merchant did not correctly indicate the time and place of the transaction).

- The goods or services were not delivered or were late.

- The merchant charged you for more than was agreed upon, either by mistake or intentionally.

- The goods or services were subpar or otherwise not as described.

- The billing descriptors were unclear or sent to the wrong address.

The Fair Credit Billing Act covers “open end” credit accounts which include credit cards and revolving charge accounts (e.g., department store accounts). However, it does not cover installment loans and extensions of credit paid on a fixed schedule.

How Does the Fair Credit Billing Act Work in Practice?

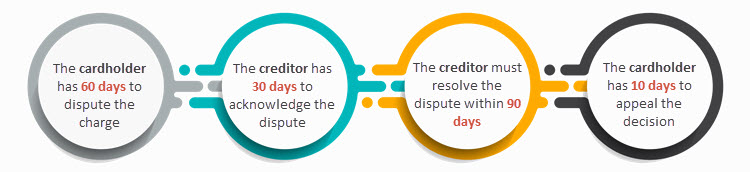

A cardholder has 60 days from when the merchant postmarked the credit bill to dispute it. The cardholder must submit a written complaint by sending a letter to the creditor (i.e., the credit or debit card company), addressed to the department for billing inquiries.

The creditor has 30 days to acknowledge a cardholder’s dispute and respond to their claim in writing. After receiving the letter, the creditor must investigate and resolve the dispute within two billing cycles (not more than 90 days).

If the solution fails to satisfy the cardholder, they can appeal the decision. The cardholder must send the appeal letter within 10 days of receiving the response to comply with FCBA procedure.

Strictly abiding by the deadlines and having a persuasive complaint letter is critical to success in a payment dispute.

Note: To stand the best chance of winning, check out The Federal Trade Commission’s Sample Letter for guidance on writing a convincing complaint letter.

What is the Purpose of the Fair Credit Billing Act?

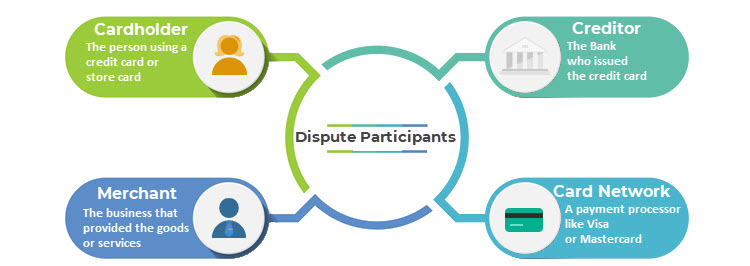

The Fair Credit Billing Act is the umbrella law of all chargeback regulations, and it mandates card networks and banks to have detailed procedures in place for payment disputes. However, the FCBA grants a great deal of autonomy to banks and card networks in managing these disputes.

Note: Learn the difference between Chargebacks and Disputes.

Aside from protecting the cardholder from billing errors and unsatisfactory purchases, the act also protects cardholders against merchants unwilling to reasonably assist their customers who are having trouble with their product, service, or billing process.

The cardholder must first attempt to settle the issue with the merchant without involving a third party before resorting to a formal dispute. Failing to do this will likely cause the creditor to decline the claim and retain the charge on the cardholder’s account.

How Does the Fair Credit Billing Act Protect Consumers?

The Federal Trade Commission (FTC) formally enforces the FCBA through legal complaints and lawsuits against creditors who violate the FCBA.

Cardholders who win complaints are awarded damages plus twice the amount of any finance charge — if it is between $500 and $5,000. Higher amounts are awarded if they discover a pattern or violations. The court may also order the creditor to pay the cardholder’s attorney’s fees and costs.

Even though the FTC enforces the Fair Credit Billing Act, they do not get directly involved in most cases. Instead, they delegate almost all decision-making to the banks and credit card companies. This means consumers would do well to know their bank’s specific regulations.

Note: If a cardholder wins a payment dispute, the merchant can appeal the decision in a process called representment. The back-and-forth can escalate further and involve the credit card companies in a process called arbitration.

Conclusion

The Fair Credit Billing Act aims to protect cardholders from unfair billing practices. It does this by mandating regulations and procedures that enable cardholders to dispute charges on their credit cards or revolving charge accounts.

Those complaints can be based on various reasons, such as billing errors, unauthorized charges, and faults with the product or service received. Before sending a formal complaint, however, cardholders are advised to first attempt to reconcile the issue with the merchant.