Introduction

To keep online payment processing secure and efficient, financial institutions, card networks, and payment service providers authenticate and approve card payments within seconds.

Some transactions must be declined to protect cardholders, merchants, and the integrity of the payment process. Customers are often confused and frustrated when their transaction is declined.

Knowing why a decline occurred and reaching out to customers without delay helps merchants avoid excessive cart abandonment and improves conversion rates.

Learn what each decline code means and how to mitigate the effects of declined card transactions.

What Are Credit Card Decline Codes?

A decline code is a response the customer’s bank, card issuer, or the payment processor sends when they cannot authorize (approve) a card transaction.

Each decline code represents a specific decline reason. Other participants in the payment process, like merchants, can use the code to determine why a transaction was declined.

Decline codes are typically accompanied by short error messages that describe the reason in more detail.

Reasons Why Credit Card Declined Codes Occur?

Payment systems are designed to authorize payments, prevent fraud, and settle transactions with minimal friction.

The customer’s bank (card issuer) declines card-based transactions if:

- The card was reported as stolen or lost.

- Bank policies or local regulations restrict transactions for specific MCC Codes.

- The card has expired.

- The card number is not valid.

- The customer does not have enough funds in their account.

- The customer provided incorrect payment data.

- There was no response from the card processor.

- A technical issue interrupted the authorization flow.

Most declines issued by the customer’s bank are referred to as hard declines. The customer must contact the bank to resolve the issue or use a different payment method. Merchants cannot override hard declines.

Payment processors and gateways may also decline to authorize transactions if:

- A customer exhibits unusual card usage patterns. For example, multiple payment attempts in quick succession, attempts from various IPs, or payments involving substantial sums.

- The customer enters incomplete or incorrect payment information.

- The country the customer is trying to pay from is not supported or is blocked by the payment processor.

- The merchant decides not to accept payments from certain countries or regions.

- The processor cannot establish communication with the bank’s systems due to a temporary technical issue.

Merchants can, in some instances, override declines issued by the payment processor’s systems. These types of declines are called soft declines.

Check with your payment processor to determine which soft declines are eligible to be overridden.

Note: Refer to our comparison article Payment Gateway vs. Payment Processor to learn more about the differences.

List of Credit Card Declined Codes

Financial institutions and card networks use the ISO 8583 messaging standard for card-based electronic transactions. The standard establishes response code values, message formats, data elements, and communication flows for exchanging transaction data.

Based on the decline reason, codes are grouped into several types.

Call/Decline Codes

The Call and Decline code types indicate that the card issuer cannot authorize the payment. The decline reason can range from suspected fraud to incorrect payment data or insufficient funds.

Typically, the customer needs to contact their bank and check their balance, card expiration date, and account status. Call and Decline codes include:

| Decline Code | Decline Message | Decline Reason |

|---|---|---|

| 01 | Refer to card issuer | The customer’s bank cannot authorize the transaction, and the customer must contact the bank to determine the specific reason. |

| 02 | Refer to card issuer's special conditions | The bank has detected unusual activity on the account. For example, payments in two different countries within a few hours. |

| 04 | Pick-up | The card is reported to be stolen or lost. |

| 05 | Do not honor | A common decline code caused by an range of reasons. Typically, it is a result of incorrect payment data or insufficient funds. |

| 51 | Insufficient funds | The customer does not have available funds to complete the payment. |

| 54 | Expired card | The card expiration date has passed. |

| 57 | Transaction not permitted to cardholder | The card is not configured for this type of transaction. For example, the card cannot be used for online payments. |

| 65 | Exceeded withdrawal frequency limit | The customer has likely reached a daily or monthly limit for the number of card transactions. |

| 93 | Transaction cannot be completed. Violation of law. | The customer needs to contact the bank to find out if there is an issue with their bank account. |

If a merchant encounters a Call or Decline code, they should advise the customer to contact their bank.

Hold-Call Codes

Hold-Call decline codes are a sign of potential fraud, and the card issuer will not permit the transaction to proceed.

| Decline Code | Decline Message | Decline Reason |

|---|---|---|

| 07 | Pick-up card, special condition | The transaction cannot be authorized due to suspected fraud. |

| 41 | Lost card | The card has been reported as lost and cannot be used to complete transactions. |

| 43 | Stolen card - pick-up | The card is reported as stolen and may be used to facilitate fraud. |

The merchant can do little to assist cardholders that receive a Hold-Call decline and should instruct the customer to use an alternative payment method.

System Error Codes

System error codes indicate that a payment system could not process the transaction due to incorrect data or a technical issue.

| Decline Code | Decline Message | Decline Reason |

|---|---|---|

| R0 and R1 | Customer Prohibited Recurring Payment | The customer has instructed the bank to prevent recurring payments initiated by your system. Future charges may result in chargeback requests. |

| 12 | Invalid Transaction | There is an issue with the data the customer entered, and the system cannot authenticate the payment. For example, an incorrect card number or address. |

| 13 | Invalid Amount | The format of the purchasing amount is not valid. This happens when a customer types a negative value or unreadable symbol. |

| 14 | Invalid Card Number (no such number) | An invalid card number was entered. |

| 15 | No such issuer | The first card number is incorrect as it does not match the card brand used for the transaction. |

| 19 | Re-enter transaction | The system is unsure why the transaction failed. The customer’s best course of action is to re-enter their payment data. |

| 28 | File update file locked out | The processor could not retrieve the necessary data from the customer’s bank. |

| 58 | Transaction not permitted to terminal | The customer’s bank cannot process the transaction for this card. |

| 62 | Restricted card | A customer is using a card that cannot facilitate online payments. Alternatively, the merchant account is not configured to accept a specific card brand. |

| 63 | Security violation | The CVV or CVC code was incorrect. |

| 91 | Issuer or switch is inoperative | The card issuer’s system is temporarily unavailable. |

| 96 | System malfunction | The customer’s bank is not able to authorize the payment due to a technical issue. |

| CV | Card Verification Error | The merchant does not accept the card brand the customer is using, or there is a technical issue with the configuration of the merchant account. |

Merchants need to reach out to the customer and try to help them resolve these errors. Most declines can be avoided by retrying later or by checking and re-entering the correct billing information.

Note: Learn more about CCBill's Merchant Services. Our single payment solutions are built to suit your buyers' purchasing needs and help your business grow.

Additional Decline Codes

Merchants encounter certain decline codes more frequently than others. Less common decline codes include:

- 03 Invalid merchant

- 06 Error

- 08 Honor with identification

- 09 Request in progress

- 10 Approved for partial amount

- 11 Approved (VIP)

- 16 Approved, update track 3

- 17 Customer cancellation

- 18 Customer dispute

- 20 Invalid response

- 21 No action taken

- 22 Suspected malfunction

- 23 Unacceptable transaction fee

- 24 File update not supported by receiver

- 25 Unable to locate record on file

- 26 Duplicate file update record, old record replaced

- 27 File update field edit error

- 29 File update not successful, contact acquirer

- 30 Format error

- 31 Bank not supported by switch

- 32 Completed partially

- 33 Expired card

- 34 Suspected fraud

- 35 Card acceptor contact acquirer

- 36 Restricted card

- 37 Card acceptor call acquirer security

- 38 Allowable PIN tries exceeded

- 39 No credit account

- 40 Requested function not supported

- 42 No universal account

- 44 No investment account

- 45/50 Reserved for ISO use

- 52 No checking account

- 53 No savings account

- 55 Incorrect personal identification number

- 56 No card record

- 59 Suspected fraud

- 60 Card acceptor contact acquirer

- 61 Exceeds withdrawal amount limit

- 64 Original amount incorrect

- 66 Card acceptor call acquirer's security department

- 67 Hard capture (requires that card be picked up at ATM)

- 68 Response received too late

- 69/74 Reserved for ISO use

- 75 Allowable number of PIN tries exceeded

- 90 Cutoff is in process (switch ending a day's business and starting the next. Transaction can be sent again in a few minutes)

- 92 Financial institution or intermediate network facility cannot be found for routing

- 94 Duplicate transmission

- 95 Reconcile error

Payment Processor Decline Codes

Payment processors often use proprietary response codes and code formats. Merchants that have an account with a PSP (payment service provider) need to obtain a list of decline codes directly from the processor.

CCBill uses custom alphanumerical decline codes when sending transaction responses to merchants. Additionally, every customer receives an automated message explaining why their transaction was declined and how they should proceed when a decline occurs.

Common CCBill decline codes and reasons include:

- BE-102 Pickup Card

- BE-103 Do Not Honor

- BE-116 Service Not Allowed

- BE-146 Blocked Country (CCBill)

- BE-132 Card Blocked (CCBill)

- BE-112 No Account

- BE-900-999 System error, authorization not successful

- BE-113 Insufficient Funds

- BE-114 Expired card

- BE-119 Activity Limit Exceeded

- BE-107 Invalid Credit card

- BE-105 Invalid Transaction

- BE-130 Invalid Field Provided

- BE-101 Invalid MID/TID

Merchants with a CCBill account can use the Admin Portal to check declined transactions and the reasons for the decline.

Decline Reasons Report

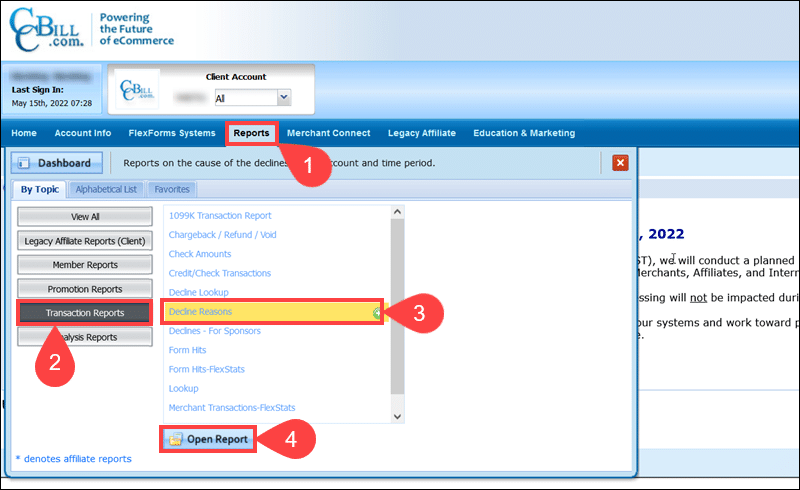

The Decline Reasons report in the CCBill Admin provides details about every unsuccessful transaction registered on a CCBill merchant account.

To access the Decline Reasons report in the CCBill Admin:

1. Expand the Reports tab.

2. Click Transaction Reports.

3. Select Decline Reasons.

4. Click Open Report.

5. Set the Start and End Date to define the report date range.

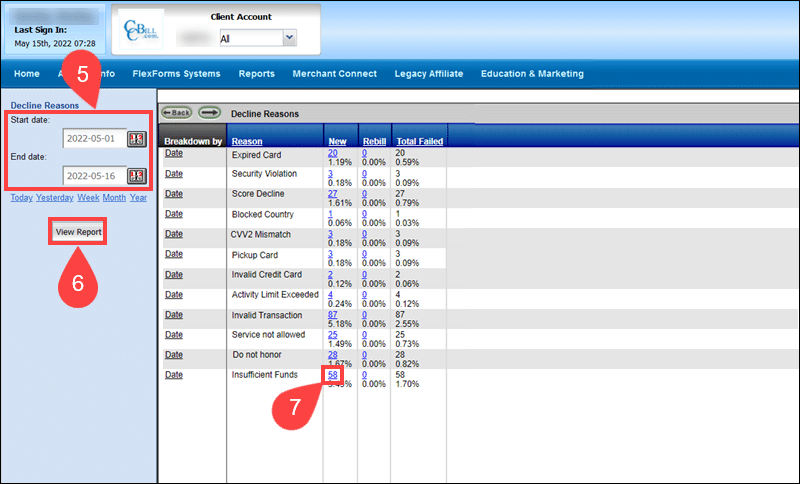

6. Click View Report. The list of declines is categorized by decline reason.

7. To see individual declines for the selected reason, click the decline count number under the New or Rebill column.

The report allows merchants to review individual declines and obtain the following information:

- Decline ID - Unique decline identifier.

- Subscription ID - The unique subscription number.

- Date - The decline timestamp.

- First Name - The customer’s first name.

- Last Name - The customer’s last name.

- Email - The customer’s email address.

- Amount - The amount or value of the subscription in U.S. dollars.

- Decline Reason - The cause of the decline and associated decline code.

- Account - The merchant account and subaccount number.

- IP Address - The IP address the customer used to initiate the transaction.

The Decline Reasons report gives merchants a high-level overview of decline statistics registered on their accounts. Merchants can use these statistics to outline fraud prevention policies or when expanding business activities in new countries or regions.

Note: Learn more about payment fraud.

How to Deal with Credit Card Declined Codes?

Losing a customer that expressed intent to make a purchase and provided their payment information is bad for business. A declined transaction can prompt the customer to abandon the purchase altogether.

Merchants need solutions that help them react immediately, mitigate the customer’s concerns, and, if possible, present the customer with a quick fix.

Customer Support

When a transaction does not go through, the customer’s first instinct is to seek assistance. Depending on the decline reason, they may contact their bank, payment processor, or the merchant.

Having a professional and dedicated service that can support customers 24/7 is essential for dealing with declined payments. The response needs to be immediate, and employees must provide customers with clear and practical advice.

Most merchants cannot afford to maintain the staff and infrastructure necessary for this type of service. When choosing a payment processor, make sure that it offers customer support services as part of the pricing plan.

Keep Track of Decline Reasons

Analyzing decline statistics and identifying patterns may be key to systematically reducing the number of declined payments. The reports provided by your payment service provider are invaluable and can show that it may be necessary to:

- Change the configuration settings for your merchant account.

- Add additional payment methods.

- Streamline the payment flow.

- Use multiple payment processors and create payment form cascades.

- Redesign existing and create new secure payment forms.

Ensure that you have a good working relationship with the payment service provider. A responsive payment processor is invaluable when introducing new features and troubleshooting technical issues.

Automation

Reaching out to customers immediately after a decline is essential for reducing abandonment rates. Implementing automated tools and solutions allows merchants to cut reaction times and overhead costs.

CCBill uses Webhooks to notify the merchant’s system whenever a transaction event occurs. Webhooks deliver structured data that allows merchants to develop and introduce custom solutions and features.

Unsuccessful transactions trigger Webhooks and transmit the transaction data and the relevant decline code and message. Merchant can use these messages to set up automated and personalized emails and provide customers with detailed instructions on how to proceed.

Conclusion

Declined transactions are an inevitable part of doing business and selling products online. Merchants who understand how declines work and what decline codes mean are in a great position to assist customers and help them complete their payments.

Use this comprehensive list to reduce the number of declined payments on your website.