Merchants who sell products to customers in other countries should display prices in the customer’s local currency whenever possible. The last thing shoppers want to do during checkout is calculate exchange rates.

Multi-currency solutions enable merchants to create price points in different currencies. Because exchange rates fluctuate daily, merchants must also monitor and adjust prices to compensate for changes in currency values.

Learn how multi-currency payment processing works, why it is an essential feature for online payment processing, and what to look for when choosing a multi-currency solution.

What Is Multi-Currency Payment Processing?

Multi-currency payment processing is a feature that allows merchants to price products and services in the customer’s local currency. Once the customer pays, the funds are converted to the merchant’s domestic currency and deposited in their account.

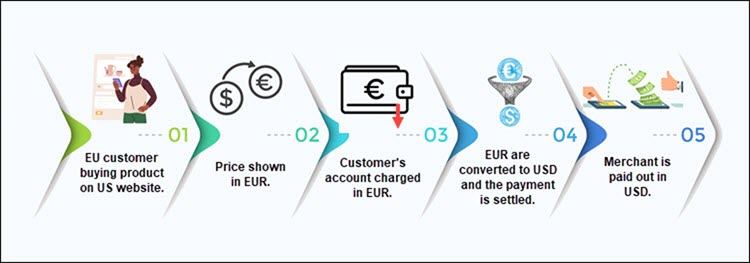

In this example, a US-based merchant is selling a product to a customer in the EU:

- An EU customer visits the US merchant’s website.

- If the merchant has a multi-currency solution, the feature recognizes the customer’s IP address and displays the price in euros (EUR) instead of dollars (USD).

- The customer pays, and their account is charged for the EUR amount.

- The funds are converted from EUR to the merchant’s currency (USD), and the payment is settled.

- The merchant is paid out in their local currency (USD).

The currency conversions and exchange rate calculations are facilitated by acquiring banks, issuing banks and payment processors.

Why Do You Need Multi-Currency Payment Processing?

If customers have misgivings about the payment process, they are much less likely to go through with the purchase.

Without multi-currency processing, customers from other countries are not sure what conversion rate is applied and how much they will ultimately be charged. Inconsistencies between the displayed price and the amount the customer pays can increase cart abandonment rates, chargebacks, and refunds.

Multi-currency processing helps merchants engage international customers transparently and on fair terms. It is an essential tool for setting up a frictionless payment flow for cross-border sales.

Foreign Payments Challenges

Selling products and services on a global market is very lucrative, but not without its challenges. Some of the biggest hurdles merchants need to overcome include:

- Cultural differences. Conducting marketing campaigns in multiple countries is expensive. In addition, running the same advertisements in different cultural settings may fail or even backfire.

- Legal restrictions. Payment processing and data protection regulations differ from country to country. Smaller and mid-sized merchants may need to invest lots of resources and time to meet PCI compliance requirements and privacy and data protection laws such as GDPR and PSD2.

- Currency conversions. Conversion rates change daily. Keeping track and manually adjusting prices to compensate for these changes is not efficient. Merchants must use automated solutions that continuously adjust prices using favorable exchange rates.

- Language barrier. Websites and payment forms should be served in multiple languages, which increases development costs. Additionally, merchants may need to invest in a dedicated customer service that handles customer requests and complaints in various languages.

- Shipping costs. High transportation costs may render sales in certain regions unprofitable. Investing in a third-party shipping solution may significantly reduce delivery costs and open new markets.

- Technical solutions. Merchants may need to buy or develop new technical solutions to streamline the administrative and logistical requirements of cross-border sales. This increases operational costs and may require substantial upfront investments.

Multi-Currency Payment Processing Benefits

Multi-currency payment processing is far superior to charging customers in a single currency. The advantages include:

- Transparency. Customers always know the exact amount they are going to be charged, which results in higher conversions and fewer payment abandonments.

- Automation. A multi-currency solution adjusts prices to match currency fluctuations in real-time. This helps merchants avoid potential losses dues to volatile currency markets, eliminate pricing ambiguity, and mitigate possible human errors.

- Customization. Merchants can manually modify prices in foreign currencies or set custom exchange rates. This way, exchange rates work in the merchant’s favor and result in higher profits from cross-border sales.

- Instant Global Reach. Merchants reach multiple markets simultaneously without investing heavily in software development, checkout forms, and payment flow design.

- Better Customer Experience. Multi-currency processing streamlines the payment processes by displaying prices and payment forms in the customer’s local currency and language.

Choosing a Multi-Currency Payment Processing Provider

A payment service provider (PSP) helps merchants simplify cross-border sales, reduces the associated costs, and facilitates increased revenue from international sales. When selecting a multi-currency payment processor, merchants need to prioritize the following:

- Settlement Currency. Select a Payment Service Provider (PSP) that pays out earnings in your local currency. Multiple currency conversions should be avoided as they can result in reduced revenue.

- Form Design. An automated solution displays the payment form in the language and currency determined by the customer’s IP. However, they may not be the language or currency the customer wants. Good form design permits the user to manually change the currency and language.

- Partner Program. The best way to understand what international customers want is to partner with other merchants from that country or region. Use a PSP with an extensive global network of merchants. They can help you form partnerships with other established merchants and affiliates.

- Multiple Payment Options. Customers do not only want prices in their currency, but they also want to pay using their preferred payment method. Make sure the PSP accepts all major card brands and payment options specific to your target markets, like SEPA or ACH.

- Exchange Rate Customization. The exchange rates and prices should adjust automatically without merchant input. However, merchants should ensure that the multi-currency processing provider has an option to manually adjust and customize exchange rates and prices for individual markets.

CCBill Payment Processing Services

CCBill’s multi-currency processing solution allows merchants to price goods and charge customers in international currencies while receiving deposits in USD. But it is only part of the equation, as CCBill offers payment processing features designed to give merchants a complete toolset to maximize earnings from cross-border sales.

Regional Pricing uses the customer’s IP address to determine their country or region and present a price point in the local currency. Customers can pay in USD, GBP, EUR, JPY, AUD, and CAD.

The regional pricing feature lets merchants set custom ratios and pricing schemes for different currencies. Merchants can utilize Regional Pricing to protect their business from volatile currency markets and draw in additional revenue.

The Merchant Connect platform allows CCBill merchants to refer customers to each other regardless of location. Partnerships with merchants in other countries reduce marketing costs and help merchants expand their customer base in new foreign markets.

The platform supports one-click cross-sells and upsells between merchant accounts. This means repeat customers can pay on different websites without re-entering their payment information.

FlexForms

CCBill’s FlexForms use GeoIP to recognize the customer’s location, language, and device. A single payment form includes all payment options, such as credit cards, debit cards, SEPA, ACH, online checks, and direct bank transfers.

The form always uses the customer’s local language to display the payment options and currencies relevant to the customer’s region. But FlexForms also allow customers to manually select a different payment option, language, or currency if it suits them.

Legacy Affiliate System

Merchants can use CCBill’s Legacy Affiliate System to create a program that enables affiliates to refer customers to the merchant’s website.

Affiliates have a good understanding of local markets and can run effective and inexpensive ads on the merchant’s behalf. An affiliate program is ideal for launching low-cost marketing campaigns in multiple countries simultaneously.

Based on the merchant’s program settings, CCBill uses a PPS (Pay Per Sale) or a Shared Revenue system to calculate and send a percentage of referred earnings to affiliates.

Conclusion

You know how multi-currency processing works and the challenges of accepting payments in different currencies.

The goal is to set up a fair pricing system that protects your business and encourages customers to spend freely on your website. Using the services of an established PSP is an excellent and cost-effective way to implement multi-currency payment processing.