Whenever a consumer notices an unknown charge on their credit card statement, they will call their bank to ask questions, kickstarting a process known as a retrieval request.

This article will explain everything a merchant should know about retrieval requests and how to handle them.

What Is a Retrieval Request?

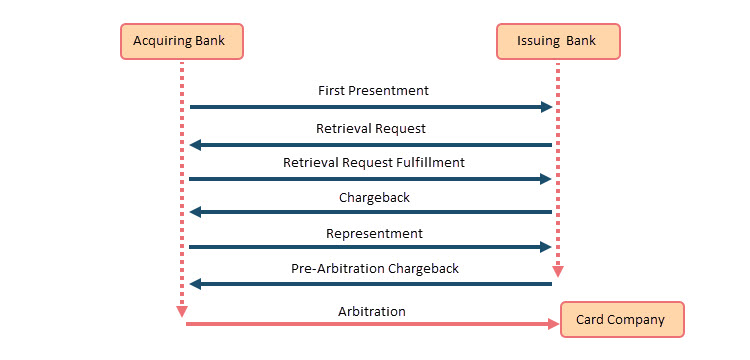

A retrieval request is initiated by a cardholder who is looking for additional information about a charge. The issuing bank (the cardholder’s bank) then forward the request to the acquiring bank (the merchant’s bank). Retrieval requests are also commonly referred to as an inquiry, a request for information, or a soft chargeback.

Retrieval requests are called soft chargebacks because if the merchant and their bank don’t respond quickly or adequately to the request for information, the issuing bank usually follows through with a chargeback request. The deadline for providing the required documentation to the acquiring bank is usually ten days.

Commonly, the issuing and acquiring banks attempt to resolve the retrieval request independently. They forward the inquiry to the merchant only if they do not possess the information needed for the request. Information only merchants might have includes a copy of the sales ticket or online order, the transaction authorization, sales receipts and invoices, tracking numbers, and shipment records.

Note: Learn about the differences between a bill and an invoice.

Retrieval Request vs. Chargeback

A retrieval request is not the same as a chargeback. However, retrieval requests are usually a sign that a chargeback is soon to come, hence the name “soft chargeback.” The only way to for a merchant to prevent a chargeback is to provide sufficient information in their response to a retrieval request.

If the issuing bank and cardholder aren’t satisfied with the information presented, the retrieval request escalates to a chargeback.

Note: Merchants can dispute chargebacks in a process called representment.

Retrieval Request Reasons

Retrieval requests often start due to problems outside of the merchant’s control.

Here are the seven most common retrieval request reasons:

- The cardholder doesn’t remember making a purchase.

- The goods didn’t arrive or were damaged during shipping.

- The cardholder thinks somebody stole their payment data and made an unauthorized purchase.

- The banks, card companies, or payment processors made a payment processing error.

- The cardholder is attempting friendly fraud.

- There was incomplete or inaccurate transaction information, or the amount on the monthly statement didn’t match the agreed-upon transaction amount.

- An unclear billing descriptor confuses the cardholder. For example, the credit card statement refers to a holding company instead of the merchant’s name.

Note: Card companies such as Visa, Mastercard, or American Express regulate retrieval requests. They also mediate in any conflicts between the issuing and acquiring banks during the chargeback process, culminating in arbitration.

Retrieval Request Fees

The acquiring bank charges merchants a one-time fee each time an issuing bank requests a copy of the sales draft to prove a charge. The fee covers the costs associated with the retrieval process and is not the same as a chargeback fee.

Note: The retrieval request fee is usually minimal, although costs vary. Merchants should check the fees before entering into contract with a bank.

Incurring an unnecessary cost, no matter how small, is never good. A large number of retrieval requests can put a sizable dent in the bottom line, so merchants should prioritize solving persistent issues causing retrieval requests. This article will explain everything a merchant should know about retrieval requests and how to handle them.

Note: Visa mandates keeping copies of sales drafts for a minimum of three years. A digital point-of-sale system can make electronic tracking and storing data much more efficient.

Are Retrieval Requests Going Obsolete?

In recent years, credit card companies have begun to phase out the formalized retrieval request process in favor of automated systems for acquiring and distributing information. These systems aim to be safer, faster, and more accurate than their human counterparts. However, banks often have procedures outside the card companies’ legislative authority, as they are the “first responders” to chargebacks.

Even if the retrieval request process changes or becomes obsolete, information requests, in general, will always remain a crucial part of payment disputes. Merchants should always be ready to produce information that might save them the time and money involved in chargeback procedures.

Conclusion

Responding to retrieval requests quickly, accurately, and thoroughly can prevent a chargeback from happening and protect the merchant’s reputation with customers, banks, and credit companies.

To respond to retrieval requests quickly, a merchant needs to implement efficient accounting and reporting practices for documenting and archiving essential details that might make or break a case down the line.

Merchants should also partner with a reliable payment processor who can provide systems for storing customer data.