Subscription-based businesses use different subscription pricing models to charge their customers.

Some business owners rely only on their instincts or revenue goals when setting subscription prices. Others calculate a price that covers production costs and brings some profits. There are also subscription businesses that analyze competitors’ subscription prices and offer lower ones.

None of these are accurate subscription pricing strategies. All of them miss out on chances to increase recurring revenue and ensure higher profits.

In this article, we’ll discuss the main pros and cons of the leading subscription models models and provide examples.

Types of Subscription Pricing

Whether you are starting a subscription business or looking to expand, knowing which subscription pricing models exist helps better understand the industry.

The following four subscription pricing models are commonly used by subscription-based businesses.

CCBill has been processing subscription payments for more than 20 years. Contact us to see how we can kick start your subscription business.

Fixed or Flat-Rate Pricing Model

In a fixed or flat-rate pricing model, the subscription principle is straightforward: there’s one product with a single set of features and a set monthly subscription price.

If a merchant adds more features, the price goes up.

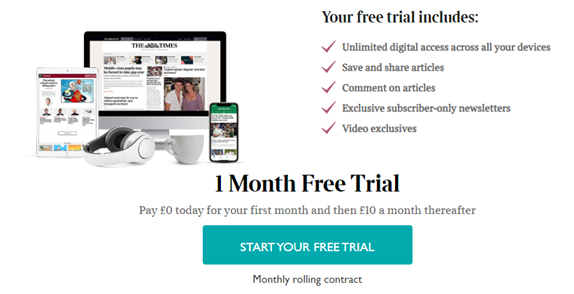

The Times is an example of a business that uses the flat-rate pricing model. After a trial period, readers pay a fixed rate of $10 a month.

Advantages

-

Simple pricing. In a flat-rate pricing model, it’s simple for merchants to set one price for a single product. Customers easily understand what they pay for: a certain number of services or features in one package.

-

Easy revenue prediction. Merchants multiply the number of users by the subscription rate and calculate the expected recurring revenue. There are no pricing variations in this model.

- Sharp sales focus. Merchants using the fixed-rate model can smoothly communicate its features to users and focus solely on increasing sales.

Disadvantages

-

Narrow market share. With a single subscription price, merchants target only one portion of the market. If a business offers a single, high-priced subscription, they may lose business from customers who would like a smaller package of products or services for less money. By offering multiple price options, a business could attract more revenue from a larger number of lower-paying subscribers than they would from a handful of big players.

-

Limited choices for customers. Demanding customers that like having control over services they use won’t go for the flat-rate plan. Customers who want more options will go to another merchant.

-

No upgrading. There’s no upgrade option for merchants in this model and, consequently, no upselling.

Pay-As-You-Go or Usage-Based Pricing Model

In a usage-based pricing model, also known as pay-as-you-go, the bill equals the number or volume of used services. The more options customers use, the more they pay, or vice versa.

This subscription pricing model is commonly used by companies operating in telecommunications, cloud infrastructure, and payments. The more minutes, gigabytes, or transactions customers consume the higher the recurring revenue.

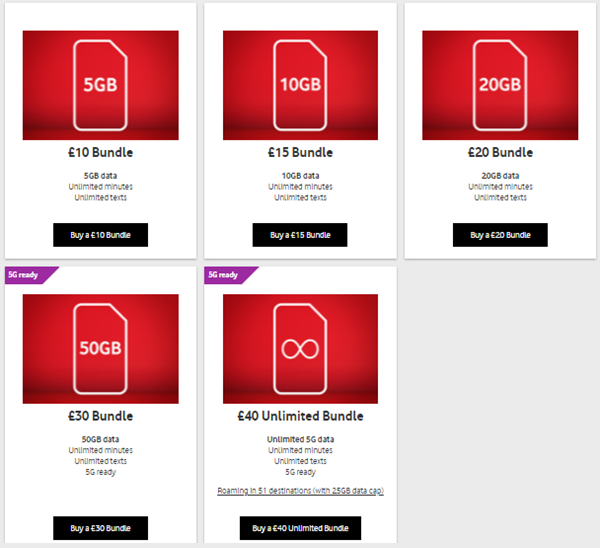

For example, Vodafone has special pay-as-you-go bundles for data packages:

Advantages

- Practical scalability. Customers choose how many services to use and pay for. They don’t waste money on unnecessary features.

- No long-term obligations. When merchants offer pay-as-you-go subscriptions, users don’t sign long-term contracts. Merchants benefit from the increased number of users, and customers avoid committing to long-lasting subscription costs.

- Protection from heavy users. Usage-based subscription pricing protects merchants from customers who could occupy their resources with high consumption in a flat-rate model.

Disadvantages

-

Uncertain revenue. The critical drawback of the usage-based pricing model for subscription businesses is not knowing how much recurring revenue they can expect. Still, they can analyze statistical data for previous periods to see when customers spend more to project potential expected revenue.

- Harder to understand. Customers, especially new ones, might not understand what exact features they are paying for. Merchants need to clearly explain their offers to avoid confusion and potential misunderstandings.

Tiered Pricing Model

The tiered pricing model is a widely popular subscription billing option among SaaS businesses. Merchants using this model package products and services into several tiers adapted for different groups of customers. Each tier offers certain features at a set price.

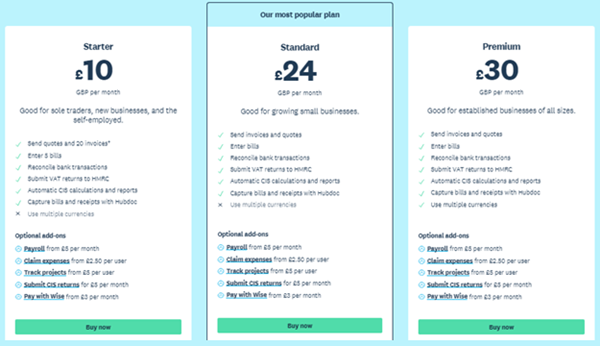

For instance, Xero offers the following three tiers:

They highlight the most popular tier, which immediately draws users’ attention.

Advantages

- Targeting multiple users. Merchants using tiered pricing attract different groups of potential subscribers, ensuring higher revenue.

- Smooth upselling. When a tier doesn’t meet users’ needs anymore, they switch to a higher tier. Merchants increase revenue as existing customers move to more expensive tiers. They spend less money on acquiring new customers as well.

- Projecting expected revenue. Multiply the number of subscribers within each tier by its relevant price, and you’ll calculate the expected recurring revenue for both annual and monthly subscriptions.

Disadvantages

-

Time-consuming process. It takes time for merchants to group features and services into different tiers. Prices usually need additional tweaks.

-

Heavy users without boundaries. If customers in the highest tier exceed their usage, merchants have no leverage to limit their services.

-

Potentially complicated. Offering too many tiers confuses customers. Offering too many features within a single tier can also be unclear to customers.

Note: Merchants should limit the number of tiers in the tiered pricing model to a maximum of five. Offering too many tiers confuse customers.

Per-User or Per-Unit Pricing Model

In the per-user pricing model merchants charge customers per number of users they include in the subscription.

Let’s say that a merchant charges $5 per user, per month. An organization that adds ten users to the subscription needs to pay $50 per month for all these users.

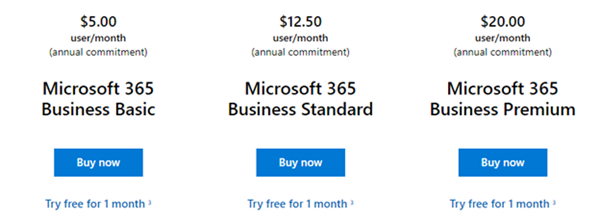

Office 365 offers a per-user pricing model with three different tiers.

Advantages

- Predictable recurring revenue. Revenue is directly related to the number of users. Every account used by a company is charged separately. Based on that data, merchants can predict long-term revenue.

- Simple use. Merchants can easily calculate a subscription price and communicate it to the customer. The more customers a merchant attracts, the higher the revenue. Users easily calculate subscription costs, as well.

Disadvantages

-

Curbed adoption. Employees within the same team or organization can share the login credentials meant for one user. Instead of acquiring new users, merchants face limited adoption.

-

Neglected product value. The per-user subscription model doesn’t take product value into account. Merchants using this option rely on the number of users without capitalizing on the quality of products or services.

-

Potential cancelations. When a customer adds more users, their subscription price increases. Organizations with fast-growing teams often cancel subscription and opt for other subscription pricing models.

Note: Learn everything you need to know about the most common subscription cancellation reasons and how to prevent them.

How to Choose the Right Subscription Pricing Model

Each of the four subscription pricing models above are profitable in some cases and inappropriate in others. Merchants need to take the following steps to get closer to the suitable pricing model for their needs:

- Conduct market research to see how many segments of your potential subscribers there are. Ask potential customers whether they prefer signing long-term contracts or subscribing without such commitments.

- Find out whether your customers prefer annual or monthly subscriptions. The more you learn about customers in each of these segments, the more accurate prices will be.

- Consider how much you need to pay for production costs and operating costs (overhead expenses, salaries and benefits, taxes, and fees) to provide customers with services.

- Divide the total amount of business costs by the number of customers. That figure is the minimum price you need to charge per subscriber to make ends meet. It's a valuable starting point for further subscription calculations.

- Check out how much competitors charge for similar services as a reference point.

After taking the steps above, if a subscription business learns that their customers prefer simplicity, they should go with the fixed-rate model.

The usage-based pricing model is good for businesses dealing with customers that don’t prefer long-term commitments. Customers pay for the number of services used and there are no other obligations.

Organizations that have several segments of subscribers should use the tiered pricing model. They’ll cover a more comprehensive share of the market and increase recurring revenue.

The per-user pricing model suits merchants who aim to offer services to enterprises. Once they acquire such a large client, it opens the door for a high adoption level within that organization.

Conclusion

Choosing a subscription pricing model is important for merchants who want to keep acquiring new customers and ensure steady business growth in the long run.

The information about subscription pricing models and their specific features above will help merchants choose the most appropriate model and accurately predict their recurring revenue.