Introduction

Organizations and individuals participating in online transactions are equally exposed to potential security threats. From unauthorized access to data and financial asset theft, hackers cause substantial damage to businesses and individual users.

Two-factor authentication is one of the most effective methods for establishing a secure payment system. At the same time, 2FA is user-friendly enough for different payment types.

In this article, we’re going to discuss the key features of two-factor authentication in terms of credit card payments.

Two-Factor Authentication and Payments

Making offline payments with credit cards includes some form of two-factor authentication too. When clients want to pay for a product or a service using a credit card, they need to enter a unique PIN to verify their identity.

Since the chip inside the card is the first factor of two-factor authentication (something you possess), the PIN is the second authentication element (something you know).

When a user enters a PIN during payment, the system verifies that the user and the PIN match, allowing the requested transaction.

NFC Payments

For bank card NFC payments (near-field communication), entering a PIN is not required up to a certain amount. For Google Pay and Apple Pay e-wallet payments, you can pay higher amounts without providing a PIN.

Online Payments

In the online environment, protecting users’ accounts on payment gateways only with a username and a password is not secure enough. One-factor authentication is like a call to action for hackers since they can access such accounts more easily.

That’s why different payment organizations opt for two-factor identification for online credit card transactions.

Note: If you are setting up payment processing for your business, read more on how online payment processing works.

Key Credit Card Payment Details

Every credit card has several elements that protect its user's identity and keep them safe from unauthorized use and material damage.

- Digits in credit card numbers - The credit card number consists of sixteen digits, representing the bank or organization that has issued it – the first six digits on Visa and MasterCard credit cards. The remaining nine digits represent the cardholder’s account number.

- CVV-numbers on credit cards - Contemporary credit cards come with additional security features, such as the CVC number, an important additional security feature for online payments.

- Expiration date - The date until which the credit card is valid.

If a malicious attacker gets in possession of a credit card number, it’s easier for them to misuse a credit card guarded only by a username/password combination. They don’t even need the credit card in question, but only the numbers on it. Once they hack the password, they’re in.

Therefore, payment gateways and other business organizations opt for the second authentication factor.

Note: CVC/CVV is an additional number used on a credit card as a security element for payments which don't necessarily require a PIN.

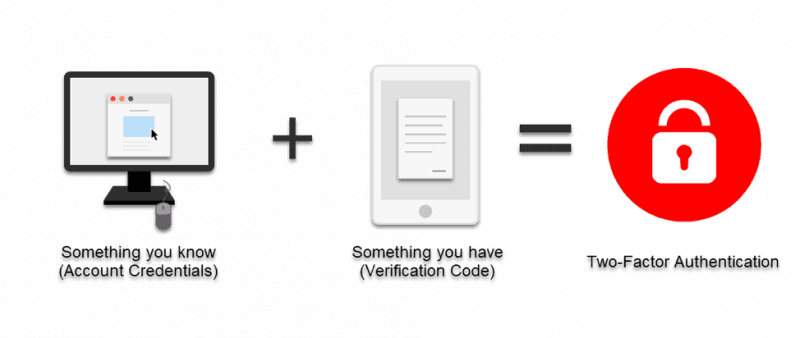

Key Authentication Factors

The five most common factors in two-factor authentication payments are as follows:

- A thing you possess. A software or hardware token, a key, a card, or a mobile phone are all possession factors.

- A thing you know. A password or a PIN is a piece of information you know.

- A biometric element. Fingerprints, facial scans, and iris recognition (retina scan) are biometric factors often used in two-factor authentication.

- Time-sensitive tokens. System generated tokens that expire.

- GPS location. Logging in is available only to a limited range of GPS or IP addresses.

Depending on the desired level of prevention or available technological options, organizations combine two or more elements to ensure security.

Benefits of Two-Factor Authentication

Multi-factor authentication ensures that only authorized cardholders make payments. By implementing two or more authentication features, payment systems increase their users’ security.

Two-factor authentication is also becoming the de facto standard for all online services that store any personal or business information. Benefits include:

- Data security. Keeps online data secure from theft and misuse.

- Fraud protection. Reduces the risk of unauthorized access and financial scams.

- Consumer trust. Consumers expect at least two factors in all online services they use.

- Lower security costs. Two-factor authentication prevents potential security costs caused by malicious attacks.

- Mobility. Improves mobility options for financial data and assets, protected by two or more authentication factors.

The Future of Credit Card Authentication

Today, payment companies and credit card issuers use at least two factors of authentication.

As technology moves fast, more and more organizations rely on biometric elements to ensure a higher level of identity protection for their clients.

Credit cards with fingerprints as authentication elements are already in use. This combination is user-friendly and provides enhanced security.

Integrated ID chips as authentication factors for credit card payments are something that we can expect in the years to come in terms of improved security. These microchips will be implanted under people’s skin and used for identification, payments, and authentication.

Many payment companies implement strong customer authentication (SCA) in their protection policies as a set of combined software and biometric elements. Additional authentication factors improve users’ online security and reduce the risk of hacker attacks.

Conclusion

As tech improvements are quickly developing, new protective measures in online payment processing, such as two-factor authentication, push the envelope in terms of online security.

Thanks to security features such as 2FA, credit card payments are becoming more secure, ensuring a high level of protection for the users of payment services.