Introduction

The growth and health of an ecommerce business depend on a steady cash flow and the timely settling and processing of payments. This is why it is essential to urge customers to pay their pending invoices sooner rather than later.

In this article, learn about outstanding invoices and how to encourage customers to pay them.

Note: The lines are blurred between invoices and bills. To learn the difference between these similar documents, see our article on Bill vs. Invoice.

What Is an Outstanding Invoice?

An outstanding invoice is an invoice that was sent to the customer and has yet to be paid. Once the payment deadline passes, an outstanding invoice becomes a past-due invoice. The payment deadline should be listed clearly on the invoice to avoid confusion and to help merchants keep track of pending payments.

Note: Customers’ payments rely heavily on the payment gateway you choose for your business. Learn more about it in our article How to Choose a Payment Gateway for Your Ecommerce Store.

How to Get Clients to Pay Outstanding Invoices?

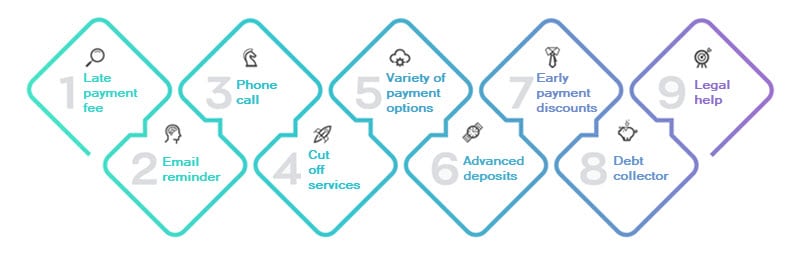

According to research, small businesses in the US spend around 15 days a year chasing late payments. Here are 9 tips on how to get customers to pay their outstanding invoices:

1. Set a Late Payment Fee

Include a late payment fee in the invoice you send to clients. Clearly state the terms of the payment arrangement to ensure the client knows what to expect if they do not pay their invoice on time. As a sign of good faith, you can offer to waive this fee if the client pays their invoice right away.

2. Send an Email Reminder

As the deadline for the invoice payment approaches, send the client an email reminder about their outstanding debts. Make this email friendly but straight to the point. Include information about the deadline and the amount they need to pay and attach a copy of the invoice you are referring to.

3. Make the Uncomfortable Phone Call

If the client is not responding to your emails, you should get more assertive and call them directly to resolve the issue. Once you get them on the phone, state clearly that the invoice needs to be fully paid by the agreed-upon deadline. Do not hang up until they confirm they will make the payment.

4. Cut Them Off Until They Pay the Invoice

If a client has stopped paying their invoices, stop supplying them and fulfilling their orders. If you do not do this, your ecommerce business will potentially suffer huge losses. Communicate to the client professionally but firmly that you will stop providing them with goods and services until they have settled all their outstanding or past-due invoices.

5. Provide a Variety of Payment Options

Clients are more likely to pay an invoice ahead of time if you offer their preferred payment method. From credit cards and direct deposits to mobile wallets and ACH payments, make sure to offer clients more flexibility.

Note: Learn more about alternative payment methods for your customers in our article Introduction to Alternative Payment Methods: Reaching a Global Audience.

6. Ask for Advanced Deposits

When working on a several-month-long project for a client or in the case of expensive goods, consider asking for a partial payment in advance. This type of request is quite common and serves to protect you from the risk of not getting paid.

7. Offer Early Payment Discounts

Consider rewarding your clients with a discount if they pay their invoice before the deadline. A symbolic amount of as little as 2% will encourage them to pay you sooner rather than later.

8. Hire a Debt Collector

If chasing outstanding invoices becomes difficult, you can hire a debt collector firm to do the job for you. Debt collectors are professionals who will communicate with your clients about their overdue invoices, saving you time and stress.

9. Seek Legal Help

If none of this helps, consider hiring a lawyer. Keep in mind that this can be costly and time-consuming, so make sure that the invoice in question is worth more than the cost of legal services.

What if an Outstanding Invoice Stays Unpaid?

If none of the previous steps bears fruit and the invoice is left unpaid, you should write it off as a bad debt expense. By doing so, you can claim back the tax you paid for it. This will prevent the unpaid invoice from showing up on your accounts as lost income.

Note: Every successful business keeps a watchful eye on its earnings and expenses. Learn more about this crucial practice in our article What Is Payment Reconciliation?

Conclusion

Occasionally, merchants need to remind their customers to pay their outstanding invoices. While an outstanding invoice is not yet a loss (since the payment deadline has not yet passed), it has the potential to turn into an unpaid invoice, which will reflect badly on your business. Use our tips to maintain a steady revenue stream and minimize the chances of your clients not paying their invoices on time.