Introduction

Returns are inevitable in any ecommerce business, and merchants will regularly encounter customers who want to return purchased items for a variety of valid reasons. However, some people resort to return fraud to deceive merchants for their own gain.

In this article, learn about return fraud, how to recognize it, and how to prevent its negative impact on your business and profits.

What Is Return Fraud?

Return fraud happens when a customer returns an item and requests a refund in violation of the merchant’s return policy.

Examples of return fraud include returning items purchased from another merchant online or in-store, returning used or stolen items, or forging receipts to make a return. Return fraud is a type of friendly fraud, since it is committed by a legitimate cardholder who purchases the items rather than a third party.

Return fraud is difficult to detect since there is no guaranteed way of establishing if the customer’s reasons for a return are valid or not. Ultimately, merchants will frequently proceed with a refund to avoid alienating customers and prevent a chargeback.

Note: Frequent refunds can be frustrating but inevitable and a vital element of the customer experience. Learn more about how to handle refunds in our article How to Respond to a Refund Request?

What Is the Cost of Return Fraud?

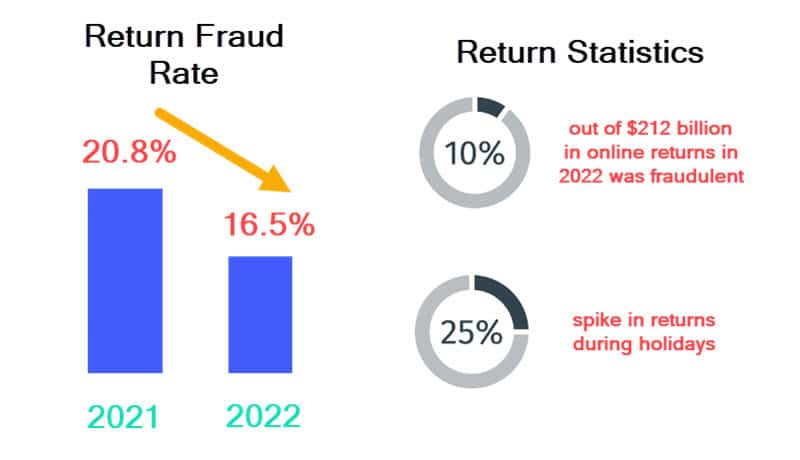

According to the National Retail Federation (NRF), for every $100 in returned items, merchants lose $10.40 to return fraud.

Online return rates have decreased from 20.8% in 2021 to 16.5% in 2022 thanks to a proactive response by merchants who understand the need to clearly display their return policies. In 2022, out of $212 billion in online returns, only 10% was estimated to be fraudulent.

Return rates typically increase by 25% during the holidays. This is the time when merchants should be particularly vigilant and monitor their returns.

Types of Return Fraud

Here is a list of the most common return fraud tactics used by customers.

- Receipt fraud. Customers make returns using fake digital or paper receipts, or receipts that do not belong to them.

- Returning stolen items. Customers return stolen items to get cash or store credit.

- Wardrobing. Customers return the items they bought and used (e.g., a book they read or dress they wore).

- Bricking. Customers purposely strip the item of some of its components and claim it is damaged or malfunctioning to get a refund and resell the components.

- Employee fraud. Some employees purposely enable customers to commit return fraud by giving them a full refund despite them not being eligible for it.

- Price switching. A customer purchases a cheaper item, puts a more expensive price tag on it, and returns it to get receive more money than they spent.

- Switch fraud. The fraudster buys a new item and then requests a refund for a malfunctioning or defective identical item they purchased earlier.

- Price arbitrage. A customer buys a higher quality product that is similar to the one they already own. They then use the receipt to return the lower-quality version and profit from their price difference.

- Cross-retail returns. A customer buys an item at one store and returns it to another store that sells the same item for a higher price to profit from the price difference.

- Open box fraud. Many stores offer an open box policy that allows customers to buy open or returned items at a lower price. Customers take advantage of this by buying a product at full price, returning it opened, and then buying it again through the open box policy.

- Empty box fraud. Customers falsely claim they received an empty box and request a refund despite receiving the items.

How to Prevent Return Fraud

Return fraud prevention relies on implementing these measures.

1. Display a Clear and Detailed Return Policy

Merchants should provide a detailed return policy on their ecommerce websites to avoid any confusion regarding returns. A good return policy is written in simple language and includes the following information:

- State of returned item. Merchants must list the condition the item must be in for a return request to be valid. This includes the items being unopened, with tags, seals, and serial numbers visible, as well as a digital or paper receipt attached.

- Time frames. Merchants need to set a time frame for returning the items, which can be anything from 30 days to several months or years, depending on the item.

- Return shipping. Merchants must explain how returns work for purchases made through card-not-present (CNP) transactions. This includes how to package them, which delivery service to contact, etc.

- Fees. Merchants should clearly state what additional charges the customer can expect, and the reason behind them (restocking fee, return shipping fee, etc.).

- Exceptions and special circumstances. Merchants should let the customers know if some items are excluded from the return policy, or if the standard return policy does not apply. An example of this is having a longer return window for international returns.

2. Make the Return Policy Easy to Find

Customers are on average very interested in a business’s return policy and want to read it. Merchants need to make sure it is accessible and prominently displayed in various locations across the website. It is a good idea to have the terms and conditions for returns on product pages, the checkout, invoices and receipts, order confirmation emails, and even packaging.

If a particular product is subject to different terms and conditions (e.g., it is non-returnable), then this must be made clear to customers on the product page and checkout.

3. Be (Reasonably) Flexible

Often customers have legitimate reasons for making a return despite missing a deadline or not fulfilling a return requirement. Merchants should fine-tune their return policies so that a certain amount of flexibility remains. This will prevent them from alienating their customers, reduce the likelihood of a chargeback, and positively impact the overall customer experience.

4. Eliminate Cash Refunds

Getting into some cash is one of the main reasons customers commit return fraud. Merchants who get rid of cash refunds and instead offer only store credit or reward points will deter fraudsters hoping for a windfall.

5. Keep Meticulous Return Records

Detailed record-keeping helps businesses keep an eye on return rates and detect return fraud attempts. They should scan the information such as the date and location of the return, the number of returns from the same customer, employees who processed the returns, etc.

6. Train Employees to Detect Fraud

Merchants should train their employees to spot and prevent return fraud attempts. Additionally, analysis of customer feedback regarding items customers are returning often shows the validity of the return request.

7. Require Identification for Returns

Aside from the receipt, merchants should require some sort of identification from the customer when processing a refund. This can be anything from their ID to the information listed on their online shopping profile, the payment method they used, or the last 4 digits on their payment card.

Doubling down on customer identification will also help reduce other forms of payment fraud including identity fraud, and especially its most insidious form – synthetic identity theft.

Conclusion

Some customers will try to work around the system and profit off merchants by performing return fraud. Although these attempts can be challenging to detect, there are many proactive measures merchants can take to protect themselves. These include implementing clear and detailed return policies, keeping thorough records of all returns, and being flexible when necessary to preserve customer relationships.