When a merchant doesn’t approve a refund, the customer requests a chargeback. However, customers often skip the refund stage and immediately request a chargeback, a potentially detrimental option for merchants.

This article takes an in-depth look into chargebacks, explain how they work, and discuss various chargeback situations and potential solutions for merchants.

What Is a Chargeback?

A chargeback is an official complaint a customer submits against a merchant to their card-issuing bank, requesting that a particular transaction is reversed.

Unlike refunds, which are resolved between the merchant and the customer, chargebacks involve the customer, the merchant, and the issuing bank.

Note: The issuing bank issued the cardholder's payment card used in the transaction.

Merchants receiving too many chargebacks face difficulties ensuring proper payment processing and a host of other issues which can seriously hurt their business.

Types of Chargebacks

The main types of chargebacks are:

- Merchant error. A merchant error is a chargeback resulting from a mistake the merchant made when charging the customer’s payment card. This includes delivering the wrong product to the customer or conducting an unauthorized transaction. A chargeback filed because the merchant withdrew an incorrect amount of money from the customer’s card during automatic payments is also considered a merchant error.

- Criminal fraud. Criminal fraud, also called true fraud, is a type of ecommerce fraud in which a fraudster makes online purchases using a stolen or lost credit card. In this case, the payment card is legitimate, but the payer isn’t. Chargebacks arising from criminal fraud are the most difficult ones to dispute.

- Friendly fraud. Friendly fraud occurs when a legitimate cardholder pays for a product or service using their credit or debit card, only to file a chargeback. Unlike true fraud, where the payer is not authorized, in friendly fraud, the cardholder is the one who initiates the chargeback procedure. This chargeback is either genuine, as in the case when the cardholder doesn’t remember making the purchase, or intentional, when the cardholder wants to use a product or service and get their money back at the same time.

Note: CCBill provides its merchants with a cutting-edge fraud scrubbing system. It analyzes each processed transaction for hundreds of different potential issues before sending payment information to credit card associations and banks. CCBill’s anti-fraud system reduces the merchants’ exposure to chargebacks and fraud.

What Qualifies for a Chargeback?

Whenever a customer recognizes a merchant’s breach of contract, they can file a chargeback. Here are the most common situations that qualify for a chargeback:

- The merchant refuses to refund a customer for delivering a wrong or defective product.

- The merchant fails to deliver the item the customer paid for.

- The customer has not authorized the payment.

- The customer has been billed several times or charged an inaccurate amount of money for the purchased product or services.

Payments made with credit cards, debit cards, and prepaid cards qualify for a chargeback procedure.

How Does a Chargeback Work?

A chargeback procedure involves the customer, the card-issuing bank, and the merchant.

When a customer decides to file an official chargeback complaint with their card-issuing bank, they start the chargeback cycle.

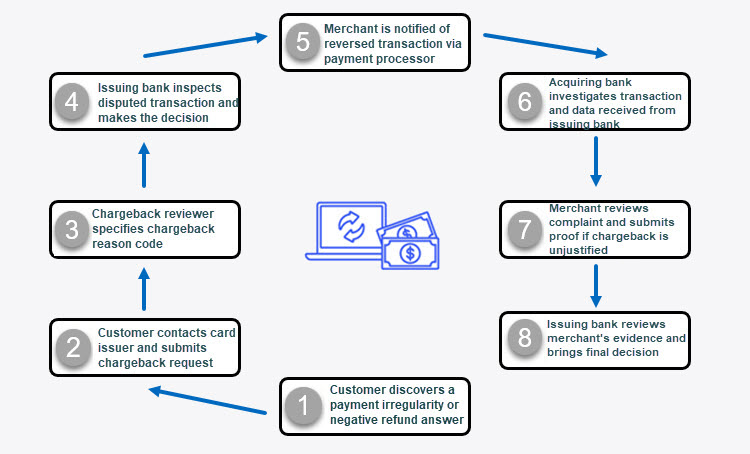

Chargeback Cycle

The chargeback cycle contains the following stages:

- The customer discovers a payment irregularity or receives a negative answer to a refund request from the merchant.

- The customer contacts the card issuer and submits a chargeback request.

- The issuing bank/chargeback reviewer labels the chargeback with a reason code.

- The issuing bank inspects the disputed transaction. If the customer’s complaint meets all the chargeback conditions, the funds are transferred from the merchant’s bank account back to the customer’s card.

- The merchant is notified of the reversed transaction via their payment processor.

- The acquiring bank (merchant’s bank) investigates the transaction and the information received from the issuing bank. If there’s no evidence that the customer is wrong, the acquiring bank forwards the chargeback to the merchant.

- The merchant reviews the complaint. If they have any substantial proof that the chargeback isn’t justified, they can ask the issuing bank to review it one more time.

- The issuing bank reviews the additional evidence (if any) and reaches a final decision. If they accept the merchant’s explanation and documentation, the money is again withdrawn from the customer’s account and sent to the merchant’s account. However, if the chargeback is confirmed, the money stays in the customer’s account. Either way, the merchant pays the chargeback fees and any other potential costs.

Chargeback Costs

A merchant is charged additional fees for every chargeback filed against them.

Chargeback costs may range from $20 to $100, depending on the type of transaction. The merchant pays a chargeback fee even if the customer withdraws the chargeback request or the outcome is positive for the merchant. In the case of intentional friendly fraud, the merchant loses both the merchandise and the money.

Additionally, if the merchant’s chargeback rate is above a predetermined limit, they have to pay fines imposed by credit card associations.

Note: Chargeback rate is the ratio between the number of chargebacks a merchant receives in one month, divided by the total number of payments credited to the merchant’s business account within the same interval. Visa uses this methodology while Mastercard divides the number of chargebacks from the previous month with the total number of payments sent to the merchant’s account at the end of the current month.

Is a Chargeback the same as a Refund?

No, a chargeback is not the same as a refund.

A refund is a request that a customer sends directly to a merchant to get back the money they paid for a particular product or service. A merchant accepts the refund request and transfers the amount in question back to the customer’s account from which the payment was made. A refund doesn’t involve any other participants, apart from the customer and the merchant.

A chargeback, on the other hand, includes the customer, the merchant, and the card-issuing bank (the customer’s bank). It is an official legal procedure that lasts much longer than the refund process and requires a legal settlement between the opposing parties.

Note: Get more in-depth information about the differences between chargebacks and refunds as well as differences between chargebacks and disputes.

How to Fix and Reduce Chargebacks?

Getting too many chargeback requests damages the merchant’s business reputation and affects their ability to process electronic payments.

Let’s have a look at some effective strategies for reducing the rate of chargebacks:

- Ask customers to log in. Require that buyers log in during the checkout stage. That way, you track your customers and payments more efficiently.

- Improve payment security. Ask customers to provide their card verification value (CVV) and card identification number (CID) at the checkout. The more security payment authentication factors there are, the lower is the chance of fraud and, consequently, chargeback.

- Use AVS. An address verification system (AVS) makes sure that the customer’s billing address and the credit card account address match. Using this system prevents false-identity fraud, which may happen when these addresses don’t match.

- Hire a trustworthy payment processor. Partner up with an experienced payment processor who knows the procedures and has the tools to prevent excess chargebacks.

- Provide excellent products and services. Customers often submit a chargeback because they’re either disappointed or dissatisfied with the product or service they paid for. So, always go the extra mile to provide top-notch products and services. When customers get what they want, they don’t file chargebacks.

- Simplify the refund policy. Bring in a straightforward return policy that puts the customer at the center. When customers know how to get a refund, they won’t opt for chargebacks. Remember that it’s always better to make 100 refunds than deal with even a single chargeback request.

- Keep the cancellation option simple. Customers sometimes forget they’ve subscribed to a product or service or that they haven’t cancelled such payments. Once charged, they file a chargeback. To avoid this, keep the subscription cancellation policy as easy and simple as possible.

- Ensure seamless customer support. Providing 24/7 customer service significantly reduces the chargeback risk. Train support agents to go the extra mile to find solutions that will satisfy even the most unhappy customers. This is the first line of anti-chargeback protection and one that cushions the negative feelings that customers might have about your business.

- Double-check your business information. Make sure that your business name and your business payment data are clearly visible on all relevant contact and payment forms. Clearly visible business ensure that customers properly identify your business information in their bank statements and don’t question the purchases made from you.

- Arrange a reliable delivery service. Working with a reliable and conscientious delivery service reduces the risk of having your products damaged during shipping. Hence, it lowers the chances that someone will receive a broken product and file a chargeback.

- Analyze the product catalog. If you repeatedly receive refund and chargeback requests for the same product(s), check what’s wrong with the items in question. If necessary, remove them from the catalog.

Note: Learn about retrieval requests, also known as "soft chargebacks".

Common Questions About Chargebacks

No matter how deep we go into the topic, there’s always something more to say about chargebacks. So, here are some FAQs about chargebacks.

How Does a Chargeback Procedure Start?

A customer starts a chargeback procedure by sending a chargeback request to the credit card issuer. This official complaint needs to specify the exact transaction and the reason for the chargeback request. The customer must also include all the supporting evidence they have, such as email correspondence with the merchant.

The issuing bank forwards the data to the merchant’s payment processor, who sends it to the merchant.

Can a Bank Refuse a Chargeback?

If the customer doesn’t provide proper evidence on an erroneous payment and doesn’t state adequate reasons, the issuing bank may opt to reject the chargeback request. The bank also considers the documentation the merchant submits. Merchants should note that even if the bank decides to reject the request, they are nevertheless charged additional fees.

Can You Go to Jail for a Chargeback?

A customer who files a dishonest chargeback and commits fraud faces various legal consequences. If the amount in question is substantial, the merchant may decide to take the customer to court. In that case, the verdict may range from a fine to imprisonment, depending on state rules.

Do Chargebacks Hurt Businesses?

Chargebacks can completely ruin a business’s ability to process payments.

Banks and credit card associations closely monitor merchants with a lot of chargeback requests. They’re often qualified as high-risk merchants, meaning they can’t open regular business accounts but need to have a high-risk merchant account. Such accounts typically include higher maintenance and processing fees than traditional merchant accounts.

Card and bank associations monitor every merchant’s chargeback rate to detect potential high-risk merchants.

A chargeback rate below 1% used to be considered a normal or acceptable rate. However, things have changed lately. Visa has reduced the threshold to 0.9%, while the initial monitoring program begins at the chargeback rate of 0.65%. Mastercard remains at 1%.

Both Visa and Mastercard have special chargeback rate ranges and special actions for merchants exceeding those thresholds. Merchants are faced with fines if they don’t reduce their chargeback rate according to the recommendations and rules imposed by credit card associations.

How Long Does a Chargeback Process Take?

The chargeback process may take from 28 to 90 days, but it is typically resolved in about 30-45 days.

Note: According to Visa regulations, customers have 120 days to file a chargeback dispute for most transactions. The chargeback period is the same for Mastercard payments, as well.

Do Chargebacks Affect Credit Score?

A high chargeback rate doesn’t affect the merchant’s credit score. The credit record tracks you as a money borrower, and chargebacks don’t belong to this financial category.

However, receiving a lot of chargebacks affects your business reputation and other financial services you may need, turning you into a high-risk merchant, as explained above.

Note: Learn about The Fair Credit Billing Act the umbrella law of all chargeback regulations.

Conclusion

Chargebacks used to be an effective customer protection tool. Today, many customers turn to chargebacks for every single inconvenience they have with merchants.

Chargebacks are troublesome for both merchants and customers. On the one hand, merchants spend a lot of time and assets handling chargebacks. On the other, customers need to go through a legal procedure and wait for their money to be paid back.

Merchants need to do everything they can to simplify and clarify in-house procedures related to payments, refunds, and customer support. With new payments trends on the horizon, it seems that things won’t get any simpler for merchants.

The tips, procedures, and practices shared in this guide will help merchants prevent chargebacks and avoid undesired additional fees and costs while providing excellent products and services.