Introduction

Allowing customers to choose between multiple payment options is a sure way to reduce cart abandonment. However, each payment option in the offer needs to be safe and convenient for online payment processing.

Even though advanced authentication tools and payment compliance regulations have improved the security of electronic funds transfers, merchants and buyers should always consider the safety of a payment option.

In this article, find out whether eChecks are safe and how they work.

Are eChecks Safe?

An eCheck, or electronic check, is a secure non-card payment method. It is a convenient and reliable payment method that lets customers pay directly from their checking or savings bank accounts.

eCheck Payment Flow

A typical online eCheck payment flow consists of the following steps:

- A customer visits an online store and decides to buy a product or service.

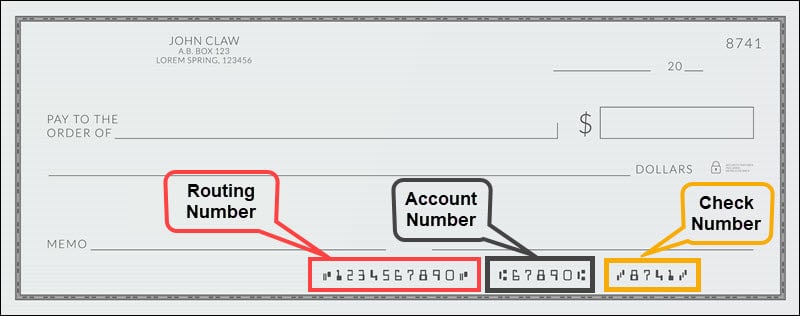

- The customer is redirected to a hosted payment form where they enter personal payment information, including their Account Number and Routing Number.

- Once the customer completes the payment form and accepts the payment terms, they click the Pay button to initiate the online payment.

- Banks may implement an additional verification step requiring customers to enter a one-time password or confirm the purchase in their banking app before authorizing the transaction.

- The ACH network authenticates the consumer’s payment information and processes the transaction.

- The funds are deducted from the customer’s bank account and deposited into the merchant account.

The communication and data transfer between all participants in the payment process is encrypted, ensuring that unauthorized individuals cannot access or use the payment data.

Preventing eCheck Payment Fraud

Payment service providers (PSPs), the ACH payment network, and the customer’s bank implement additional tools and processes to minimize the risk of payment fraud for eCheck payments.

- Strong Customer Authentication. The customer’s bank always verifies the account information of the person submitting the payment. Most banks use advanced authentication tools and protocols like 3D Secure to verify the customer’s identity before authorizing a transaction.

- Transaction Limits. Payment networks may limit the number of consecutive transactions in a short period to prevent duplicate payments or ask customers to verify their identity over the phone before approving large-sum transfers.

- Risk Management. Established payment processors employ entire teams and sophisticated risk detection software to identify potential threats and suspicious behavior. PSPs can also impose rules and procedures to limit transactions based on risk assessments. For example, preventing eCheck transactions initiated from locations outside of the US.

- Encryption. Transactions processed through the ACH network are encrypted, including eChecks.

Payment Disputes

A customer can cancel an eCheck by alerting their bank before the payment has been settled. The customer must request a refund if the funds are already in the merchant’s account.

The customer can dispute an eCheck by filing a de-authorization request. The account holder has 90 days from receiving their bank statement to submit a de-authorization form.

The bank processes the chargeback request along with any accompanying documentation. If the request is cleared, the funds are deducted from the merchant’s account.

eCheck Payments for Overseas Purchases

In the United States, eCheck payments are facilitated through the ACH network. This means that the customer and the merchant’s payment processor need U.S.-based bank accounts for the payment to be processed successfully.

A U.S. customer can successfully initiate an eCheck payment even from abroad.

Customers from other countries can use eChecks to complete payments if the merchant’s payment processor supports payments for payment networks in those countries.

For example, CCBill accepts both ACH payments for U.S. customers and SEPA payments initiated by European customers.

Customers that hold bank accounts in the EU and EEA (European Economic Area) can use SEPA to pay directly from their bank accounts.

Like other payment options, merchants need to be vigilant when the customer’s IP does not match their country of origin. This is especially true if the transaction is initiated from countries that historically have higher levels of payment fraud.

Conclusion

eChecks are a safe and efficient payment method. Some customers are still hesitant about sharing payment information online, and rightfully so, as no payment method is impervious to fraud.

Using a payment processor with extensive experience, advanced risk management tools, and a team of dedicated risk analysts is your best defense against payment fraud, regardless of the payment method.