Among the many preferred payment methods, Automated Clearing House (ACH) payments and electronic funds transfers (EFTs) are particularly gaining a lot of popularity. They are fast, efficient, and rely on secure payment processing systems that minimize errors and ensure a stable financial flow.

In this article, learn about the essential differences between ACH payments and EFTs, their benefits, and uses.

What Is an ACH Payment?

An ACH payment is an electronic payment from one bank account to another, processed through the Automated Clearing House network. The ACH network processes payments in batches instead individually, thus making ACH transfers very cheap.

Many U.S. banks and financial institutions participate in the ACH network and work together to send and receive electronic payments.

ACH payments are an alternative to physical checks, wire transfers, and credit and debit card payments, which often take longer to process and cost more. The two primary type of ACH payments are direct deposits and direct payments.

Note: Follow the link to learn how to accept ACH payments as an online merchant.

ACH payments offer the following benefits:

- Flexible. By offering alternative payment options to customers, businesses increase the chances of making a sale.

- Fast. ACH payments are typically processed within 1-3 business days, much faster than physical checks that take up to 5 business days.

- Cheap. On average, ACH payments are charged between 0.5% and 1.5% per transaction, while credit card transactions typically carry a fee between 1.5% and 3.5%. Paper check transactions go even higher – between $4 and $20 each in some cases.

- User-friendly. ACH transfers are optimized for recurring payments. The payer authorizes the payment only once and doesn’t have to worry about the details ever again.

- Secure. ACH payments go through the ACH network, which verifies each transaction request and processes it through a reliable payment processor, the ODFI and the RDFI.

Note: Learn all about ACH payment processing for your business in our article ACH Payment Processing – Features, Comparisons, and Costs.

Are ACH Transactions the Same as EFT?

ACH transactions fall under the broader term of EFTs. However, EFTs include many other payment options besides ACH transfers. Both refer to electronic payments, but not every EFT payment is processed through the Automated Clearing House network.

What Is an EFT Payment?

An electronic funds transfer (EFT) is a digital payment that allows money transfer from one bank account to another or the physical withdrawal of money from an account. EFTs include a broad range of popular payment methods, including:

- ACH payments

- Credit and debit card payments

- Mobile payments

- Direct deposits

- Wire transfers

- E-wallets

- eChecks

- Real-time-payments (RTP)

- Peer-to-peer payments.

There are many benefits to using EFT payments:

- Encrypted authorization. EFT payments are not authorized manually by bank staff, which is still the case with paper checks. The payer authorizes an electronic funds transfer with pin codes and secure passwords through two-factor or multi-factor authentication.

- Fast payment processing. EFTs are typically processed much faster than physical checks, which improves business efficiency. Some EFT payments (e.g., real-time payments and mobile payments) are even processed immediately, which does not apply to ACH payments.

- Transaction tracking. The payer and the receiver can track EFT transactions through account dashboards, which provides transparency.

- Convenience. With EFT payments (including ACH), there is no need to go to the bank or carry a checkbook around to make a payment. The transactions are initiated, authenticated, and completed electronically.

ACH vs. EFT: Key Differences

Here are the key differences between ACH and EFT payments you should know about:

1. Security

Although both ACH and EFTs are highly secure types of payments, especially compared to physical checks that can be forged or stolen, ACH payments go the extra mile when it comes to providing the safety of payment data. Namely, the ACH network is a rigorous system that ensures the highest levels of security. On the other hand, EFT payments, such as the ones done via credit or debit card, are easier to breach and misuse. In addition, credit and debit cards can also be stolen or tampered with, which is not the case with ACH transactions.

2. Chargebacks

Due to ACH transfers being safer than most other electronic funds transfers, the occurrence of valid chargebacks is very low. The rules are strict, and customers have only 90 days to request a chargeback for an ACH transfer. There are only three valid reasons to dispute an ACH transfer: unauthorized payment, payment processed earlier than agreed upon, the transaction amount is different than authorized.

When it comes to other EFT payments, the chargeback rate is much higher, especially for credit card payments. Consumers can dispute credit card payments up to 120 days after the payment took place. Additionally, the merchant would need to provide substantial evidence to win representment in the case of a credit card chargeback.

Note: Learn the difference between chargebacks and disputes, and chargebacks and refunds.

3. Speed

Certain EFT transactions are processed a lot faster than ACH payments, which take 1-3 business days to complete. For example, real-time and mobile payments are processed instantly. ACH transfers, on the other hand, are processed in batches and cannot be processed instantly.

Note: Refer to our article ACH Payment Processing Time to learn about different factors that can influence how long an ACH payment takes to process.

4. Costs

Both ACH and EFT transactions carry lower fees than physical checks, but there are also differences between the two. A transaction fee for ACH payments ranges between 0.5% and 1.5%, while EFT transaction fees go from $1.50 to $1.90 for direct deposits, 1.5% to 3.5% for credit card payments, and $0.30 to $1.50 for eChecks.

5. Transaction Processing

The Automated Clearing House processes ACH payments in batches, which minimizes costs. On the other hand, most EFT payments are processed individually.

6. Geo Limits

ACH payments are tied to the Automated Clearing House, which is used in the United States, while other countries have their own version of ACH (such as SEPA in Europe).

In contrast, EFTs are global payments that go beyond the limitations of a single country or financial network.

Note: Follow the link to learn about the key differences between ACH and SEPA.

7. Amount Limits

ACH transfers have a daily and monthly limit. The amount limit varies from bank to bank, however, usually the daily threshold is $100,000.

On the other hand, many electronic funds transfers options do not have amount limits (e.g., wire transfers).

8. Fee for Insufficient Funds

If a payer doesn’t have enough funds in their account, the bank might charge them an additional fee when attempting to do an ACH transfer. There is no such fee for other EFT payments methods.

ACH vs. EFT: Which One Should You Choose?

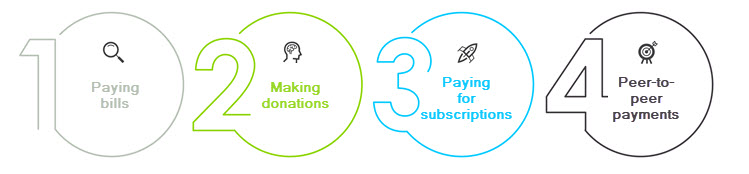

ACH payments are convenient for long-term or recurring payments that require a one-time authorization. For example:

- Paying bills. Repeated payments for bills such as utilities, phone bills, mortgage, car payments, etc.

- Making donations. ACH payments are suitable for making recurring donations, similar to paying recurring bills.

- Paying for subscriptions. When paying for a subscription service, ACH payments are much more convenient and cheaper than credit card payments.

- Peer-to-peer payments. ACH transfers are excellent for sending money from one bank account to another. Often, there are no fees associated to making peer-to-peer ACH payments.

On the other hand, EFTs are suitable for payments that require instant processing, sending large amounts, or international payments, including:

- Peer-to-peer payments. EFTs are excellent for quick money transfers to another person’s bank account within the same bank or a different one.

- Large payments. eChecks and wire transfers are forms of EFT payments that can process larger sums of money than ACH payments and credit cards.

- Salaries and tax refunds. Direct deposits are widely used in the U.S. for salaries and wages, employer-reimbursed expenses, government benefits, tax refunds, and interest payments deposited directly into the receiver’s account.

- Instant payments. Mobile and real-time payments are processed immediately.

- Online shopping. E-wallets and credit cards are the most widely accepted payment methods for shopping online.

Note: E-wallets and credit cards are popular online payment methods. Learn how to differentiate them in our article E-wallet vs. Credit Card: What’s the Difference?

Conclusion

ACH and EFT payments offer a variety of benefits to global customers. They are secure and fast, with low processing costs and more convenient than cash or physical checks.

While ACH payments are a type of EFTs, there are some distinctive differences between the two in terms of processing, security levels, and transaction costs.