1099K Transaction Report

The 1099K Transaction Report is used to help reconcile your annual 1099-K tax form. It details how gross transactions are calculated and gives insight into deductions to assist you with your yearly tax returns.

The report is generated for merchant accounts based in the US region (Business and Principal address) during the time the transactions were processed. The account also needs to meet two additional conditions:

- At least $20,000 was processed in Gross transactions for the tax year.

- 200 (or more) total transactions processed for the tax year.

This report is available at the main account level only.

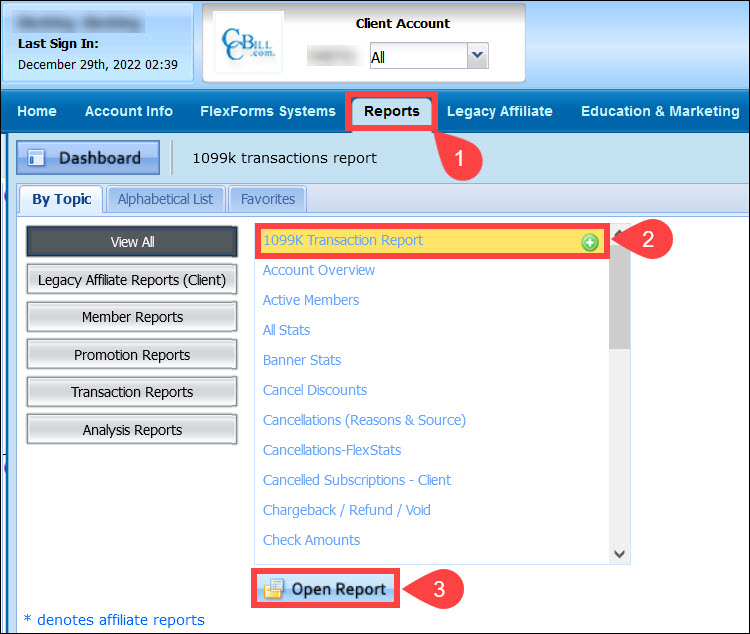

To access the 1099K Transaction Report:

1. Expand the Reports menu.

2. Select the 1099K Transaction Report.

3. Click Open Report.

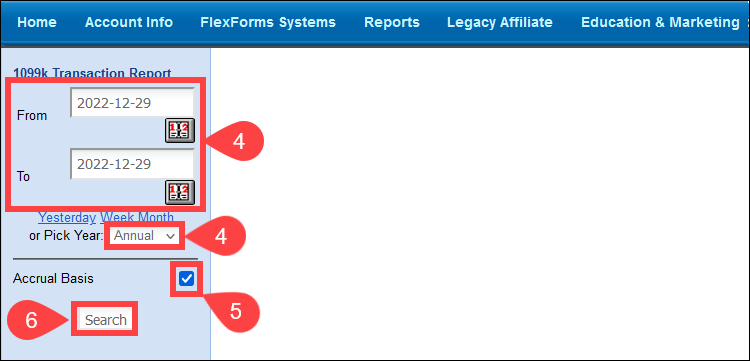

4. Select the Date Range (or pick a specific Year for the report run).

5. The Accrual Basis check box is pre-checked; if you use cash method accounting, click to deselect the box (learn more about different accounting methods).

When selected, transactions are pulled by the transaction (auth) date. Deselecting this box will cause the report to run by check date.

6. Click Search.

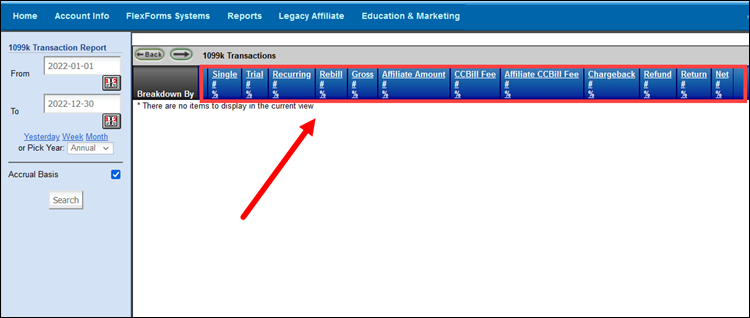

The report contains the following columns:

- Single #. Includes all single billing transactions.

- Trial #. Includes all trial transactions.

- Recurring #. Includes all recurring transactions.

- Rebill #. Includes all rebilled transactions.

- Gross #. Total is calculated as ((Single #) + (Trial Recurring) + (Rebill) + (Phone)) - Void. The same method is used to calculate 1099-K gross totals.

- Affiliate Amount #. An aggregated total of the Affiliate Amount.

- CCBill Fee #. An aggregated total of CCBill Fees. Fees are listed up to six decimal places and use standard rounding.

- Affiliate CCBill Fee #. An aggregated total of Affiliate Fees. Fees are listed up to six decimal places and use standard rounding.

- Refund #. Includes all refunds for the selected timeframe.

- Return #. Includes all returns for the selected timeframe.

- Net #. Total is calculated as ((CCBill Fee) + (Chargeback) + (Refund) + (Return)) + Affiliate CCBill Fee.

Clicking a link in the Breakdown By column focuses the report and breaks down data by:

- Account.

- Pay Period.

- Payment Type.

- Currency.

- Detail views within the report may contain any or all of the following columns:

| Transaction ID (as a hyperlink to subscription details). |

| Account/Subaccount/Site |

| Date and Time |

| Transaction Type |

| Payment Type |

| Currency |

| USD Amount |

| Affiliate Amount |

| CCBill Fees (Fees are listed up to six decimal places and use standard rounding). |

| Affiliate CCBill Fee (Fees are listed up to six decimal places and use standard rounding). |

| State |

| Country |

| First Name |

| Last Name |

| Active (Y/N) |