Credit/Check Transactions

The Credit/Check Transactions report provides information on all transactions that occurred on a merchant account.

It aggregates data on single and recurring billing, rebills, gross, refunds, chargebacks, voids, returned checks, and affiliate deductions for the specified date range.

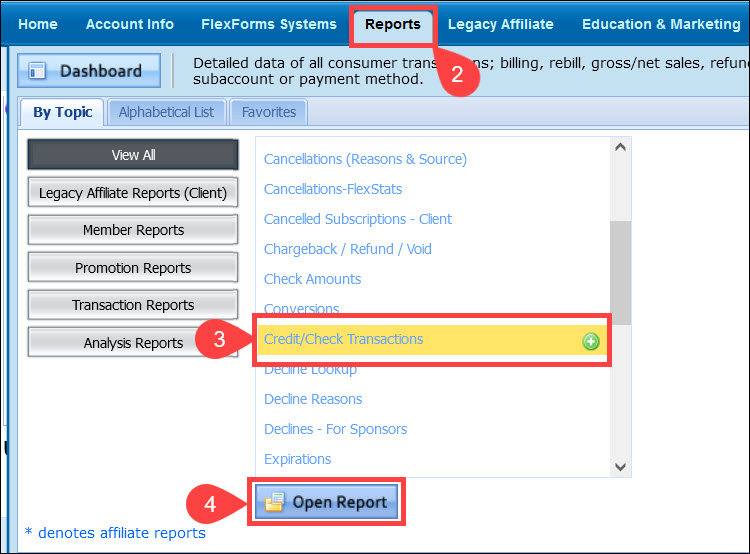

To access the Credit/Check Transactions report:

1. Log in to the Admin Portal.

2. Click Reports.

3. Select Credit/Check Transactions.

4. Click Open Report.

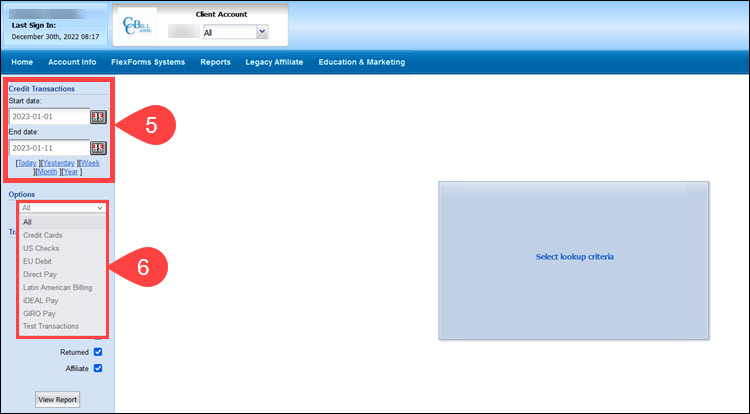

5. Use the Start date and End date fields to define the report date range.

6. The Options dropdown menu allows you to select specific transaction types:

- All. Look at all transactions simultaneously (minus Test Transactions).

- Credit Cards. Only display Credit Cards transactions.

- US Checks. Only show Checks transactions.

- EU DEBIT. Only view EU Debit transactions.

- Direct Pay. Only display Direct Pay transactions.

- Latin American Billing. Only show Latin American Billing transactions.

- iDEAL Pay. Only view iDEAL Pay transactions.

- GIRO Pay. Only show GIRO Pay transactions.

- Test Transactions. Only display Test Transactions.

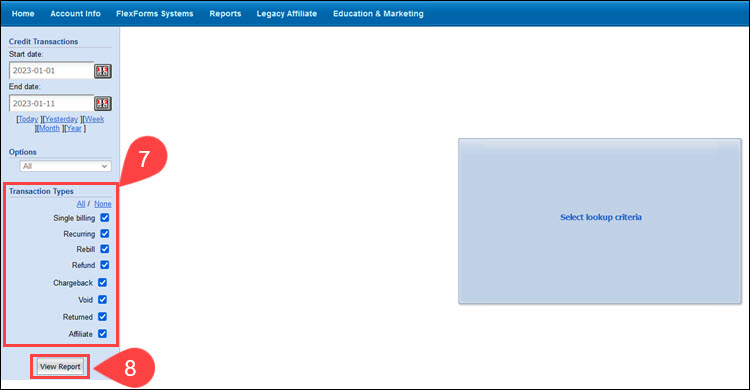

7. There are 8 Transaction Types you can choose from by checking the checkbox:

- Single Billing. Single Billing will include Single Billing transactions.

- Recurring. Recurring will include Recurring transactions.

- Rebill. Rebill will include Rebilled transactions.

- Refund. Refund will include Refunded transactions.

- Chargeback. Chargeback will include Chargeback transactions.

- Void. Void will include Voided transactions.

- Returned. Returned will include Returned ACH or Eu Debit transactions.

- Affiliate. Affiliate will include Affiliate referred transactions.

8. Click View Report.

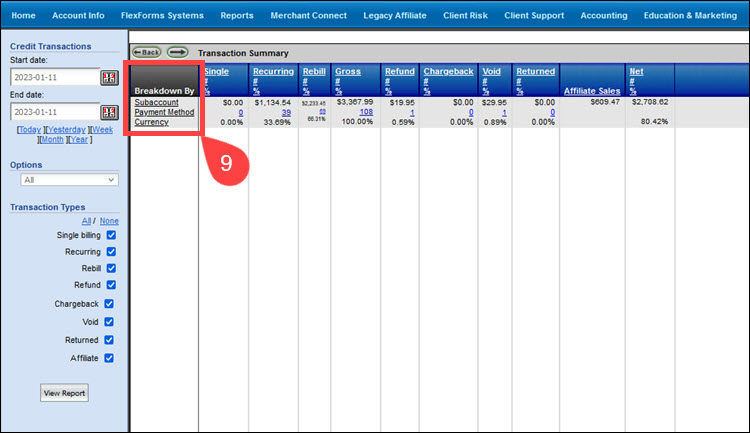

9. The Breakdown by section allows you to breakdown data by:

- Subaccount. The data is broken down by subaccount.

- Payment Method. The data is broken down by the payment method the consumer used.

- Currency. The data is broken down by the transaction currency.

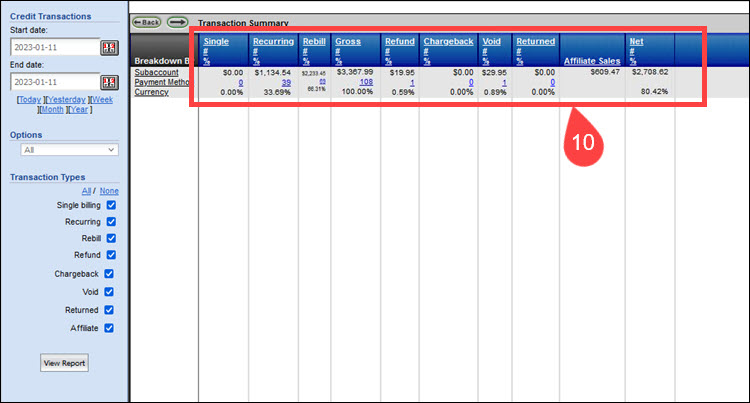

10. The main report window is divided into 10 columns:

- Single. The number of single non-recurring transactions that occurred in the selected date range.

- $X.XX. The total US dollar amount earned from single (non-recurring) transactions.

- X (link). The hyperlink is the number of single (non-recurring) transactions in that period. If you click the link, it will list the subscription IDs for individual transactions.

- X.XX%. The percentage of single (non-recurring) transactions compared to the overall number of transactions displayed in the Gross column.

- Recurring. The number of recurring transactions that took place in the selected date range.

- $X.XX. The total US dollar amount earned from recurring transactions.

- X (link). The hyperlink represents the number of recurring transactions in that period. If you click the link, it will list the subscription IDs for individual recurring transactions.

- X.XX%. The percentage of non-recurring transactions compared to the overall number of transactions displayed in the Gross column.

- Rebill. The number of rebills that occurred in the selected date range.

- $X.XX. The total US dollar amount earned from rebills.

- X (link). The number of rebills in the selected period. If you click the link, it will list the subscription IDs for individual rebills.

- X.XX%. The percentage of rebills compared to the overall number of transactions displayed in the Gross column.

- Gross. The number of Single, Recurring, and Rebill transactions in the defined date range.

- $X.XX. The total US dollar amount earned in the specified date range.

- X (link). The number of Single, Recurring, and Rebill transactions. If you click the link, it will list the subscription IDs for individual transactions.

- X.XX%. The percentage of total sales. The value should always be 100%.

- Refund. The number of refunds that occurred in the selected date range.

- $X.XX. The total US dollar amount that was refunded.

- X (link). The number of refunds in the selected period. If you click the link, it will list the subscription IDs for individual refunds.

- X.XX%. The percentage of rebills compared to the overall number of transactions displayed in the Gross column.

- Chargeback. The number of chargebacks that occurred in the selected date range.

- $X.XX. The total US dollar amount that was charged back.

- X (link). The number of chargebacks in the selected period. If you click the link, it will list the subscription IDs for individual chargebacks.

- X.XX%. The percentage of chargebacks compared to the overall number of transactions displayed in the Gross column.

- Void. The number of voided transactions that occurred in the selected date range.

- $X.XX. The total US dollar amount that was voided.

- X (link). The number of voided transactions in the selected period. If you click the link, it will list the subscription IDs for individual voids.

- X.XX%. The percentage of voids compared to the overall number of transactions displayed in the Gross column.

- Returned. The number of returned ACH or EU Debit payments that occurred in the selected date range.

- $X.XX. The total US dollar amount for returned ACH or EU Debit payments.

- X (link). The number of returned ACH or EU Debit payments in the selected period. If you click the link, it will list the subscription IDs for individual returns.

- X.XX%. The percentage of returned ACH or EU Debit payments compared to the overall number of transactions displayed in the Gross column.

- Affiliate Sales. Transactions referred by affiliates that occurred in the selected date range.

- $X.XX. The total US dollar amount for transactions referred by affiliates.

- Net. The net value is calculated by deducting chargebacks, voids, refunds, and returned payments from the revenue-generating transactions.

- $X.XX. The net US dollar amount earned during the selected date range.

- X.XX%. Net income percentage relative to the Gross USD value.