W-9 Info Details

The IRS now requires that CCBill submit a form 1099-K for any CCBill merchant that has a US-based company, more than $20,000 in gross processing volume, and has more than 200 total transactions for a given tax year. To learn more about this requirement you may view our FAQ about 1099-K implementation in our Knowledge Base.

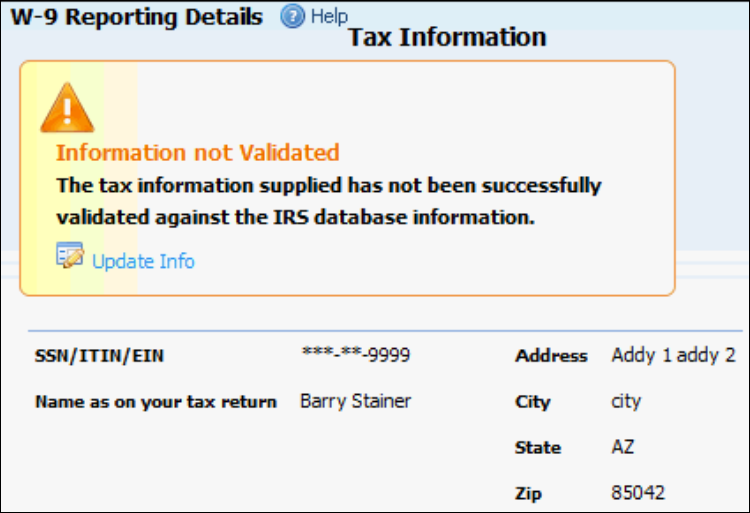

Because of the new rules, we have added a new screen that enables you to update your tax information in our records. Once the information is entered we submit it to the IRS database to verify that the SSN/EIN matches up with the business name. If the data doesn't exist or doesn't match, you will see the Bad Data Alert at the top of the page until the data is correctly entered or verified.

W-9 Info Details Screen Access

The W-9 Info Details screen can be accessed by selecting the Account Info Mega Menu, then selecting the W-9 Info Details link in the Main Account section.

This screen allows you to view the information that we have on file for the account, and make changes to the information as necessary by clicking the Update Info link.

Changing Data

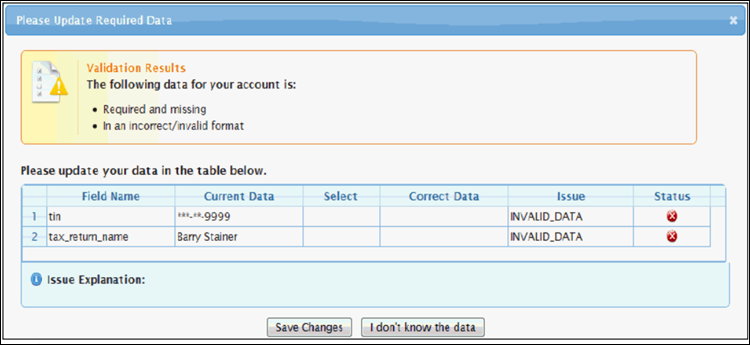

Clicking the Update Info link will open the Bad Data Service screen, which can also be accessed by clicking the Resolve Bad Data link in the alert box at the top of the page.

To make changes to the data:

- Click in the cell under the Select column, then choose the Data Type from the choices in the drop-down menu that appears.

- Click in the cell under the Correct Data column, then enter the data to update the field to.

This information should match the IRS database entry for your business/self exactly. Incorrect entries will cause an error message.

- Repeat step 2 for any other bad data rows left.

- Click Save Changes.

Note that if you reach this screen and do not have access for the data associated with the account, you may click I don't know the data at the bottom of the screen and continue working on other tasks.