Web Verify

To maintain high security standards and fraud protection, CCBill has developed numerous systems that would help merchants in processing transactions safely. The challenge to minimize the merchants’ exposure to fraudulent behavior imposed the need for strict background security checks.

Thus, the payment system would occasionally decline a suspicious transaction which could potentially be approved with a simple authentication step – contacting CCBill Consumer Support. In order to increase the number of authorized transactions, CCBill has developed a feature called Web Verify which would allow consumers to complete a purchase after a decline.

Overview

The CCBill pre-authorization scrubbing system is strong, and some transactions may get declined at the pre-auth stage. Web Verify was introduced as an opportunity for consumers to have such transactions approved.

If a consumer attempting to complete a purchase gets declined by one of our internal fraud systems, they will be presented with a message that they can contact CCBill Consumer Support to have their transaction authorized. By utilizing Web Verify, the risk of fraud and chargebacks is reduced without lowering the security standards.

Note: This feature is activated by default on all accounts.

Web Verify Process

When a consumer arrives to your website and decides to make a purchase, CCBill’s proprietary security fraud prevention tools, e.g. VScrub, examines if the transaction passes all checks. In case the system determines the transaction needs further inspection, it will soft decline it. The consumer will get the message stating that the transaction in question has been declined by CCBill, including the instructions on how to validate it. The process is:

- The consumer needs to contact CCBill Consumer Support to inquire about the declined transaction and verify any incorrect details provided during the initial signup.

- A Customer Service Representative inspects the reason for the decline and transaction history to ensure there is no evidence of chargebacks, requests for card block, or any fraud history.

- VScrub failed tests are further analyzed, if applicable, to determine whether to perform the manual override or if unblocking the card/user is appropriate.

- The approval confirmation email is sent out if the consumer is eligible for the decline override.

Potential Triggers

Some of the reasons for soft declines are:

- Multiple Submissions

- CVV2 Mismatch

- Timeout

- Address Verification Mismatch

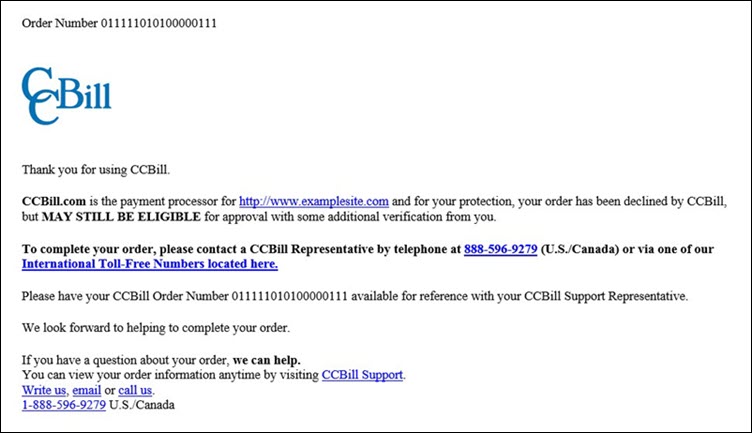

All transactions eligible for a manual override can easily be approved after confirming there is an actual consumer trying to process a payment. Making a purchase while traveling or using a prepaid card can sometimes trigger our security systems. Instead of completely declining a consumer, we give them the opportunity to call our Consumer Support and easily verify the signup information to complete the transaction. Click on the image to see the example of the email notification.

Notes

Web Verify is a system designed to allow consumers to contact Consumer Support department to see if they are eligible for a manual override of the decline. Merchants do not get notifications for these events and cannot perform the overrides themselves. Here are a few things to have in mind:

- Web Verify can be disabled for the desired subaccount, but the number of successful sales may reduce if the consumers do not get the opportunity to override the declines.

- This system is designed for New Subscription Signups; Rebill Declines and New Declines are not eligible for manual overrides.

- Web Verify will not be triggered by Upgrades, SMS Upgrades, One Click Cross-Sales, and ChargeByPreviousTransactionID functionality.

- Merchants using Cascade setup for other payment types for external processors may encounter double transactions only if a consumer contacts CCBill after the transaction is processed through the other cascade option.

- If a merchant account is using a decline redirect, it will override the online notification for the Web Verify feature. Nevertheless, the consumer will receive the email with notification about the possibility to call and have the transaction approved.

- Only soft-declines trigger the Web Verify System.

- Consumers can contact CCBill 24 hours after the decline to manually override the transaction. If the decline is not overridden during that timeframe, the system will send a Decline Confirmation email to the consumer.

Benefits

By allowing consumers to authorize their purchase after it was soft declined, Web Verify provides more successful sales for CCBill Merchants and helps them grow their business.

Consumers will not be driven away from the merchants’ websites by offhand declines. Instead, they remain on the site and get a chance to complete the purchase. CCBill retains a high level of security ensuring that fraudulent transactions are not processed on your account and, at the same time, drives more consumers towards your business.